Canadian Mortgage Economic Data, June 4th, 2025

The Bank of Canada announced today that it is keeping its benchmark interest rate at 2.75%, unchanged from April (and March) of 2025.

As noted under “Rationale”, the Bank appears to be in a holding pattern until it gains more information on the direction of US trade policy and its impact on Canada.

Below, is a summary of the Bank’s observations and its outlook.

Summary – the 5-year fixed is the best option for June 2025 and July 2025 so far. ensure you get a rate hold are rates are creeping up.

Mortgage Mark Herman, top Calgary Mortgage Broker for First Time Buyers

Canadian Economic Performance, Housing, Employment and Outlook

- Economic growth in the first quarter came in at 2.2%, slightly stronger than the Bank had forecast, while the composition of GDP growth was largely as expected

- The pull-forward of exports to the United States and inventory accumulation boosted activity, with final domestic demand “roughly flat”

- Strong spending on machinery and equipment held up growth in business investment by more than expected

- Consumption slowed from its very strong fourth-quarter pace, but continued to grow despite “a large drop” in consumer confidence

- Housing activity was down, driven by a sharp contraction in resales; government spending also declined

- The labour market has weakened, particularly in trade-intensive sectors, and unemployment has risen to 6.9%

- The economy is expected to be considerably weaker in the second quarter, with strength in exports and inventories reversing and final domestic demand remaining subdued

Canadian Inflation

- Inflation eased to 1.7% in April, with the elimination of the federal consumer carbon tax shaving 0.6 percentage points off the Consumer Price Index

- Excluding taxes, inflation rose 2.3% in April, slightly stronger than the Bank had expected

- The Bank’s preferred measures of core inflation, as well as other measures of underlying inflation, moved up

- Recent surveys indicate that households continue to expect that tariffs will raise prices and many businesses say they intend to pass on the costs of higher tariffs

- The Bank will be watching all of these indicators closely to gauge how inflationary pressures are evolving

Global Economic Performance

- While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs

- In the United States, domestic demand remained relatively strong but higher imports pulled down first-quarter GDP

- US inflation has ticked down but remains above 2%, with the price effects of tariffs still to come

- In Europe, economic growth has been supported by exports, while defence spending is set to increase

- China’s economy has slowed as the effects of past fiscal support fade; more recently, high tariffs have begun to curtail Chinese exports to the US

- Since financial market turmoil in April, risk assets have largely recovered and volatility has diminished, although markets remain sensitive to US policy announcements

- Oil prices have fluctuated but remain close to their levels at the time of the April Monetary Policy Report

Rationale

With uncertainty about US tariffs still high, the Canadian economy softer but not sharply weaker, and some unexpected firmness in recent inflation data, the Bank’s Governing Council decided to hold the policy rate steady “as we gain more information on US trade policy and its impacts.

Looking Ahead: Uncertainty Remains High

The Bank noted that since its April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the United States have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the Bank said the outcomes of these negotiations “are highly uncertain,” tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high.

As a result, the Bank says it is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases are passed on to consumer prices; and how inflation expectations evolve.

Final comments

Today’s announcement ended with the following statement from the Bank’s Governing Council: “We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.”

Next scheduled BoC rate announcement

The Bank is scheduled to make its fifth policy interest rate decision of 2025 on July 9th.

BMO & CIBC: Not on list of Top-11 banks in Canada

Wow hey??

Who would guess that 2 of Big-6 banks that millions of Canadians “think they have a financial relationship with” did not even make the list of the Top-11 banks in Canada.

It is surprising the amount of customers that call us looking to “beat their bank’s mortgage rate” when they should be looking at if they should even be doing mortgage business at their main personal bank.

Mortgage Mark Herman, Calgary Alberta new home buyer and mortgage renewal specialist of 21 years.

We recommend that they also look at the T’s & C’s – Terms and Conditions – to their own bank’s mortgages to find:

- Payout penalties that are 500% to 800% – yes, 5x to 8x the amount of payout penalties at broker banks.

- Their renewal rates are usually always at rates higher than what Broker Banks offer – because Broker Banks know the broker that placed you there will jump at the chance to move them to a different bank, for a better/ market rate, and then we get paid again. Big-6 banks don’t have to worry about that because you are usually not aware of market rates.

- SELF-employed mortgage holders are often “worked over by the Big-6 banks” whereas, Broker Banks are more than happy doing tons for self-employed business owners.

Here’s the full list of Canada’s best banks for 2025, according to Forbes:

- Tangerine

- Simplii Financial

- RBC

- PC Financial

- Vancity

- EQ Bank

- TD

- Scotiabank

- National Bank

- Desjardins

- ATB Financial

footnote: link action here https://www.narcity.com/best-banks-in-canada-forbes-2025

Mortgage renewal: Now switch lenders without re-taking the stress test

Great news as a few leading banks, soon to be followed by the rest of the pack, have DITCHED THE STRESS TEST for RENEWALS.

This means if you have extra debts or a debt level higher than when you got your mortgage, some banks can now overlook that and still get you the best rates.

there is now an option if you were concerned about renewing due to higher debt loads or if your financial situatoin has changed since you bought your home.

Technically, this means most conventional switch (more than 20% down payment) customers no longer need to prove they can afford a payment based on the minimum qualifying rate (MQR). That rate is at least 2% higher (or 200 bps where 100 bps = 1.oo%) than actual rates.

This news is just out today for BOTH High ratio/ insured (meaning you bought with less than 20% down payment) AND Conventional (meaning 20% or more down payment)

Note, however, that property values for insurable borrowers must be under $1 million unless grandfathered.

To find out more please call (best) 403-681-4376 or email to reach out for more data.

This is a BIG DEAL. For renewals we always had to do the math to ensure you could change banks and many with higher debts than they bought with were not able to change banks. The banks knew this and offered them renewal rates that were way to high, but the home owners had no option. Now you do!

20 year mortgage expert, Mortgage Mark Herman

YES!

Canada’s New Capital Gains Tax Rules and Mortgages

Next pressing issue after 25% tariffs is the Canadian Federal Government’s decision to delay the implementation of its new capital gains tax rules until 2026.

In the 2024 budget Ottawa was set to increase the capital gains inclusion rate – the portion of gains that is taxable – from 50% to 66.7% for individuals earning over $250,000 in annual capital gains, as well as for corporations and most types of trusts.

- That plan has now been pushed back to January 1, 2026.

- For average Canadians this would mainly affect those selling a second residence, such as a cottage.

- The delay could see some properties come onto the market with owners hoping to take advantage of the tax saving.

The government caused panic-selling of Cottage Country Cabins in Ontario, and has now paused the capital gains tax.

We hope this pause will allow a normal sales cycle to take place.

Mortgage Mark Herman, Calgary Alberta mortgage broker near me

Variable Rate Beats BOTH 3-year & 5-year Fixed Terms

The Variable is the best way to go right now and this blue link has all the details in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

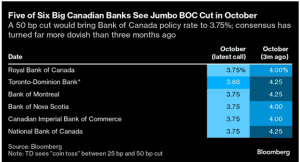

Data point 1: Variable rates should be coming down 2% in the next 13.5 months, with a “jumbo reduction” of 0.5% (1/2%) expected on Wednesday, Oct 23rd – by 5 of the 6 Big Banks.

Data point 2: Historically, fixed rates only go down about 40% of the reductions to Prime, so fixed rates will not be going down anywhere near as much or as fast as the Variable.

Data point 3: Just a 1% rate reduction is expected to “reactivate” at least half of buyers who previously stopped shopping due to “buyer fatigue.”

Data point 4: As interest rates come down, prices INCREASE because most buyer’s need to go to their max mortgage when buying.

Graphic details of expected rate reductions and the dates of expected changes, in PDF: VARIABLE RATE beats both 3-year fixed & 5-year fixed terms

Our favorite customer quote so far in October:

I am not locking in 3-year money nor 5-year money today, when the Bank of Canada has made it clear rates are coming down 2% in the next 15 months.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker near me.

Prime now 6.95% from 7.20%: BoC reduces its benchmark interest rate to 4.75%

Today, the Bank of Canada reduced its overnight policy interest rate by 0.25% to 4.75%. This welcome and widely expected decision comes on the heels of evidence pointing to a deceleration of the rate of inflation.

SUMMARY:

The “overnight rate” being quoted is the rate that Banks borrow from each other at, not consumer Prime, which is confusing.

Canadian Consumer Prime has just been reduced from 7.20% to 6.95% – this only affects Variable Rate mortgages.

Fixed rates remain unchanged because they track the Canadian Mortgage Bond Rates which are different, and similar.

There has also been about 40 “silent” fixed rate reductions of o.o5% each in 2024 that the press did not cover.

Mortgage Mark Herman, Top best Calgary Alberta mortgage broker specializing in 1st time buyers

Below we examine the Bank’s rationale for this move by summarizing its observations below, including its all-important outlook comments that are sure to shape market expectations for the remainder of the year.

Canadian inflation

- Inflation measured by the Consumer Price Index (CPI) eased further in April to 2.7%

- The Bank’s preferred measures of core inflation also slowed and three-month indicators suggest continued downward momentum

- Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average, however, shelter price inflation remains high

Canadian economic performance and housing

- Economic growth resumed in the first quarter of 2024 after stalling in the second half of last year

- At 1.7%, first-quarter GDP growth was slower than the Bank previously forecast with weaker inventory investment dampening activity

- Consumption growth was solid at about 3%, and business investment and housing activity also increased

- Labour market data show Canadian businesses continue to hire, although employment has been growing at a slower pace than the working-age population

- Wage pressures remain but look to be moderating gradually

- Overall, recent data suggest the economy is still operating in excess supply

Global economic performance and bond yields

- The global economy grew by about 3% in the first quarter of 2024, broadly in line with the Bank’s April Monetary Policy Report projection

- The U.S. economy expanded more slowly than was expected, as weakness in exports and inventories weighed on activity

- In the euro area, activity picked up in the first quarter of 2024 while China’s economy was also stronger in the first quarter, buoyed by exports and industrial production, although domestic demand remained weak

- Inflation in most advanced economies continues to ease, although progress towards price stability is “bumpy” and is proceeding at different speeds across regions

- Oil prices have averaged close to the Bank’s assumptions, and financial conditions are little changed since April

Summary comments and outlook

The Bank cited continued evidence that underlying inflation is easing for its decision to change its policy interest rate. More specifically, it said that “monetary policy no longer needs to be as restrictive.”

Also welcome was the Bank’s statement that “recent data” have “increased our confidence that inflation will continue to move towards” its 2% target.

However, it also added this to its outlook: “Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

And has it has been doing for some time, it said the Bank “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

The Bank returns on July 24th with its next monetary policy announcement – I think they will do another 0.25% reduction at the next meeting and they will continue to reduce at every meeting for the next 3 meetings this year.

Current Risks to the Canadian Mortgage Market? May 15th, 2024

Summary:

May 21, 2024 is when the inflation a report comes out and it should be the determining factor if the Canadian PRIME RATE of INTEREST is reduced from 7.2% in June or not. Maybe July. Maybe later.

Nobody is buying anything big right now, which is the idea … to reduce inflation.

Which means now is the best time to buy a home before everyone waiting for rates to drop jumps in on the 1st Prime rate reduction.

Says Mortgage Mark Herman, Calgary Alberta best/ top/ mortgage broker for first time home buyers

DATA:

Mortgage holders have been anxiously waiting for the Bank of Canada to cut interest rates. The increase of 90,400 jobs in April – 5 times what analysts expected – has heightened concerns that the Bank will continue to wait before lowering rates. 🙁

While the economy has not slowed as much as expected, there’s growing economic slack, with the jobless rate up 1 percentage point over the past year and a 24% year-over-year increase in the number of unemployed individuals, which is slowing down wage growth. The crucial factor in determining whether a rate cut will occur in June or be postponed to later this year hinges on the April CPI release scheduled for May 21st.

In the background of these deliberations, the Bank of Canada also assesses various potential risks to the economy. Last week, the Bank released its Financial Stability Report, highlighting two key risks: debt serviceability and asset valuations.

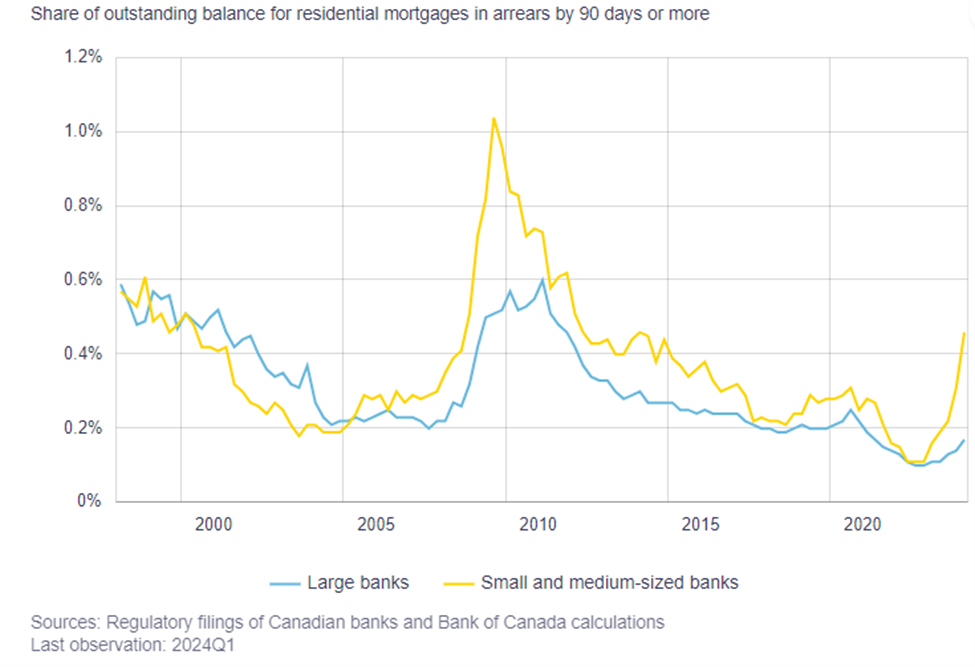

The report notes that the share of mortgage holders who are behind on their credit cards and auto loan payments, which had hit historic lows during the pandemic, has now returned to more normal levels. It also notes that smaller mortgage lenders are seeing an uptick in credit arrears. This increase isn’t surprising, given the run up in rates and the market segment that these lenders cater to. While the arrears rate is up, it remains relatively low compared to historical levels.

This overall positive portfolio performance is due to two key factors: 1) financial flexibility and 2) employment.

Canadian mortgage defaults tend to spike up during periods of rising unemployment. While the unemployment rate has risen, it remains relatively low. Additionally, mortgagors are holding higher levels of liquid assets. Before the pandemic, homeowners with a mortgage held 1.2 months of liquid reserves, which increased to 2.2 months during the pandemic and has since fallen to 1.8 months. These increased reserves provide a solid buffer for mortgagors to meet unexpected increases in expenses.

The Bank remains concerned that nearly half of all outstanding mortgages have yet to be renewed, leaving these borrowers at risk of payment shock due to the increase in interest rates. Scotiabank is an interesting case because, unlike other banks, it offers adjustable-rate mortgages (ARM) with variable payments instead of variable rate mortgages with fixed payments. Scotia has seen its 90+ days past due rate increase from 0.09% to 0.16%. During their fourth-quarter earnings call, Scotia noted that ARM borrowers have been cutting back on discretionary spending by 11% year-over-year, compared to a 5% reduction among fixed-rate clients.

The mortgage maturity profile in the Financial Stability Report suggests that we could see significant slowing in consumer discretionary spending over the next two years. While the rise in debt-servicing costs will be partially offset by income growth, we should expect to see belt tightening by mortgage holders. This poses less of a risk to the banking sector mortgage market than to the overall outlook for the economy.

How the Big-5 Banks Trap You in Their Mortgages

- what your credit score is

- your pay and income going into your accounts

- your debt payments

- other debt balances on your credit report

- your home/ rental addresses so they can accurately guess at your home value.

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said Eight Capital analyst Steve Theriault. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), the country’s biggest lender, said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations and also to improvements it has made to make it easier for customers to renew.

Ron Butler, owner of Toronto-based brokerage Butler Mortgage, said the changes leave borrowers with less choice.

“Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Link to the full article is here: https://business.financialpost.com/news/fp-street/canadas-big-banks-tighten-grip-on-mortgage-market-after-rule-changes

We saw the “Mortgage Renewal Trap” coming long ago when the Stress Test was announced. It is more important than ever to consider Mortgage Broker Lenders for your mortgage now.

Mark Herman, Top Calgary Alberta Mortgage Broker.

My bank REALLY REALLY REALLY wants my mortgage! Really?

Does your bank really, really, really want your mortgage that badly?

Do you know why?

NOT because they make lots of money on mortgages.

NOT because the bank rep needs to fill their mortgage quota this month (this happens too.)

BECAUSE the banks have studies that if they can get you to have 3 or more products with them, your odds of leaving to go to another bank fall by 75%.

This means 2 things:

- If they can get you to have the mortgage in addition to your existing checking and savings accounts and or credit card then you will probably not leave for another bank and their cost of customer acquisition is very high.

- Then they can cross-sell you the products they really, really make money on:

- LOCs – line of credits – and more credit cards both with overdraft protection and insurance for the minimum payments if you are injured or laid-off.

- mortgage insurance – a huge profit for them as they try very hard later not to pay claims in their post-claim underwriting process

- mutual funds

- long distance phone plans

- travel insurance

- all the rest.

And 1 more VERY important thing:

Banks know that 86% of people will stay with their existing bank at mortgage renewal time. AND if you have the magic 3 products will you move your mortgage somewhere else then?

Banks expect you to chisel them down now, and when you renew they renew you at rates that are typically .25% to .75% higher than they should be. And 86% of people just sign the renewal docs and send them back. (More data from studies.)

This does NOT happen with mortgages via mortgage brokers as the banks know they have to renew you at the best possible rates or the very same broker that took the customer to that bank will be the very same broker that moves the customer to a new bank if for a better rate on renewal.

Do you want to play this game with the banks or just skip it all together?

All this advice from the top mortgage broker in Calgary Alberta, Mark Herman.

Spring Real Estate Market Underway in Edmonton

This is a GREAT article on how to look at things. Edmonton, just like Calgary, is seeing lots of in-migration which is also supporting their home prices.

Spring Real Estate Market Underway in Edmonton

Low inventory is causing rapid growth in the average price of real estate in Edmonton. The interesting thing is that the inventory is low because there are fewer new listings than we typically see at this time of year, not because of increased sales.

As you can see below, the inventory of properties for sale is significantly lower than we typically see in March. There were 4,741 properties available on the MLS® system at the end of March – down 15.4% from the same time last year.

Edmonton Real Estate Inventory

Alberta’s population expanded by 3.04% in 2012, nearly three times the national average. 46,000 Canadians move to Alberta from other provinces last year, just beneath the record levels seen in 2006, leaving many people wondering – where is our boom?

“The great mystery here is that we’ve had phenomenal employment growth, very strong income growth, very strong net in-migration, and yet it hasn’t poured over into the housing market yet,” says John Rose, chief economist for the City of Edmonton.

“These are unprecedented levels of in-migration into the province, so this (the relative stability in house prices) has kind of mystified us,” says Richard Goatcher, economic analyst with the Canadian Home Builders’ Association-Alberta.

From my perspective, there are a number reasons we are (thankfully) not seeing a repeat of 2007:

- It’s harder to get financing than it was in 2007. Back then it seemed like the banks approved just about anything, today they are being much stingier.

- Lack of speculation: in ’07 everyone and their brother wanted a piece of the action, and a lot of people bought properties (especially new homes) to flip… a lot of those people still own those properties 5 years later.

- Low vacancy rate: this situation typically leads to higher sale prices, but in this case I believe it is leading to low inventory. For years now we’ve heard “if I can’t sell it for the price I want I’ll just rent it out” and I think a lot of people have their investment properties rented out to good tenants. Why sell when you’re finally making money by renting?

- Lower consumer confidence – no matter what is happening locally, the news from Toronto, Vancouver and around the world does not encourage people to jump into the market.

Of course, as Don Campbell recently reminded us, real estate is local:

“At no other time in history has the real estate market in Canada been so regional… Alberta’s population is growing substantially, especially with that younger age cohort. They come out here to get a job and make $80,000 instead of $30,000 back home. And once they’re here, they discover Alberta is a pretty cool place to live, but it takes awhile for that to kick in, often about two years. So I’m very bullish on the direction that the market is going to be taking over the next portion of the cycle, say the next three, five or seven years.”

With all that said, we did see a significant jump in the average sale price of residential real estate in Edmonton in March. The residential average was $354,759 in March, up 4.3% from $340k last year and $343k last month. The median price did not jump as much and was $329,700 in March, up from $323k last year and $320k last month.

Edmonton Average Real Estate Price

Sales are up, but they would be up higher if there were more homes on the market. There were 1497 sales in March, up from 1480 last year and 1068 last month.

When first time buyers cannot find a house that meets their needs or are forced into a multiple offer situation, they often remain on the sidelines,” said REALTORS® Association of Edmonton President Darrell Cook. “Low interest rates and rising rental rates create the interest and desire but lack of suitable properties means they are not able to make the transition to home ownership at this time.”

Edmonton MLS® Sales

The number of new listings were significantly down from previous years – there were 2422 new listings in March compared to 2847 last year and 1995 last month.

New Listings

http://edmontonrealestateblog.com/2013/04/spring-real-estate-market-underway-in-edmonton.html