Bank of Canada increases its benchmark interest rate to 4.50%

Today, the Bank of Canada increased its overnight benchmark interest rate 25 basis point to 4.50% from 4.25% in December. This is the eighth time since March 2022 that the Bank has tightened money supply to address inflation.

While the headline increase will certainly make news, it is the Bank’s accompanying commentary on its future moves that will capture the most attention. We summarize the Bank’s observations below, including its forward-looking comments on the potential for future rate increases.

Canadian inflation

- Inflation has declined from 8.1% in June to 6.3% in December, reflecting lower gasoline prices and, more recently, moderating prices for durable goods

- Despite this progress, Canadians are still “feeling the hardship” of high inflation in their essential household expenses, with persistent price increases for food and shelter

- Short-term inflation expectations remain elevated and while year-over-year measures of core inflation are still around 5%, 3-month measures have come down, suggesting that core inflation has “peaked”

Canadian economic and housing market performance

- The Bank estimates Canada’s economy grew by 3.6% in 2022, slightly stronger than was projected in the Bank’s Monetary Policy Report in October, however it projects that growth is expected to “stall through the middle of 2023,” picking up later in the year

- Canadian GDP growth of about 1% is forecast for 2023 and rising to about 2% in 2024, little changed from the Bank’s October outlook

- The economy remains in “excess demand” and the labour market remains “tight” with unemployment near historic lows and businesses reporting ongoing difficulty finding workers

- However, there is “growing evidence” that restrictive monetary policy is slowing activity especially household spending

- Consumption growth has moderated from the first half of 2022 and “housing market activity has declined substantially”

- As the effects of interest rate increases continue to work through the economy, spending on consumer services and business investment is expected to slow

- Weaker foreign demand will likely weigh on Canadian exports

- This overall slowdown in activity will allow supply to “catch up” with demand

Global economic performance and outlook

- The Bank estimates the global economy grew by about 3.5% in 2022, and will slow to about 2% in 2023 and 2.50% in 2024 — a projection that is slightly higher than the Bank’s forecast in October

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- Global inflation remains high and broad-based although inflation is coming down in many countries, largely reflecting lower energy prices as well as improvements in global supply chains

- In the United States and Europe, economies are slowing but proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- China’s abrupt lifting of pandemic restrictions has prompted an upward revision to the Bank’s growth forecast for China and “poses an upside risk to commodity prices”

- Russia’s war on Ukraine remains a significant source of uncertainty

- Financial conditions remain restrictive but have eased since October, and the Canadian dollar has been relatively stable against the US dollar

Outlook

Taking all of these factors into account, the Bank decided today’s policy rate increase was necessary and justified.

However, the Bank also offered this important piece of news: “If economic developments evolve broadly in line with (its) outlook, Governing Council expects to hold the policy rate at its current level while it assesses the impact of the cumulative interest rate increases.”

That sounds positive, but as is customary, the Bank also noted that it is prepared to increase the policy rate further if needed to return inflation to its 2% target. It also added the usual language that it “remains resolute in its commitment to restoring price stability for Canadians.”

Although the Bank did not say it, the bottom line is Canadians will have to wait and see what comes next.

Next touch point

March 8, 2023 is the Bank’s next scheduled policy interest rate announcement and we will be on hand to provide an executive summary the same day.

New Mortgage Rules 2023: Expanding the “Stress Test” to Everything?

This is from the Desk of Dr. Cooper, our Economist, and this data is 1 of the reason we are at Dominion Lending – to get this data.

Below is the details of the government expanding the STRESS TEST, or other mechanisms, to make it harder to buy a home.

OSFI Is Concerned About Federally Insured Lender Exposure to Mortgage Risk.

Late last week, the Office of the Superintendent for Financial Institutions (OSFI) announced it was concerned about the risks associated with the large and rising number of highly indebted borrowers, especially those with floating-rate mortgages, which stands at a record proportion of outstanding mortgage loans.

With the economy in danger of entering a recession and the Bank of Canada warning of potentially more rate hikes to counter persistent inflation, the housing market may face continued pressure in the coming months.

A record number of buyers used floating-rate debt for purchases during Canada’s pandemic-era real estate boom. Those borrowers may come under increasing strain if mortgage costs remain high. Job losses from an economic slowdown also would make it harder for people to keep up with loan payments and stay in their homes.

Superintendent of Financial Institutions Peter Routledge said a review of the country’s mortgage-underwriting rules that starts later this week would look beyond its current main measure — a stress test requiring borrowers to qualify for higher interest rates than what their banks are offering.

“The question in our minds is, is it sufficient?” Routledge said of the current stress test. “So we will look at a broader range of debt-serviceability tools, including debt-to-income constraints, debt-service constraints, as well as the current interest-rate stress test tool.”

The proposed rules—subject to public consultation—include loan-to-income and debt-to-income restrictions, new interest rate affordability stress tests and debt-service coverage restrictions.

Highly Indebted Borrowers

OSFI is particularly concerned about the rise in mortgage originations to households with a loan-to-income ratio of 450% or more, which the Bank of Canada has long asserted is the sector most at risk of delinquency and default. This risk has repeatedly been highlighted in the Bank’s financial risk analysis–the Governing Council’s Financial System Review. The latest report says, “Those with high debt are more vulnerable to a decline in income and will face more financial strain when they renew their mortgages at higher rates.”

This vulnerability relates to households’ ability to continue servicing their debt if incomes decline or interest rates rise without significantly reducing their consumption. The Bank staff estimate that the most highly indebted households have generally seen the smallest increases in liquid assets. At the same time, alongside higher house prices, many households have taken out sizable mortgages to purchase a house, adding to the already large share of highly indebted households.

The chart below shows that the average share of high loan-to-income borrowers before the pandemic was 23.8%. The average since the pandemic onset has risen to 33.7%.

Proposals for Comment

To date, mortgage delinquency rates at federally regulated financial institutions (FRFIs) are at a record low. The large FRFIs have worked closely with borrowers who have reached their trigger points. TD, CIBC, and BMO have allowed some negative amortizations until renewal. As a result, the proportion of their mortgages having remaining amortizations has risen sharply (see second chart below). Questions remain regarding how they will deal with this at renewal time. Will the new mortgage be amortized at 25 years at renewal, raising the monthly payments dramatically and increasing the risk of delinquency or default, especially among highly indebted households?

Earlier last week, CEOs of the Big 5 banks weighed in on vulnerable mortgage clients. None were quite as forthcoming as Scotiabank’s new President and CEO, Scott Thomson, who said the bank has about 20,000 borrowers that it considers “vulnerable.” These are borrowers with a high loan-to-value (LTV) mortgage, a low credit score, lower deposits in their checking accounts and those with home valuations that are susceptible to market conditions.

“So, as you think about the tail risk, we have about 20,000 vulnerable customers, which would be 2.5% [of the total portfolio],” he said Monday during the RBC Capital Markets Canadian Bank CEO Conference.

However, he added this represents a “manageable-type situation for us on mortgages.” Scotiabank’s floating-rate mortgages are not fixed payment. They adjust monthly payments every time the central bank changes the overnight rate.

According to Steve Huebl at Canadian Mortgage Trends, RBC President and CEO Dave McKay said that his bank is “keeping a watchful eye on its mortgage clients, turning to AI and various types of modelling to forecast clients’ cash flow.”

“We look at incomes, we look at the stress of inflation on expenses in a household, and we monitor cash flow to interest payments, as you would in any corporation,” McKay said during the conference. “We do that [for] every single consumer in our portfolio because over 80% of our clients have their core checking and core cash management with us.”

Looking at the bank’s variable-rate mortgage portfolio, which totals between $100 and $120 billion, McKay said the bank has been able to segment that group of clients, keeping tabs on when they reach their trigger rates and when they’ll be coming up for rate resets in the next several years.

Through modelling, the bank can then predict which clients with upcoming renewals “will or will not have a cash flow challenge” should the economy enter a moderate or severe recession, he said. “We have a pretty clear view of that.”

For clients who have difficulties making their payments, mortgage lenders have several options to try and assist borrowers before the situation progresses to the point of them needing to sell their homes.

“You have skip-a-payment deferrals, you have maturity extensions, whatever it happens to be, you have a lot of ways to work with that client,” McKay said.

In terms of clients with cash flow challenges in addition to a collateral problem, where the property sale wouldn’t cover their mortgage and could result in default, McKay said it’s a much smaller group but one the bank is actively monitoring.

“That bucket, I can tell you, is in the low single-digit percentages of our portfolio,” he said. “And that’s the bucket we’re managing”.

Bottom Line

To the extent these measures are implemented, further pressure on mortgage growth is likely. Mortgage brokers can access lenders not impacted by OSFI B-20 rule changes. More than ever, brokers could add value to borrowers turned away from the banks. In these uncertain times, existing and new clients need advice from a trained and caring professional.

Work Visa’s / Non-Canadians Can’t Buy Homes: 2023 New Rules

Prohibition on the Purchase of Residential Property by Non-Canadians Act.

Summary of New Rules, 2023:

Anyone with a work visa will have to have lived here for 3 of the past 4 years and have filed taxes during those years. Here are the RULES!

- Holds a valid work permit as defined in section 2 of the Immigration and Refugee Protection Regulations, or is otherwise authorized to work in Canada in accordance with section 186 of the Regulations;

- Has worked in Canada for a minimum continuous period of 3 years within the past 4 years, where the work meets the definition set out in s. 73(2) of the Regulations; and

- Has filed a Canadian income tax return for a minimum of 3 of the past 4 taxation years preceding the year in which the purchase is made.

Please also find below the Globe and Mail article that ran last week on December 1st.. I copied and pasted the whole article:

Ambiguity about Canada’s ban on foreign home buyers creating hiring headaches for businesses

Canada’s impending ban on foreigners purchasing residential real estate is complicating how businesses hire, promote and transfer immigrant workers because of an information vacuum about the final rules.

The Prohibition on the Purchase of Residential Property by Non-Canadians Act, passed by Parliament earlier this year, will restrict foreigners from buying homes in Canada starting next month. That ban will remain in place for two years – supposedly to curb investor speculation in the housing market.

Although the legislation will come into force on Jan. 1, 2023, the federal government still hasn’t released the final regulations outlining how the prohibition will work. Those details are essential because they will specify which non-Canadians, both individuals and corporations, will be exempt from the ban.

Our legislators, however, seem unaware that 2023 is less than 30 days away. But you can be damn sure the businesses and foreign workers who have to comply with the law are acutely aware of the problem.

“The regulations will be made available soon,” Claudie Chabot, a spokeswoman for the Canada Mortgage and Housing Corporation, wrote in an e-mail. (The national housing agency led the government’s consultation on the law.)

The sooner the better. Businesses and workers are being kept on hold.

The government’s consultation paper proposed that exemptions would only be given to temporary residents who hold a valid work permit and who’ve worked in Canada for a “minimum continuous period of three years within the past four years.” Additionally, those individuals would have to prove they filed Canadian income tax returns for at least three of the four years preceding their property purchase.

That potentially sets a high bar for skilled workers. Is Ottawa really planning to prohibit executives and other talent, who plan to move to Canada with their families, from buying a home until they’ve worked here for three years?

We don’t know because the government still hasn’t finalized the rules. It’s ridiculous.

“If I’m sitting in London, England, and I’m saying, ‘Well, gee, do I want to go to Canada? Do I really want to go through all of this aggravation?’ ” said Stephen Cryne, president and CEO of the Canadian Employee Relocation Council.

Known as CERC, the non-profit organization advocates for increased labour force mobility on behalf of companies in sectors including financial services, technology, natural resources and telecommunications.

As Mr. Cryne points out, top executives who work for companies such as banks, energy companies and manufacturers have plenty of choices about where they and their families choose to live in the world.

“I was speaking with one of our members,” he recounted. “They’re looking at bringing in several executives and their families from South Africa, and [because of the uncertainty around the new rules], they’re second-guessing saying, ‘We’re not sure.’ ”

That’s hardly a vote of confidence in Canada.

CERC is asking the federal government for a blanket exemption for any foreign national with a valid work permit who is living and residing in Canada. It’s a reasonable ask.

“Given Canada’s critical skills shortages, these requirements will place Canada in an uncompetitive position when compared to other countries where such restrictions on the purchase of residential property by foreign nationals may not exist,” CERC told the government in a submission.

The proposed rules are also creating headaches for U.S. relocation management companies that handle employee moves on behalf of Canadian corporations. Some of these American companies will purchase and resell an executive’s home to speed up a move. But as non-Canadians, they could be banned from conducting such property transactions for two years – further complicating the process of relocating employees.

Not only are businesses’ hiring and relocation plans getting gummed up, the regulatory uncertainty about the forthcoming ban also risks chasing away foreign direct investment. Our immigration backlog is already a frustration for foreign companies that want to hire more employees and expand their operations in Canada.

Worst of all, it’s not clear that a ban targeting foreign home buyers will actually prevent speculation in the real-estate market.

After all, non-residents only owned 3.1 per cent of residential property in British Columbia in 2020, according to Statistics Canada. In Ontario, that figure is only 2.2 per cent.

So why is the Liberal government pointing a finger at foreign buyers for pricing Canadians out of the housing market?

This is the problem with populist policies. They might make for good politics, but they often have undesirable consequences for businesses and consumers.

The government needs to clear up the confusion about its foreign-home-buyer ban – and fast.

If Ottawa’s goal is to admit nearly 1.5 million new immigrants to Canada by the end of 2025 to solve labour shortages, it shouldn’t be giving skilled workers reasons to think twice about moving here

Canadian Residential Mortgage Market: Inflation & Interest Rates: the Lead Characters for 2023

Summary:

- The Bank of Canada (BOC) increased interest rates 7 times in 2022. Exactly as expected 16 months ago.

- Inflation is at least 5.7%; and it needs to get down to 3%

- The BoC would rather over-tighten than under-tighten

- Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle

These 4 painful data points mean Prime will increase from 6.45% to 6.70% on Jan 25th.

We now expect there to be at least 1 or 2 more o.25% increases to Prime before it is expected to hold for the rest of 2023, and then begin to decrease in 2024.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

DATA

A lot of the recent talk in financial and real estate circles has been centering on the possibility of a pause in the Bank of Canada’s aggressive interest rate increases. Some speculate that could happen at the next rate setting, later this month, on January 25th.

The Bank raised rates 7 times last year in an effort to rein-in galloping inflation. It does seem to be working, but there are some stubborn sticking points.

Headline inflation, known as the Consumer Price Index (CPI), has dropped. It was 8.1% in July and drifted down to 6.8% in November. However, the drop from October to November was a mere one-tenth of one percentage point and the Bank’s target rate remains significantly below that, at 2.0%.

As well, the BoC’s preferred inflation measure, Core Inflation (which strips out volatile components like food and fuel), actually increased. A simple averaging of the three components that the Bank uses to measure Core Inflation came in at nearly 5.7% in November, up from 5.3% in October.

Other factors that figure into the Bank’s plans include Gross Domestic Product and unemployment. Canada’s GDP continues to grow, albeit modestly, despite rising interest rates. It increased by 0.1%, month-over-month in November. Unemployment dipped 0.1% to 5.0% in December. Both of these tend to fuel higher wages which are a key driver of inflation.

The Bank of Canada, itself, remains firmly dedicated to battling back inflation. Governor Tiff Macklem has said he would rather over-tighten than under-tighten and run the risk of having high inflation linger and become entrenched.

The U.S. central bank has made it clear it plans more rate hikes. Given the integration of the Canadian and American economies, the Bank of Canada does have to pay attention to what its American counterpart does.

The BoC will have new economic data by the time it makes its January 25th announcement. The December numbers will provide a fresh look at how well the inflation fight is going.

Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle. It is reasonable to expect another 25 basis-point increase on the 25th. Given the Bank’s apparent success so far it also seems reasonable to expect a pause sometime after that.

Looking ahead to a year from now some forecasters say we might start to hear talk of interest rate cuts, which would be welcome news. Cuts would allow the BoC to move toward its, long stated, goal of normalizing rates back into the neutral range of 2.5% to 3.5%. The Bank of Canada, and central banks around the world, have been trying to do that for more than a decade – since the ’08 – ’09 financial collapse.

Details of Canadian Economic & Housing Market Performance, as at Dec 7, 2022

Bank of Canada increased Consumer Prime to 6.45% – exactly as expected for the last 5 months. January 25th is the next BoC interest rate announcement & I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Mortgage Mark Herman, Best Calgary mortgage broker with a Master’s degree in Finance.

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 4.25% from 3.75% in October. This is the 7th time this year that the Bank has addressed inflation and means the policy rate is now as high as it has been in 15 years.

We summarize the Bank’s observations below, including its forward-looking comments on the need/likelihood of future rate increases below:

Canadian inflation

- CPI inflation remained at 6.9% in October, with many of the goods and services Canadians regularly buy showing large price increases

- Measures of core inflation “remain around 5%”

- Three-month rates of change in core inflation have come down, “an early indicator that price pressures may be losing momentum”

Canadian Economic and housing market performance

- GDP growth in the third quarter was stronger than expected, and the economy continued to operate “in excess demand”

- The labor market remains “tight” with unemployment near historic lows

- While commodity exports have been strong, there is growing evidence that tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter

- Housing market activity continues to decline

- Data since the October Monetary Policy Report supports the Bank’s outlook that growth will essentially stall” through the end of this year and the first half of 2023

Global inflation and economic performance

- Inflation around the world remains high and broadly based

- Global economic growth is slowing, although it is proving more resilient than was expected at the time of the Bank’s October Monetary Policy Report

- In the United States, the economy is weakening but consumption continues to be solid and the labor market remains “overheated”

- The gradual easing of global supply bottlenecks continues, although further progress could be disrupted by geopolitical events

Outlook

Although the Bank’s commentary noted that price pressures that are driving high inflation may be losing momentum, it went on to say that inflation is “still too high” and that short-term “inflation expectations remain elevated.” In the Bank’s view, the longer that Canadian consumers and businesses expect inflation to be above the Bank’s 2% target, “the greater the risk that elevated inflation becomes entrenched.”

Given these economic signals, the Bank’s Governing Council stated that it “will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target.”

It concluded its statement with a familiar refrain: “We are resolute in our commitment to achieving the 2% inflation target and restoring price stability for Canadians.”

Analysts and commentators will seek to interpret those outlook comments for signs that the Bank has reached or believes it is close to reaching the terminal point in its current rate-hike cycle. For now, that remains a question of debate and speculation that will turn on future economic signals.

Next Touchpoint

January 25th is the next BoC interest rate announcement. I hope it is a 0.25% increase and then holds there for all of 2023. We will see…

Canadian Prime Rate is now 5.95% – Mortgage Rate Analysis to End of 2022

Bank of Canada increased benchmark interest rate to 3.75%

Today, the Bank of Canada increased its overnight benchmark interest rate 50 basis point to 3.75% from 3.25% in September. This is the sixth time this year that the Bank has tightened money supply to quell inflation, so far with limited results.

Some economists had assumed the increase this time around would be higher, but the BoC decided differently based on its expert economic analysis. We summarize the Bank’s observations below, including its all-important outlook:

Inflation at home and abroad

- Inflation around the world remains high and broadly based reflecting the strength of the global recovery from the pandemic, a series of global supply disruptions, and elevated commodity prices

- Energy prices particularly have inflated due to Russia’s attack on Ukraine

- The strength of the US dollar is adding to inflationary pressures in many countries

- In Canada, two-thirds of Consumer Price Index (CPI) components increased more than 5% over the past year

- Near-term inflation expectations remain high, increasing the risk that elevated inflation becomes entrenched

Economic performance at home and abroad

- Tighter monetary policies aimed at controlling inflation are weighing on economic activity around the world

- In Canada, the economy continues to operate in excess demand and labour markets remain tight while Canadian demand for goods and services is “still running ahead of the economy’s ability to supply them,” putting upward pressure on domestic inflation

- Canadian businesses continue to report widespread labour shortages and, with the full reopening of the economy, strong demand has led to a sharp rise in the price of services

- Domestic economic growth is “expected to stall” through the end of this year and the first half of next year as the effects of higher interest rates spread through the economy

- The Bank projects GDP growth will slow from 3.25% this year to just under 1% next year and 2% in 2024

- In the United States, labour markets remain “very tight” even as restrictive financial conditions are slowing economic activity

- The Bank projects no growth in the US economy “through most of next year”

- In the euro area, the economy is forecast to contract in the quarters ahead, largely due to acute energy shortages

- China’s economy appears to have picked up after the recent round of pandemic lockdowns, “although ongoing challenges related to its property market will continue to weigh on growth”

- The Bank projects global economic growth will slow from 3% in 2022 to about 1.5% in 2023, and then pick back up to roughly 2.5% in 2024 – a slower pace than was projected in the Bank’s July Monetary Policy Report

Canadian housing market

- The effects of recent policy rate increases by the Bank are becoming evident in interest-sensitive areas of the economy including housing

- Housing activity has “retreated sharply,” and spending by households and businesses is softening

Outlook

The Bank noted that its “preferred measures of core inflation” are not yet showing “meaningful evidence that underlying price pressures are easing.” It did however offer the observation that CPI inflation is projected to move down to about 3% by the end of 2023, and then return to its 2% target by the end of 2024. This presumably would be achieved as “higher interest rates help re-balance demand and supply, price pressures from global supply chain disruptions fade and the past effects of higher commodity prices dissipate.”

As a consequence of elevated inflation and current inflation expectations, as well as ongoing demand pressures in the economy, the Bank’s Governing Council said to expect that “the policy interest rate will need to rise further.”

The level of such future rate increases will be influenced by the Bank’s assessments of “how tighter monetary policy is working to slow demand, how supply challenges are resolving, and how inflation and inflation expectations are responding.”

In case there was any doubt, the Bank also reiterated its “resolute commitment” to restore price stability for Canadians and said it will continue to take action as required to achieve its 2% inflation target.

NEXT RATE INCREASE

December 7, 2022 is the BoC’s next scheduled policy interest rate announcement. We will follow the Bank’s commentary and outlook closely and provide an executive summary here the same day.

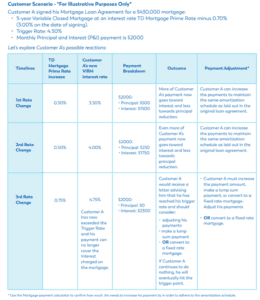

Trigger Point for Canadian Variable Rate Mortgages Explained, with Example

You have likely heard – or will soon be hearing – a lot of talk about “trigger rates” and “trigger points”. More importantly, you are probably hearing “trigger point” together along with more changes in the Bank of Canada rate and you need expert guidance.

Let’s start with a few definitions:

- Variable Rate Mortgage (VRM) – prime changes, rate changes. When interest rates change, typically, your mortgage payment will stay the same.

- Adjustable Rate Mortgage (ARM) – prime changes, rate changes. Unlike variable rate, your mortgage payment will change when interest rates change.

- Trigger Rate – When interest rates increase to the point that regular principal and interest payments no longer cover the interest charged, interest is deferred, and the principal balance (total cost) can increase until it hits the trigger point.

- Trigger Point – When the outstanding principal amount (including any deferred interest) exceeds the original principal amount. The lender will notify the customer and inform them of how much the principal amount exceeds the excess amount (Trigger Point). The client then typically has 30 days to make a lumpsum payment; increase the amount of the principal and interest payment; or convert to a fixed rate term.

NOW, WHICH MORTGAGES WILL BE AFFECTED FIRST?

Quick answer, VRMs from March 2020 to March 2022.

During the month of March 2020, the prime rate dropped three times in quick succession from 3.95% to 2.45%, and variable-rate mortgages arranged while prime was 2.45% have the lowest payments. The lower the interest rate was, the lower the trigger rate, and the faster your client may hit this negative amortization.

WHAT TO DO

When this happens, customers are contacted by the lender and generally have three ways they can proceed:

- Make a lump-sum payment against the loan amount

- Convert with a new loan at a fixed-rate term

- Increase their monthly payment amount to pay off their outstanding principal balance within their remaining original amortization period

Below is a customer scenario so you can see how this could play out.

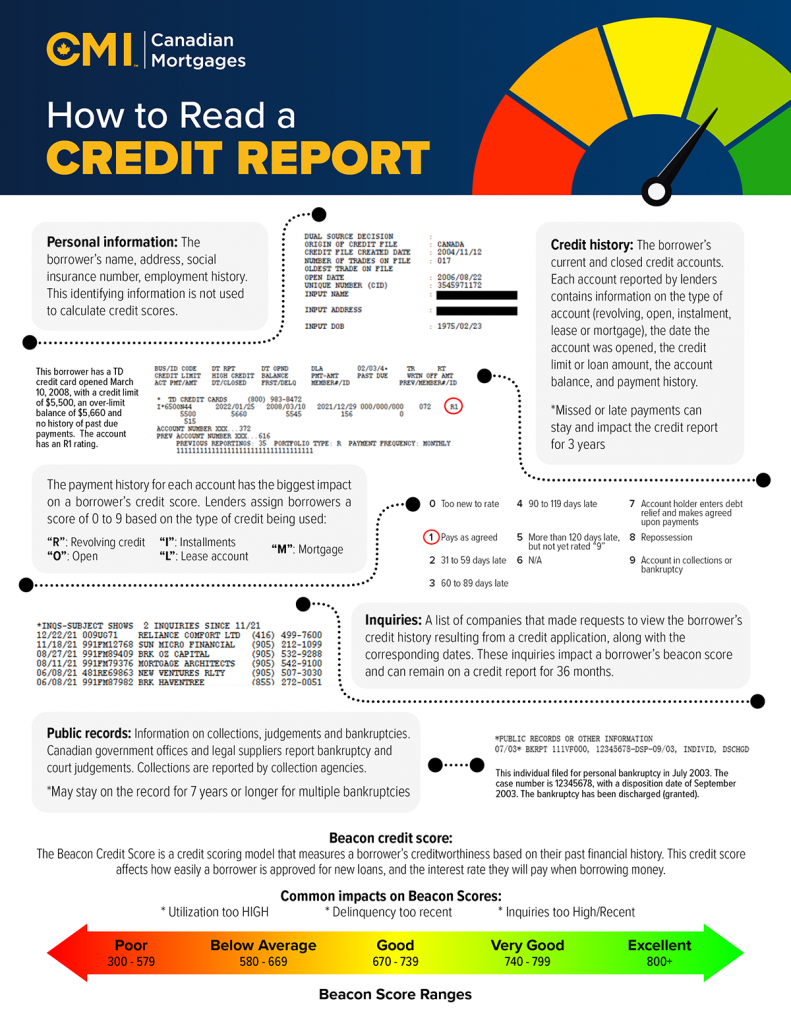

WHAT’S REALLY BEHIND A CREDIT SCORE? Revealing the components of the calculations

Credit scores typically range between 300 and 850 points and provide an indication of a borrower’s capacity r to repay their loans. There are two main credit bureaus in Canada – Equifax and TransUnion – that collect, store, and share information about how you use credit.

5 main factors used to calculate credit scores:

Payment History

The most important factor in a credit score is whether a borrower has a good track record of repaying the money loaned to them. Payment history comprises up to 35% of a credit score. Remind clients that multiple late or missed payments, overdue accounts, bankruptcies and any written off debts will all lower their credit score. Paying back debt quickly can help repair their credit.

Credit Utilization

Credit utilization ratio looks at the percentage of debt used out of all credit limits available to the borrower. If your client has multiple credit cards, revolving lines of credit or other accounts that are maxed out consistently, it can lower their credit score. Help clients examine the type of accounts they hold and stress the importance of managing each of them responsibly.

Credit History

The longer someone has an account open, the better for their credit score. Credit history is a window into how much experience a borrower has managing debt and their ability to pay it off. Work with clients to review active and inactive accounts. Suggest leaving credit card accounts open, even if they don’t use them much, as the age of the account might help boost their score.

New Credit

New credit is another key input to a person’s credit score. Check with clients to see how recently and how often they’ve applied for new credit, as well as how many new accounts have actually been opened. When you apply for new credit, borrowers are subject to a “hard inquiry” so that the lender can check their credit information. If there have been many of these hard credit checks in a short period of time, it could impact their credit score negatively.

Types of Credit

Having more than one type of credit account (while managing them responsibly) can improve your credit score, such as credit cards, an auto loan, mortgages, and lines of credit. This makes up a smaller portion of a borrower’s score, but balancing different types of credit can be a way to raise your client’s score.

Mortgage Tips for Canadian Buyers

Buying a home should be exciting – not exhausting.

Mortgage Checklist

1. Determine your Budget

Determine what your monthly budget is for the following:

– Mortgage payment

– Property taxes and Condo fees (if applicable)

– Utilities, maintenance and repair

2. Pre- Qualification

You will be asked to provide information about yourself and whoever is going to be on the mortgage with you. All of the information that is relayed is strictly confidential. You will be provided with a Mortgage Disclosure and Consent document to review and sign. Next, your Mortgage Broker will pull your credit bureau and review your overall situation and start the document collection process so they can determine your maximum purchase price and min down payment. A rate hold can be obtained once documents have been reviewed.

3. Document Preparation

Income for Salary or Hourly Employees

– Most recent Pay Stub

– Letter of employment – must be on company letterhead and state your name, position, length of employment. Guaranteed min # of hours and rate of pay or annual salary. It also must have contact information for the lender to call to verify employment once an offer has been made.

– Last 2 years Notice of Assessments (NOAs), T1 Generals and T4 slips for any hourly overtime, commission or bonus income

Income for Self-Employed:

– Last two years Notice of Assessments and T1 generals + confirmation no CRA tax in arrears

– Last 2 years statement of business activities for Sole Proprietors

– Articles of incorporation and Last 2 years company financials for Corporations/Partnerships

Down Payment/Closing Costs

– Anti Money Laundering Laws require the lender to review your 90 day Bank or Investment account histories to verif funds in account for down payment. Any frequent or large deposits and transfers must be verified. Online statements are acceptable, but smartphone screenshots are not.

– Gift letter + gift funds deposited to account, proof of Line of Credit available or sale of existing home proceeds (if applicable)

– You are required to have 1% to 1.5% of the purchase price on top of your down payment for costs relating to the closing of your new home purchase such as home inspection, property tax adjustments, appraisal fees, title insurance, moving expenses, utility hook ups and home fire insurance.

4. Find a realtor and start looking at houses

If you do not already have one, we can highly recommended you to one of our realtor connections. You can the proceed to look for a home that is within your pre-determine price. When you have found a house that you want to purchase, make sure your realtor makes it conditional on obtaining satisfactory financing. It is best to specify 7 to 10 days. It is also recommended to include the condition of a satisfactory house inspection.

5. Mortgage Approval

Once you have a confirmed Offer to Purchase on a house, notify your Mortgage Broker right away so they can start to work on getting the mortgage approved. At this time you will need to give your Mortgage Broker the following documents:

– Updated paystub, job letter and down payment account histories if they are more than 30 days old

– Completed & signed Offer to Purchase

– MLS listing (fact sheet) of the property, if private sale – old MLS listing or appraisal to confirm details

– Lawyer Information (Including the firm and solicitor’s name, address, phone and fax)

– Copy of void cheque for mortgage payments

6. Commitment Signing

A mortgage commitment is provided to your Mortgage Broker by the lender after your deal is approved. Your Mortgage Broker will spend time to review your mortgage commitment with you and let you know about any other lender requirements that need to be fulfilled. You then need to submit those requirements in order to get a final mortgage approval.

7. House Appraisal and Inspection

If required, your Mortgage Broker will order and schedule an appraisal. The mortgage lender determines th requirement of this. This is also the time where you should arrange to have an inspection performed on the home by a certified house inspector. The main purpose of a home inspection is to determine if the home has any existing major defects or any major repairs coming up in the near future. A home inspector will determine structural and mechanical soundness, identify any problem areas, provide cost estimates for any work required and provide you with a report.

8. Condition Removal

Once the lender has confirmed they have all the required documents and the deal is approved you can contact your realtor and have the financing condition removed. At the same time, if the home inspector’s report came back satisfactory, that condition can be removed as well. Do not remove conditions until all amendments to your real estate contract have been reviewed and accepted by the lender as it could affect your financing.

9. Meet with Lawyer

Once all of the conditions for the mortgage are verified and approved, the lender will package your mortgage up and send it to your lawyer whereupon your lawyer will call you in for a meeting one to two weeks before your possession date to go over the legal matters of the mortgage. You will review and sign documents relating to the mortgage, the property you are buying, the ownership of the property and the conditions of the purchase. Your lawyer will also ask you to bring a certified cheque or bank draft to cover closing costs and any other outstanding costs. Avoid signing up for duplicate Mortgage Life/Disability insurance at lawyers.

10. Possession Day

Once the transfer of money has occurred between your lawyer and the seller’s lawyer, you will officially own your new home. Your realtor will arrange to meet with you at your new home and do a walk through to make sure everything is as it should be and also to give you the keys. Congratulations!

Creating happy homeowners by providing personal bespoke mortgages solutions with uncompromising service.

Mortgage Mark Herman

Mortgage Broker & Overall Happiness Creator

Mortgages Are Marvellous

Mark@MortgagesAreMarvellous.ca

Serving Clients In: Calgary, Okotoks, Airdrie, Strathmore, Cochrane, Lethbridge, Red Deer,= & Medicine Hat.

Also Serving: All areas of Alberta including: Edmonton, Sherwood Park, Fort Saskatchewan, Leduc, Nisku, Stony Plain, Spruce Grove, Beaumont and St. Albert. Wood Buffalo / Fort McMurray, Grande Prairie, Airdrie, Lloydminster AB, Okotoks, Cochrane, Camrose, Chestermere, Sylvan Lake, Brooks, Strathmore, High River, Wetaskiwin, Lacombe, Canmore, Morinville, Whitecourt, Hinton, Olds, Blackfalds, Taber, Coaldale, Edson, Banff, Grand Centre, Innisfail, Ponoka, Drayton Valley, Cold Lake, Devon, Drumheller, Rocky Mountain House, Slave Lake, Wainwright, Stettler, St. Paul, Vegreville, Didsbury, Bonnyville, Westlock, Barrhead.

How sudden job loss affects your mortgage pre-approval or approval

If you’ve been thinking about buying a house, you’ve probably considered how much you can afford in mortgage payments. Have you also thought about what would happen if you lost your source of income?

While the sudden loss of employment is always a possibility, the current uncertainty of our economy has made more people think about the stability of their income. Whether you’ve already made an offer on a home or you’ve just started looking, here is how job loss could affect your mortgage approval.

What role does employment play in mortgage approval?

In addition to ensuring you earn enough to afford a mortgage payment; mortgage lenders want to see that you have a history of consistent income and are likely to in the future. Consistent employment is the best way to demonstrate that.

To qualify for any mortgage, you’ll need proof of sufficient, reliable income. Your mortgage broker will walk you through the income documents your lender will need to verify you’re employed and earning enough income. So, if your employment situation is questionable, you may want to reconsider a home purchase until your employment is more secure.

Should you continue with your home purchase after you’ve lost your job?

What if you’ve already qualified for a mortgage, and your employment circumstances change? Simply put, you must tell your lender. Hiding that information might be considered fraud, and your lender will find out when they verify your information prior to closing. If we are aware of this change we may be able to work it out with the lender.

What if you don’t tell the lender or us – your broker – and hope the lender does not find out?

The lender will probably “pull your financing” if they find out on their own, and this can happen right up to the minute before possession, like 11:59 am on possession day.

At best, you may “close late” and there are fees for that, at worst, you could both:

· Lose your deposit that you gave and

· Be sued for “specific performance” of completing a legal and binding contract to buy the home. If the sellers need the funds to close on another house, they could “fire sale” the home for say $50,000 less and sue you for that to. And you will probably lose.

If you’ve already gone through the approval process, then you know that your lender is looking for steady income and employment.

Here are some possible scenarios where you may be able to continue with your purchase:

- If you secure another job right away and the job is in the same field as your previous employment at a direct competitor. You will still have to requalify, and it may end up being for less than the original loan, but you may be able to continue with your home purchase. Be aware, if your new employer has a probationary period (usually three months), you might not be approved.

- TIP: ask if you can have probation waived or be hired without probation.

- If you have a co-signer on your mortgage, and that person earns enough to qualify on their own, you may be able to move forward. Be sure your co-signer is aware of your employment situation.

- If you have other sources of income that do not come from employment, they may be considered. The key factors are the amount and consistency of the income. Income from retirement plans, rentals, investments, and even spousal or child support payments may be considered if we have not used that income to qualify you please tell us.

Can you use your unemployment income when applying for a mortgage?

Generally, Employment Insurance income can’t be used to qualify for a mortgage. The exceptions for most financial institutions are seasonal workers or people with cyclical employment in industries such as fishing or construction. In this situation, you’ll be asked to show at least a 2-year cycle of employment followed by Employment Insurance benefits.

Also if you are in an apprenticeship, then you are on EI when you are in your “school term” and that is totally fine.

What happens if you’re furloughed (temporary leave of absence)?

Not all job losses are permanent. As we’ve seen during the COVID-19 pandemic, many workers were put on temporary leave. If you’ve already been approved for a mortgage and are closing on a house, your lender might take a “wait-and-see” approach and delay the closing if you can demonstrate you’ve only been furloughed. In these cases, you’ll need a letter from your employer that has a return-to-work date on it. Keep in mind, if you don’t return to work before your closing date, your lender will likely cancel the approval and ask for a resubmission later.

If you haven’t started the application process, it would be wise to wait until you are back to work for at least 3-months to demonstrate consistent employment.

Your credit score and debt servicing ratios may change because of lost income, which means you may no longer meet your lender’s qualifications for a mortgage. While it may not be possible, try to avoid accumulating debt or missing any payments while unemployed.

Talk to your mortgage broker.

You don’t want to get locked into a mortgage you can’t afford. You also don’t want to lose a deposit on a home because you lost your financing. When trying to assess if it’s better to move forward or walk away, we should be your first call.