Advice on Mortgage Renewals Before April 2026 from an MBA

Questions on what product to pick for your upcoming mortgage renewal.

Here are the reasons that we like the 5 year fixed for Canadian mortgage renewals over the next few months.

(renewals from now, February 2nd until April 1st.)

This data is recent and should be good for the next few months.

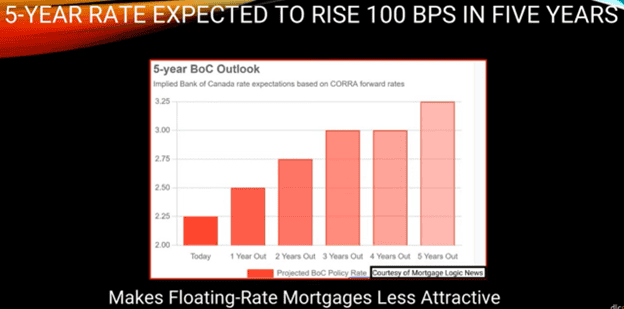

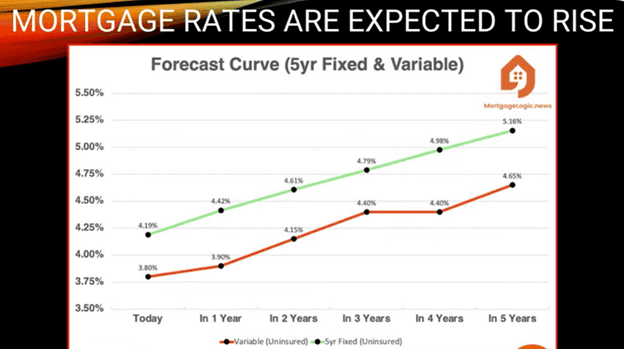

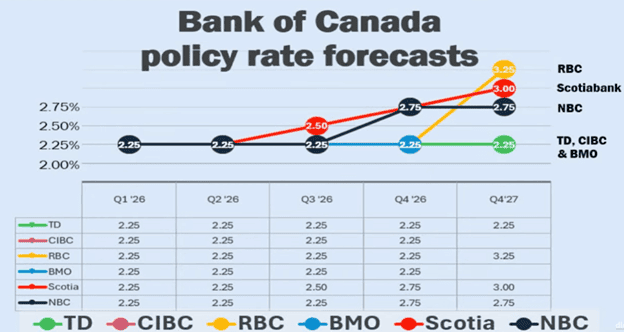

Below are the graphs that show that rates are trending up and are on the increase.

Q: Why are rates trending up?

A: Because Trump policy is generally inflationary, and add in the “cost of uncertainty” due to changing tariffs and other world political issues we have an increasing rate environment.

Big Picture Perspective

I also look at from this perspective, rates were close to 4% BEFORE Covid in 2020, and we are now back to about the same; 3.99% for a 3-year fixed and 4.25% to 4.54% for a 5 year fixed rate term.

- Comparing these rates, there is not much room for rates to go down; maybe .5%, half a percent.

- But there is lots of room for them to go up.

What if things get out of hand and rates are at 6% or 7%?

When I started out in 2004, my first customer’s rate was 8.99% and they were happy it did not start with a 9. (You always remember your first deal.)

Summary

The rates for the 3 year fixed and the 5 year fixed are similar so take the 5 year and know you are getting a good rate at the bottom of the rate cycle.

If you take the 3 year and rates DO go up, and you then renew 2 years sooner into what could be 6% or 7% rate environment (when you could have had 2 more years at 4.zz%.) You will be pretty upset as your new monthly payment would now be higher even though your balance is lower.

If you take the 3 year fixed and the rates stay low then you gain a slightly lower payment ($25/ month) over the first 3 years.

Most of our customers agree the safer bet is less expensive when you factor in how sound you will sleep at night.

Mortgage Mark Herman, best Calgary broker for mortgage renewals and advice.

Stress Test Continues; Was Almost Abolished

Yes, the Stress Test was almost done away with but it continues.

It seems to be a good thing that all the mortgages since 2018 have been “stress tested” at 5.25%. Now that we are in the middle of 3.6 million mortgages renewing over an 18 month period we find that most everyone is able to make their new mortgage payments after renewal.

Mortgage Mark Herman, MBA in Finance and 22 years experience as a mortgage broker in Western Canada

Nerd alert here!!

OSFI has also determined that loan-to-income (LTI) limits on each institution’s mortgage portfolio will remain in place, alongside the existing stress test.

LTI limits have been in place since each institution’s 2025 fiscal year start and are reported on a quarterly basis.

This is a limit on the volume of newly originated uninsured mortgage loans, at that financial institution, that exceed a 4.5x loan-to-income multiple. This is not a limit on each individual loan.

This measure was introduced in an effort to lessen the build-up of highly leveraged residential mortgage borrowers.

Background

Canada’s federal mortgage stress test began on January 1, 2018, when the Office of the Superintendent of Financial Institutions (OSFI) introduced it for uninsured mortgages.

Key Details of the Stress Test

- Introduced: January 1, 2018

- Regulator: OSFI (Office of the Superintendent of Financial Institutions)

- Applies to: Uninsured mortgages (20%+ down payment) at federally regulated lenders

- Purpose: Ensure borrowers can afford payments at a higher qualifying rate than their contract rate

Buying a Home with a Basement Suite – Some Details

Buying a home with a basement suite can be a powerful way to increase affordability, improve cash flow, and build long-term wealth — but not all suites (or lenders) are treated the same. If you’re considering a home with a suite, here are four important things to think about before you buy.

1) The type of suite matters.

If a suite is legal (fully permitted and meets municipal bylaws), all lenders will accept the rental income for qualification. If it’s not legal, make sure it’s at least fully self-contained, meaning it has its own entrance, its own kitchen, and its own bathroom. Many lenders will still consider rental income from these types of suites, but not all.

2) Your lender choice can change how much you qualify for.

Different lenders treat rental income very differently. Some will only allow 50% of the rental income to be used, while others allow up to 100%. Some lenders make you debt-service property taxes and heat, while others do not. These differences can have a huge impact on your approval amount, which is why working with a broker who understands rental income policy is so important.

3) Whether the suite is already rented or not DOES matter.

If the suite is currently rented, you should obtain a copy of the lease, make sure the purchase contract clearly states that the tenant is staying, and ensure the monthly rent amount is documented. If the suite is not already rented when you purchase the home, lenders will typically require an appraisal to confirm market rent. It’s very important to be conservative about what you expect the suite to rent for — especially if that rental income is crucial to comfortably affording the home.

What about adding a basement suite OR Mother-in-Law suite to the home I am buying?

Great idea, adding a suite to the home that you are buying AND at the same time, using the expected rental income from that same suite to qualify for the mortgage IS possible. There are a few lenders that allow this to happen and we do deals like this all the time. (No shortcuts though, as the final step is a final inspection and also providing the lender a copy of the occupancy permit from the City before the funds can be released.

Obviously there are some details involved but adding a suite and using the expected rental income to qualify for the mortgage is a huge helper for buyers looking to push a bit higher and get a “mortgage helper.”

Mortgage Mark Herman, 1st time home buying mortgage specialist

5 Car Loan Strategies That Can Boost Your Mortgage Approval — An MBA-Level Approach

Top 5 Car Loan Strategies We Used for Mortgage Clients in 2025

In today’s mortgage landscape, qualification isn’t just about income and credit—it’s about strategic debt management. With an MBA in Finance and 21 years in the industry, I approach mortgage qualification the same way I would evaluate a business balance sheet: identify inefficiencies, reduce liabilities, and optimize cash flow.

One of the most overlooked opportunities to a mortgage approval is your auto loan.

Car loan rates now at their lowest point in nearly five years—6.25% to 6.99%—the math has never worked better.Mortgage Mark Herman; Best Mortgage Broker for New Home Buyers in Calgary, Alberta.

Most clients are seeing sizeable reductions in their monthly payments, which directly improves affordability ratios and increases borrowing capacity. In other words, small changes on the car side can create big changes on the mortgage side.

Why Auto Loan Optimization Matters

Mortgage lenders don’t qualify you based on total debt—they focus on monthly obligations. So even if your auto loan balance is reasonable, the payment itself may be restricting your mortgage approval.

From a financial efficiency standpoint, this is low-hanging fruit. Reducing or restructuring this one line item can dramatically shift your debt-to-income (DTI) ratio and unlock far greater mortgage purchasing power.

Top 5 Car Loan Strategies We Used for Mortgage Clients in 2025

1. Commercial Auto Loans for the Self-Employed

By shifting the vehicle loan from personal to business liability, we remove the payment entirely from your mortgage ratios. This is financial restructuring 101—use the proper balance sheet for the proper asset.

2. Auto Loan Payment Reductions

With today’s lower rates and extended terms (up to 96 months on newer models), most clients see substantial monthly reductions.

This isn’t about stretching debt—it’s about reallocating cash flow to where it has the highest ROI: qualifying for a home.

3. Cash-Back Refinancing

Lower the payment and pull out equity from your vehicle.

This can fill down payment gaps or pay off high-interest debt—another strategic reshuffling of resources to strengthen your mortgage file.

4. “Free and Clear” Mortgage-First Strategy

Sometimes paying off a car is required to get a mortgage approved.

The sophisticated move? Refinance the vehicle after closing and reimburse yourself. You maintain mortgage eligibility and preserve liquidity—exactly the type of sequencing we analyze in financial planning.

5. Co-Signer Removal

If you’ve co-signed for someone else, you’re carrying a liability without receiving the benefit.

Removing yourself restores borrowing capacity and aligns your financial profile with your actual obligations.

The Bottom Line

Your auto loan isn’t just a monthly payment—it’s a strategic lever in your overall financial picture. By applying an analytical, MBA-driven approach to debt optimization, we can often increase mortgage qualification dramatically without changing income or credit.

If you’re planning to buy a home this year, let’s look at your auto loan the way a CFO looks at a balance sheet:

Find the inefficiencies, optimize the structure, and unlock the capacity you didn’t know you had.

Mortgage Renewals – 2.75 million Canadian Mortgage Renewals Before 2028!!

Mortgage Stress Test: Why It’s Protecting Homeowners Ahead of the 2026 Renewal Wave

If you locked in your mortgage around 2% five years ago, you probably remember grumbling about the federal “stress test.” At the time, qualifying at 5.25% felt unnecessary — almost punitive. Fast forward to today, and that very safeguard is proving to be one of the smartest policies in Canadian housing finance.

The Renewal Wave Is Coming

According to the latest CMHC report, Canada is heading into a busy period of mortgage renewals:

- 750,000 mortgages will renew in the second half of 2025

- Over 1 million more in 2026

- 940,000 in 2027

Even though the Bank of Canada has cut rates nine times since its peak tightening cycle, borrowing costs remain much higher than they were during the pandemic lows. In fact, the average five-year fixed uninsured mortgage rate in July 2025 was still 67% higher than five years earlier.

“Banks are ready for the almost 3 million mortgage renewals before 2028. Lets get you a strategy on how to get the best rates on your renewal. Its a quick 10 minute phone call and we usually send you back to your own bank with the data you need to get a better rate from them OR we can move you to a bank that does get you better rates.”

Mortgage Mark Herman, Top Calgary Mortgage Broker for renewal advice

Stress Test Success

Here’s the good news: borrowers who qualified at 5.25% back in 2020 are now proving resilient. The stress test ensured they could handle payments at rates much higher than what they actually received. That foresight is paying off:

- National mortgage delinquency rates fell in Q2 2025 — the first decline since 2022.

- While Ontario and BC saw arrears climb (reflecting higher property values and loan sizes), the overall system is holding steady.

- Fears of a “renewal cliff” have eased, thanks to both the stress test and recent rate cuts.

What This Means for You

If your mortgage is coming up for renewal in 2026, now is the time to plan. Options like refinancing, adjusting amortization, or exploring different products can help smooth the transition. The stress test gave you a buffer — but proactive planning will maximize your financial flexibility.

Call to Action: If your mortgage is set to renew in the next 12–18 months, let’s talk strategy. As a mortgage broker, I specialize in helping clients navigate renewals, refinances, and complex lending scenarios. Call me today to review your options and make sure you’re ready for what’s ahead.

Thinking twice when handing your mortgage over to a bank adviser

Great story below of a recent Scotiabank advisor messing up a deal so bad that it ended up disqualifying a buyer from getting a special at 3.69% insured mortgage when market rates are 4.45%.

Bank advisors mess up all the time and I hear about it all the time. Maybe 15% of our deals get to us from bank mess ups.

In the story cut and paste below these buyers just would have ended up with a a higher rate but their deal wold still work… this one caused a 1 year delay.

Let me tell you a mortgage story…

We had a customer that we helped sheppard past 3 or 4 fiery hoops getting his mortgage ready for approval with a bumpy past we were smoothing over. Then 1 day he calls and says a met a bank mortgage rep at a gas station, that bank rep “guaranteed” him getting approved so our customer applied and … surprise – worse than a decline, CMHC declined him.

CMHC was the only lender that would do his specific deal, for the mess he was in, and/ but CMHC NEVER forgets – anything. All the insurers retain all data for ever. So he now had to wait another 12 months to get insurer approval. The delay in the end was 12 additional months that he had to wait before he could buy.

So … Think twice before handing over your mortgage to a bank adviser

Mark Herman, Best mortgage broker in Calgary Alberta for new home buyers.

Opinion: Think twice before handing your mortgage to a bank adviser – CMT News

Written by Ross Taylor, Mortgage Strategies, Opinion,

Let me tell you a story.

Recently, a major chartered bank ran a very competitive promotion: 3-year fixed rates at 3.69% for insured files and 3.99% for conventional files. Needless to say, these rates were popular, business was booming, both for the bank and for brokers working with them.

We had pre-approved a young couple earlier in the year, but when it came time to seek approval on a home they had made a successful offer on, they first went directly to their local branch to withdraw funds from their First Home Savings Account (FHSA).

When a branch adviser steps in

During that visit, the branch financial adviser offered to handle their mortgage as well. He convinced them there was no need to come back to our team, he had it all under control.

They also explored options at another bank, but the rates they were offered were mediocre. Our promo was still the best rate in town.

The deal gets declined, and there’s no second chance

But here’s the twist. After the financial adviser submitted their deal, it was declined. He escalated the deal to senior management, but again was given a firm no.

When they came back to us and told me the news, I was shocked. I couldn’t understand why they were declined. On paper, this was a strong file. Solid income, great credit, and their debt service ratios were within reasonable bounds.

Misinterpreting income cost them the deal

I asked if they were told why they were turned down, and they said, “because our debt service ratios were over the 39/44 limit.”

Now, their pay stubs were a bit complicated, I’ll give you that. But we had their T4s, and I could easily make a case for either using a two-year average or taking their current full-time salary. Both would have worked. You just had to know how to interpret the documentation properly.

I contacted our Business Relationship Manager at the bank and asked if I could re-submit the file. After all, it had been declined, and I felt confident we could get it approved with the correct interpretation of income. But the answer was a firm no.

Why bank policy closed the door

The bank’s position was that I wouldn’t want another broker or branch employee taking one of our approved files and trying to submit it again. And while I understand the sentiment, this wasn’t the same thing. This wasn’t poaching a win, it was salvaging a decline.

But rules are rules, and because the file had already been escalated and declined by the branch, there was no path forward for me to resubmit it — even if I knew how to fix it.

What’s the lesson here? Be careful who you trust with your mortgage

This story isn’t about one bank being better than another. It’s about understanding that not all mortgage advisers are created equal. When you walk into a branch, you’re often speaking to a generalist. They might have good intentions, but they don’t always have the same level of mortgage-specific training or experience as a full-time mortgage broker.

And the consequences of that can be enormous. In this case, the clients lost out on a great rate and had to start over, simply because it seems their adviser didn’t fully understand how to package their income. And once the file was declined, there was likely no second chance.

The bottom line

Mortgages are complex, especially if your income is even slightly non-standard. Getting declined not only wastes time, it can actually prevent you from accessing the best deals, even if you’re fully qualified. Before you hand over your file to someone behind a desk at your local branch, ask yourself: do they really specialize in mortgages?

Because once a file is escalated and declined at the bank level, it may close off options you didn’t even know you had.

Make sure you’re putting the biggest financial transaction of your life in the right hands.

Reverse Mortgage Specials: October 2025

The reverse mortgage market is surging yet remains undeserved by brokers that dabble in this product.

We have been doing Reverse Mortgages since 2005, and also did the largest Reverse Mortgage ever at the time (in 2014) for $720,000!!

With millions of Canadians approaching retirement and facing a savings shortfall, now’s the time to look into REVERSE MORTGAGE Options.

Mortgage Mark Herman, expert in Canadian Reverse Mortgages

The Numbers

3M

Canadian households retiring in the next 10 years

$1M

What most Canadians believe they need to retire

$272K

Average retirement savings for Canadians 65+

That’s a $728K gap—and reverse mortgages can help close it.

Right now 2 of the 3 big lenders have a special on.

- Available in AB, BC, ON, QC

- We’ll beat any posted rate for comparable reverse mortgages

HIGHLIGHTS of these lenders and their reverse mortgages:

- Tax-free cash for:

- Paying off an existing mortgage

- Debt consolidation

- Health care & renovations

- Living inheritance & gifts

- No monthly payments required

- No impact on federal retirement benefits

- 100% home ownership retained⁶

- Preserve investments & legacy while aging in place

Ready to start the conversation?

Reach out today to discover how reverse mortgages can grow your business—and help your clients thrive.

Reach me direct at 403- six81- 437six

I answer from 9-9 x 365.

#1 Mortgage Rate SPECIAL in Canada ⚡

|

|

|

How to Buy a Home in Alberta with Poly B Plumbing

Are you trying/ looking to buy a home in Alberta with Poly B plumbing?

We just completed financing on a purchase in Calgary with Poly-B throughout the home AND we managed to INCLUDE the cost to replace it it all into the mortgage too!!

Mortgage Mark Herman, best Calgary Alberta mortgage broker near me.

Action Steps

Please reach out if you would like to talk about:

- The contact for the home/fire insurance company that INCLUDES Poly B, with full replacement value of the home, as required

- Buying a home / getting a mortgage that needs Poly B replacement.

- Adding/ including the cost of a renovation into your mortgage on purchase, or on renewal, or at any time.

Summary

Homes with Poly B are priced lower accordingly due to the difficulty of getting home/fire insurance BUT there is some “good uplift to the value” if it can be fixed.

It was a rough ride but now that we have all the pieces in place, the next ones will be easier.

2 extra moving parts to a normal deal:

- Getting the quote for the replacement of the Poly B for the entire home, from a company that will do it.

- Hardest part was getting the home/fire insurance to cover 100% of the home replacement cost.

Below is the wording in the mortgage approval that came back to us on what it had to include from the mortgage lender:

- *Copy of home insurance policy – need receipt of valid fire insurance particulars for the subject property.

- **Coverage must include full replacement cost of Poly B for single family dwelling

- *** Require full disclosure to insurance provider that home contains Poly B Plumbing and endorsement.

Tricks

Sometimes the insurance companies will only cover it for 30 – 60- or 90 days; until the work is completed. Then they go back to a normal policy at normal rates. If that is the case then the bank adds this clause:

- It must be noted that Poly B will be replaced within “x” amount of days.

- (This is usually whatever the contractors timeline to having the work done is the “x-days”)

Adding the cost of the reno into the mortgage – our specialty for the last 20 years.

We have a fantastic “Perfect Home Mortgage” that allows you to add up to $40,000 easily, or with some difficulty (more questions and paperwork) up to $100,000 in renos to the mortgage.

Essentially, 1 quote is needed for the work being done, then bank send the funds for the home, and the reno to the lawyer. When the work is 100.000% complete we order an inspection of the work, and the the lawyer pays the company for the work. this usually has to be completed in 90 days.

Below is the wording from the bank for this:

- Please ensure the client knows there will be a holdback at the lawyers for the full cost of the Poly B improvement.

- It is the buyer’s responsibility to make arrangements with the contractor to either pay them direct or have lawyer directed funds once completed.

- It is a condition that an appraiser inspects and confirms the work done prior to funds being released and the cost of the inspection is paid by buyer.

ENDING…

Is this for you? Are you ready for the ride?

* Poly B, or polybutylene, is a type of plastic plumbing pipe that was commonly used in residential plumbing systems from the mid-1970s to the mid-1990s. It was initially favored for its low cost and ease of installation, but it has since been identified as a material prone to leaks and failures.