Using cryptocurrency to buy a home in Canada: 2025

We have been getting lots of customers asking this question with the recent rise of crypto values.

Below are ALL the details I have collected: from tax implications to AML compliance, what buyers need to know before turning digital gold into a home.

I have bitcoins for my down payment on my home!

Many Canadians now have significant Bitcoin, Ethereum or other crypto and want to use that for the down payment in a home purchase.

However, turning crypto into a viable down payment, or leveraging it as collateral, isn’t nearly as simple as it sounds.

Mortgage Mark Herman, Best Calgary Alberta mortgage broker for crypto mortgage brokers and first time home buyers

First, what is a crypto mortgage?

Crypto mortgages typically fall into one of two categories:

- Crypto-funded mortgage – the way that actually works: You sell your crypto, convert it to Canadian dollars, and use those funds as your down payment. This way also comes with some with tax consequences on the sale – but hey, your crypto may be up 15000%, and the capital gains tax is only on the amount you cash in, and it is 50% of the profit. SEE THE MATH ON THIS at the bottom.

- Crypto-backed mortgage – what everyone is asking for: You pledge your crypto as collateral without selling it. This probably helps avoid triggering capital gains tax, but requires a lender capable of assessing and managing that risk. We have not found this route to work due to enormous anti-money-laundering laws that realtors, banks, and brokers have to follow.

Version 1: Using your crypto as a mortgage down payment

This is the way that works, and the easiest way to use your crypto is to cash it in/ convert to cash, and move the funds into a Canadian bank account to “seed” or “season” for 90 days.

- This is not really needed with most other assets and we have tried so many ways to get the lenders to accept the funds held in a crypto trading platform (like Binance, NDAX or similar, but they always sound the alarm right here, send the file to “the risk desk” and then it is a battle the entire rest of the way.

Why do I need to cash it in and leave it in the bank for 90 days? It’s AML!

The “kink in the system” is that we have to show a 90 day history for the source of all down payment funds for AML – anti money laundering law compliance. Normally banks are fine with funds sitting in Wealth simple or any trading account but NOT for crypto. After getting “all the NO’s” we found this is the way to go.

What about – buying with cash and refinancing/ getting a mortgage on it later?

- When you do this in the 1st year, the banks still need to re-verify the original down payment for the original purchase so this will still be tough to do.

- And refinance rates are higher than purchase rates, and you would then also be re-registering the mortgage and registration has shot up to about $2000, from $200 over the last year in Alberta.

Version 2: which we have NOT found to work – is leveraging your crypto and pledging it without a sale.

If you want to access liquidity without selling your crypto, a crypto-backed loan is another option and here is how it is supposed to work to avoid the capital gains event.

- If this has too many moving parts, then selling your crypto and putting it into the bank for 90 days is the way to go.

- Deposit crypto as collateral

You transfer your crypto to a platform, where it is held in a secure wallet or smart contract. Platforms such as YouHodler and Ledn support this model.

- Loan-to-value (LTV) ratio

You can typically borrow between 30% and 70% of your crypto’s value. For example, pledging $10,000 worth of Bitcoin may get you a $5,000 loan.

- Disbursement

Loans are issued in fiat (e.g., CAD, USD) or stablecoins. Most do not require a credit check and can be approved quickly.

- Repayment and interest

Terms vary. Some platforms offer flexible repayment options; others require fixed schedules. Once the loan and interest are repaid, your crypto is returned.

- Liquidation risk

If the value of your crypto drops and your LTV exceeds a certain threshold, you may be required to add collateral. Otherwise, your crypto may be liquidated.

- No taxable event

Since you are borrowing, not selling, there is no capital gains tax event. This can be beneficial from a tax-planning perspective.

WHAT ALSO WORKS …

A simpler, safer alternative: using crypto ETFs for mortgage planning

For a more straightforward path, consider using crypto ETFs instead of direct crypto holdings. ETFs allow you to gain exposure to digital assets without managing wallets, keys, or exchange accounts.

Held through mainstream brokerages, including in TFSAs and RRSPs, crypto ETFs are easier for lenders to understand and verify, avoiding the friction that often comes with direct crypto assets.

Leading crypto ETFs in Canada

These are some of the top crypto ETFs available to Canadian investors:

- BTCC (Purpose Bitcoin ETF): The first Canadian Bitcoin ETF, with CAD and USD options and a carbon-neutral version

- BTCQ (3iQ CoinShares Bitcoin ETF): Physically-backed BTC, held in cold storage

- FBTC (Fidelity Advantage Bitcoin ETF): Designed for registered accounts

- ETHH and ETHX (Purpose and CI Galaxy Ethereum ETFs): Offer direct ETH exposure, with or without staking

- IBIT (iShares Bitcoin ETF): Managed by BlackRock, a major global asset manager

Several ETFs now include additional exposure to AI stocks or newer crypto assets like Solana, expanding diversification options within this space.

Naturally, this is our experience and this should NOT be taken as investment advice. Ask your licensed financial adviser for their opinion before proceeding please.

SUMMARY

Can I use crypto as a down payment?

Yes, but there are strict conditions:

- You must convert the crypto to Canadian dollars

- Maintain a documented paper trail of the sale and deposit

- Be prepared to explain the origin of your funds for AML compliance

Many lenders will still be hesitant. Working with a mortgage broker familiar with these requirements and a lender that understands crypto is essential.

Is it legal and safe in Canada?

Yes, but regulatory guidance is evolving.

Lenders must comply with OSFI and FINTRAC standards, which include thorough AML and source-of-funds verification.

OSFI is expected to implement new digital asset rules in 2025, which may influence how Canadian financial institutions handle crypto-collateralized products.

Key risks to consider

- Price volatility: A drop in crypto value can lead to margin calls or liquidation

- Lender restrictions: Many banks still reject crypto-related funds

- Platform risk: Some crypto lenders have gone bankrupt

- No deposit insurance: Crypto held as collateral is not insured by CDIC

- Compliance complexity: Documentation, tax reporting, and regulatory scrutiny can be significant

How does CRA treat crypto in mortgage scenarios?

Under CRA guidelines, cryptocurrency is treated as a commodity.

Selling it to fund a down payment is a taxable event, and any capital gains must be reported.

However, borrowing against your crypto is not a disposition and does not trigger capital gains taxes, at least under current rules. Regardless, thorough documentation is critical.

Crypto-backed mortgages and crypto-collateralized loans offer new possibilities, but they’re not ideal for everyone. If you’re a crypto holder considering homeownership in Canada:

- Convert your crypto to Canadian dollars early, and let it seed for at least 90 days

- Alternatively, accumulate your crypto wealth in Exchange Traded Funds

- Document everything: sales, transfers, deposits, and sources of funds

- Work with professionals who understand both traditional lending and crypto

- Be ready to meet rigorous compliance and verification requirements

Canada’s mortgage landscape is still catching up to the digital asset world. Planning ahead is key to avoiding delays or declined applications.

Further reading and sources

Taxable Capital Gains on Bitcoin in Canada

When you dispose of Bitcoin (for example, selling or “cashing in”), the Canada Revenue Agency treats it as a commodity. If your transaction is considered a capital disposition, only 50% of the gain is taxable.

How It’s Calculated

- Adjusted Cost Base (ACB): The original purchase price (in CAD), plus any fees.

- Proceeds of Disposition: Fair market value (in CAD) on the date you sell.

- Capital Gain:

Gain=Proceeds−ACB−Disposal Fees\text{Gain} = \text{Proceeds} – \text{ACB} – \text{Disposal Fees}

- Taxable Capital Gain:

For example, if you bought Bitcoin for $10,000 CAD and later sold it for $15,000 CAD (with $100 fees), your gain is $15,000 – $10,000 – $100 = $4,900. You report half—$2,450—as taxable income.

Tax Payable

- The $2,450 is added to your total income for the year.

- The actual tax you owe equals your marginal tax rate multiplied by the taxable gain.

Municipal, provincial and federal rates all apply, so total tax varies by province and your income bracket.

Reporting & Recordkeeping

- Report on Schedule 3 (Capital Gains) of your T1 return.

- Keep detailed records: transaction dates, CAD valuations, fees and wallet addresses.

- Use reliable crypto-tax software or a professional to ensure accuracy.

Special Considerations

- If CRA deems your activity a business (frequent trading, mining, or providing services), 100% of profits may be taxed as business income.

- Capital losses can offset gains—claim them on Schedule 3 to reduce your taxable gain.

Beyond capital gains, remember that receiving Bitcoin as income (mining rewards, staking, payments) is taxed at 100% of its fair market value on receipt. Always consult a tax professional for personalized advice

Canadian Mortgage with American Income, 2025

Yes, that headline is true!!

August 15, 2025

We finally have an “A lender” in the Canadian mortgage broker space that will allow a buyer’s USA/ American income to be used.

Quick summary of the details.

- 30% down

- 80% of USA salary to be used, income based on USA tax docs

- Almost any standard residential property in Canada

- “A lender,” at A rates, no lender fee, no broker fee, underwritten the same as all Canadian mortgages

- No funny business here. This is a normal mortgage, that you would want. The same as what expect from any of the Big-6 banks in Canada.

For more data or to ask about a deal, contact Mortgage Mark Herman, on his cell phone. He usually answers his own phone; from 9 am to 9 pm MST daily.

Data points below summarize key criteria and parameters for an “A-lender” in the Canadian mortgage broker channel that accepts US income.

Borrower Eligibility

- Citizenship: any (US, Canadian, or other)

- Canadian residency: no minimum length of stay required

- Tax history: two consecutive years of US tax filings (no CRA filings needed – its true!)

Income Documentation

- W-2 forms (equivalent to Canadian T4 slips)

- IRS Form 1040 (equivalent to Canadian T1 returns)

- US Tax Return Transcripts or Notices of Assessment (NOA – Notice of Assessment)

- All documents must cover the most recent two-year period

Income & Loan Parameters

- Income recognized: up to 80% of gross US salary

- Income types accepted: salary only (sorry, the bank can’t use fee-for-service, or self-employed/ BFS income)

- Maximum loan-to-value ratio (LTV): 70%, means 30% down payment

- Credit underwriting conforms to Canadian mortgage regulations

Property Types

- Primary residence

- 2nd home / Secondary or vacation home and even…

- Rental or investment property

Notes

- No requirement for employer size, industry, or Canadian work history

- Simplified process: bypass CRA income filings entirely

- Ideal for US-based clients relocating, investing, or holding dual residences

We used to run into a few of these deals ever year, and now we see one every month so we found a lender that can do this business for our realtor partners.

The buyers only need 30% down, and the bank will use 80% of their USA salary as the income.

Mark Herman, top Calgary Alberta and Vancouver Island mortgage broker

Canadian Residential Market Update

Fixed rates are slowly rising due to Trump’s inflationary policies and we see that continuing until tariffs are sorted out.In the mean time, now is a great time to buy as inventory is high and rates are only .4% above where they were before Covid.Mortgage Mark Herman, Top Calgary mortgage broker specializing in 1st time buyers.

Summer is here!

Our 55+ clients are thinking about ways to refresh their homes.

Whether it’s for comfort, safety, or curb appeal, renovations can get pricey and the CHIP reverse mortgage can really help out.

Mortgage Mark Herman, CHIP and Reverse Mortgage specialist, here to help the 55+ home owners.

The CHIP Reverse Mortgage by HomeEquity Bank can help you access the funds you need—tax-free and with no monthly mortgage payments required.

Here are just a few popular spring projects our recent customers have been planning:

- Retrofitting their home to support aging in place

- Resealing windows and doors for better energy efficiency

- Landscaping makeovers to enhance privacy and beauty

- Adding an outdoor kitchen and seating area for entertaining

- Repaving the driveway to boost curb appeal

With the CHIP Reverse Mortgage, you can unlock up to 55% of your home’s equity, giving you the freedom to renovate now and enjoy the results for years to come—all without dipping into your retirement savings.

Looking for tips on how use the CHIP in renovations? Call or email me, I’d be happy to help!

GST Rebate for 1st Time Home Buyers

We have had lots of questions about this proram.

The legislation has been tabled, but is not done yet. As of today, and it is for contracts written May 27, 2025 or later.

Updates as they come in.

We have a 4-plex buyer who is purchasing a newly constructed 4-plex in Calgary at $1,250,000. His rebate is about 60k – now that is now pretty substantial!

Mortgage Mark Herman, 1st time buyer and move up mortgage specialist in Calgary Alberta.

Bank of Canada Lowers Consumer Prime to 4.95%

The Bank of Canada lowers its benchmark interest rate to 2.75%

In the face of significant geopolitical tensions, the Bank of Canada announced today that it has lowered its policy interest rate by 25 basis points. This marks the seventh reduction since June of 2024.

Below, we summarize the Bank’s commentary.

Canadian Economic Performance and Housing

- Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter

- This “growth path” is stronger than was expected when the Bank last reported in January 2025

- Past cuts to interest rates have boosted economic activity, particularly consumption and housing

- However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity

- Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments

- The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed

- The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies

Canadian Inflation and Outlook

- Inflation remains close to the Bank’s 2% target

- The temporary suspension of the GST/HST lowered some consumer prices, but January’s Consumer Price Index was “slightly firmer” than expected at 1.9%

- Inflation is expected to increase to about 2.5% in March with the end of the tax break

- The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation

- Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices

Canadian Labour Market

- Employment growth strengthened in November through January and the unemployment rate declined to 6.6%

- In February, job growth stalled

- While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market

- Meanwhile, wage growth has shown signs of moderation

Global Economic Performance, Bond Yields and the Canadian Dollar

- After a period of solid growth, the US economy looks to have slowed in recent months, but US inflation remains slightly above target

- Economic growth in the euro zone was modest in late 2024

- China’s economy has posted strong gains, supported by government policies

- Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth

- Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report

Rationale for a rate cut

While the Bank offered that economic growth came in stronger than it expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, the Bank decided to reduce its policy rate by 25 basis points.

Outlook

The Bank notes that the Canadian economy entered 2025 “in a solid position,” with inflation close to its 2% target and “robust” GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

Final comments

The Bank noted that monetary policy “cannot offset the impacts of a trade war.” What monetary policy “can and must do” is ensure that higher prices do not lead to ongoing inflation.

The Bank said it will carefully assess: i) the timing and strength of both the downward pressures on inflation from a weaker economy and ii) the upward pressures on inflation from higher costs. It will also closely monitor inflation expectations.

It ended its statement by saying it is committed to maintaining price stability for Canadians.

More scheduled BoC news

The Bank is scheduled to make its third policy interest rate decision of 2025 on April 16th.

Summary of Mortgage Rule Changes

Key Mortgage Rule Updates

30-year amortization for insured mortgages

Starting December 15, 2024, 30-year amortizations will be available for insured mortgages. This option is open to first-time homebuyers and those purchasing newly built homes, including condos.

Higher insured mortgage limits

Applications for insured mortgages will now be accepted for properties valued under $1.5 million, giving more buyers access to high-value homes with lower down payment requirements.

Stress test simplification

In line with OSFI’s guidance, current stress test requirements will continue for insurable, uninsurable, and uninsured applications. Eligible insured transfers and switches will remain qualified at the contract rate.

How these changes benefit you

✔️ Reduced monthly payments

Extending amortizations to 30 years will lower monthly payments, helping clients manage affordability amidst rising living costs and fluctuating interest rates.

It usually works out to reduce your payment by 9% or lets yo buy 9% more home (increases the mortgage amount but about 9%.)

✔️ Expanded opportunities for buyers

Higher insured mortgage limits make it possible for more Canadians to purchase homes in competitive urban markets like Toronto and Vancouver for up to $1,500,000 with 5% down on the 1st 500k and 10% down payment on the balance.

This set of mortgage rule changes should make it easier for buyers to get into a home now.

More importantly, it lets buyers purchase up to $1.5M with $125k down, where before they would have topped out at $1m with $75k down payment.

- Mortgage Mark Herman, top best Calgary mortgage broker,

- 403,681-4376

New Housing Rules for 1st First-Time Buyers and New Builds

If you’re a first-time home buyer or looking to purchase a new build, this affects you.

Here’s a quick summary of the changes coming in December 2024:

What’s New?

30-Year Amortizations Now Available for First-Time Buyers and New Build Purchases

- First-time home buyers can now access 30-year amortizations for insured mortgages.

- This increases the amount you qualify for by about 9% or lowers your monthly payment about the same.

- 30-Year Amortization for New Builds – Technically, this took effect on August 1, 2024, and is available to everyone, not just First-Time Homebuyers.

Price Cap Increase for Insured Mortgages

- The price cap (purchase price) for insured mortgages has been raised from $999,999 to $1,499,999 million.

- EG: if you were to purchase a home today priced at $1.1 million, your minimum down payment to qualify for a mortgage would be 20% or $220,000. After December 15th, the minimum down payment required decreases to $85,000.

- If that $1.1 million dollar home also has a self contained suite, you can use the rent or “potential” rent that suite will generate to help qualify for a bit more of a mortgage too.

The Fine Print

Down payment – Great news, minimum requirements stay the same:

- 5% on the portion up to $500,000

- 10% on the portion between $500,000 and $1.5 million

* Previously, the down payment on a $1.5 million home for a First-Time Home buyer was $300,000.

FTHB’s can now get into that same home with $125,000.

This will undoubtedly take some pressure off the Bank of Mom and Dad.

Effective Date

These changes will apply to mortgage insurance applications submitted on or after December 15, 2024. The key word here is ‘submitted.’ Your offer will need to be timed just right if you wish to take advantage of the new 30-year amortization.

Potential Impacts on the Housing Market:

We are in an interesting position right now. On one hand, lenders are competing for new business in what could be described as a ‘rate war.’

Additionally, with First-Time Home Buyers (FTHB) set to qualify for 30-year amortizations after December 15th, we can expect an uptick in demand.

Historically, higher demand leads to higher prices and rate decreases cause an equal and opposite increase in home prices.

Buy or Sell – Now or Later?

While there’s no crystal ball, consider these possibilities:

- Buy Now: Prices are expected to rise once the new rules take effect, so purchasing before December could mean less competition and potentially lower prices.

- Sell Later: If your home is priced between $1 million and $1.5 million, waiting until after December 15th could attract more qualified buyers and possibly higher offers.

More details will emerge as lenders and insurers prepare to offer the new 30-year amortization, such as how lenders will view the minimum down payment.

If you want to discuss how these changes might impact your plans to buy or sell, feel free to reach out!

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

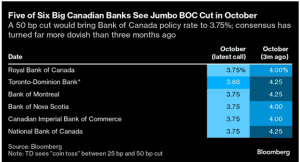

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

New Canadian Mortgage Rules; Sept 2024

Great news from Ottawa today on the new rules for Canadian mortgages:

- An Increase to the Insured Mortgage Price Cap: The government will raise the price cap from $1 million to $1.5 million, reflecting the realities of today’s housing market. This change, effective December 15, 2024, will help more Canadians qualify for insured mortgages and make homeownership more attainable, especially for younger Canadians.

- Expanded Eligibility for 30-Year Amortizations: First-time homebuyers and all buyers of new builds will now be eligible for 30-year insured mortgage amortizations. This is a crucial step in reducing monthly mortgage payments and helping more Canadians, particularly Millennials and Gen Z, achieve the dream of owning a home.

- Increased Mortgage Competition: The strengthened Canadian Mortgage Charter now enables insured mortgage holders to switch lenders at renewal without being subject to another stress test. This will foster greater competition and ensure Canadians have access to the best mortgage deals.

All 3 of these changes will help New Buyers / 1st Time Buyers afford to get into a home of their own.

Most of our First Time Buyers need gifts or co-signing from parents to be able to buy. The 30 year amortization and increase of CMHC insurance will totally help.

Mortgage Mark Herman, Best top Calgary Alberta mortgage broker specializing in 1st time buyers for 20 years.