Summer is here!

Our 55+ clients are thinking about ways to refresh their homes.

Whether it’s for comfort, safety, or curb appeal, renovations can get pricey and the CHIP reverse mortgage can really help out.

Mortgage Mark Herman, CHIP and Reverse Mortgage specialist, here to help the 55+ home owners.

The CHIP Reverse Mortgage by HomeEquity Bank can help you access the funds you need—tax-free and with no monthly mortgage payments required.

Here are just a few popular spring projects our recent customers have been planning:

- Retrofitting their home to support aging in place

- Resealing windows and doors for better energy efficiency

- Landscaping makeovers to enhance privacy and beauty

- Adding an outdoor kitchen and seating area for entertaining

- Repaving the driveway to boost curb appeal

With the CHIP Reverse Mortgage, you can unlock up to 55% of your home’s equity, giving you the freedom to renovate now and enjoy the results for years to come—all without dipping into your retirement savings.

Looking for tips on how use the CHIP in renovations? Call or email me, I’d be happy to help!

GST Rebate for 1st Time Home Buyers

We have had lots of questions about this proram.

The legislation has been tabled, but is not done yet. As of today, and it is for contracts written May 27, 2025 or later.

Updates as they come in.

We have a 4-plex buyer who is purchasing a newly constructed 4-plex in Calgary at $1,250,000. His rebate is about 60k – now that is now pretty substantial!

Mortgage Mark Herman, 1st time buyer and move up mortgage specialist in Calgary Alberta.

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

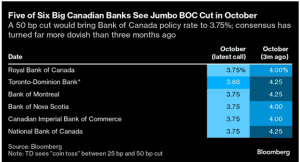

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

New Canadian Mortgage Rules; Sept 2024

Great news from Ottawa today on the new rules for Canadian mortgages:

- An Increase to the Insured Mortgage Price Cap: The government will raise the price cap from $1 million to $1.5 million, reflecting the realities of today’s housing market. This change, effective December 15, 2024, will help more Canadians qualify for insured mortgages and make homeownership more attainable, especially for younger Canadians.

- Expanded Eligibility for 30-Year Amortizations: First-time homebuyers and all buyers of new builds will now be eligible for 30-year insured mortgage amortizations. This is a crucial step in reducing monthly mortgage payments and helping more Canadians, particularly Millennials and Gen Z, achieve the dream of owning a home.

- Increased Mortgage Competition: The strengthened Canadian Mortgage Charter now enables insured mortgage holders to switch lenders at renewal without being subject to another stress test. This will foster greater competition and ensure Canadians have access to the best mortgage deals.

All 3 of these changes will help New Buyers / 1st Time Buyers afford to get into a home of their own.

Most of our First Time Buyers need gifts or co-signing from parents to be able to buy. The 30 year amortization and increase of CMHC insurance will totally help.

Mortgage Mark Herman, Best top Calgary Alberta mortgage broker specializing in 1st time buyers for 20 years.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

GIFTed down Payment now possible for New-to-Canada home buyers!!

For New to Canada buyers – Expanded “GIFT-ing” is now possible for close family members!

That’s right! As of now, May 23, 2024, buyers who are New to Canada – in Canada for less than 2 years – ARE now allowed to use /receive GIFTS for down payment from “close family members.”

This is a big deal because it now includes; aunts, uncles, nephews, and cousins; all were not allowed to provide a “GIFT for down payment” before.

The standard used to be only: mother, father, brother, sister, grandparent and legal guardian; and that was it.

From our data that we have on on our own customers, this will help about 20% of our New to Canada files to buy a home, where they would have been shut out before.

Mortgage Mark Herman, top best fantastic Calgary Alberta mortgage broker, specializing in First Time Buyers.

We view that the Expanded Gift-er Options ARE needed due to the average new home price being 500k+, it is super tough for newcomers to save enough to buy a home. GIFTS are relied on all the time by 1st time home buyers.

Bank of Canada Leaves Prime the Same, April 2024

As Expected, No change in Bank of Canada benchmark interest rate for April 2024.

As noted in August 2023, the 1st Prime Rate reduction is expected in July and then Prime should come down at o.25% every 90 days so … 1 quarter percent reduction, every calandar quarter, for the next 2 years.

Mortgage Mark Herman, best top Calgary Alberta mortgage broker.

Today, the Bank of Canada announced it is keeping its benchmark interest rate at 5.0%, unchanged from July of 2023. However, much has changed in the economy and in the world since then. For evidence, we parsed today’s announcement and present a summary of the Bank’s key observations below.

Canadian Inflation

- CPI inflation slowed to 2.8% in February, with easing in price pressures becoming more broad-based across goods and services. However, shelter price inflation is still very elevated, driven by growth in rent and mortgage interest costs

- Core measures of inflation, which had been running around 3.5%, slowed to just over 3% in February, and 3-month annualized rates are suggesting downward momentum

- The Bank expects CPI inflation to be close to 3% during the first half of 2024, move below 2.5% in the second half, and reach the 2% inflation target in 2025

Canadian Economic Performance and Housing

- Economic growth stalled in the second half of last year and the economy moved into excess supply

- A broad range of indicators suggest that labour market conditions continue to ease. Employment has been growing more slowly than the working-age population and the unemployment rate has risen gradually, reaching 6.1% in March. There are some recent signs that wage pressures are moderating

- Economic growth is forecast to pick up in 2024. This largely reflects both strong population growth and a recovery in spending by households

- Residential investment is strengthening, responding to continued robust demand for housing

- The contribution to growth from spending by governments has also increased. Business investment is projected to recover gradually after considerable weakness in the second half of last year. The Bank expects exports to continue to grow solidly through 2024

- Overall, the Bank forecasts GDP growth of 1.5% in 2024, 2.2% in 2025, and 1.9% in 2026. The strengthening economy will gradually absorb excess supply through 2025 and into 2026

Global Economic Performance and Bond Yields

- The Bank expects the global economy to continue growing at a rate of about 3%, with inflation in most advanced economies easing gradually

- The US economy has “again proven stronger than anticipated, buoyed by resilient consumption and robust business and government spending.” US GDP growth is expected to slow in the second half of this year, but remain stronger than forecast in January

- The euro area is projected to gradually recover from current weak growth. Global oil prices have moved up, averaging about $5 higher than the Bank assumed in its January Monetary Policy Report

- Since January, bond yields have increased but, with narrower corporate credit spreads and sharply higher equity markets, overall financial conditions have eased

- The Bank has revised up its forecast for global GDP growth to 2.75% in 2024 and about 3% in 2025 and 2026

- Inflation continues to slow across most advanced economies, although progress will likely be bumpy. Inflation rates are projected to reach central bank targets in 2025

Outlook

Based on the outlook, Governing Council said it decided to hold the Bank’s policy rate at 5% and to continue to “normalize” the Bank’s balance sheet. It also noted that while inflation is still too high and risks remain, CPI and core inflation have eased further in recent months.

The Council said it will be looking for evidence that this downward momentum is sustained. Governing Council is particularly watching the “evolution of core inflation,” and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.

As it has said consistently over the past year, the Bank will remain “resolute in its commitment to restoring price stability for Canadians.”

Next Touchpoint

On June 5th, 2024, the Bank returns with another monetary policy announcement and economists are already lining up with predictions of a rate cut either then or in July.