Using Business Income / Corporate Income to Qualify for a Mortgage in Canada, 2024

Are you self- employed and thinking about, or hopping to use your own business income or corporate income to help you qualify for a mortgage?

It is possible, but not very common, as it usually does not help as much as we hope it would.

Mortgage Mark Herman, best Calgary Alberta mortgage broker for self-employed buyers

For RESIDENTIAL Purposes:

Very few lenders (like 3 out of 40+) will consider using business income that is not on personal taxes.

- When they will allow the business income added in, they only use between 40-60% of the net business income after dividends paid.

- They wouldn’t allow the operating company to actually be on mortgage/title;

- it would be in personal name or

- Hold Co name (with full personal guarantee, for the full mortgage amount – with full recourse. Meaning they can/ do/ will sue you into bankruptcy if they need to foreclose.)

Docs Needed

They do need to review more data than usual if trying to use business financials. I addition to the regular documents needed (2 years of T1 Generals, and NOAs and T4’s if there is T4 income), add in these docs:

For the Business:

- 2 years of professional accountant prepared financial statements

- including a signed ‘Notice to Reader’ and

- Need a compilation of all billing engagements for the fiscal periods

Catch – there are always a few:

If the property in question has a large shop – it is usually not allowed in determining the value so a higher mortgage amount is usually required.

They also have a hard time if there is any income to be derived from the property.

Acreage Details

Max land is limited to 4, 8, or 10 acres – depending on lender

- Only the home, de/attached garage and 4 acres are used for valuation by lender.

- NO value is attributed to: out-buildings, sheds, riding rings, stables, storage, nor fences

- Many of which could be valued at 200k+, like fences and buildings.

Updated: Using Disability Income to Qualify for a Canadian Mortgage: 2024

NOTE: this post has been updated in August 2024.

CAN DISABILITY INCOME BE USED TO QUALIFY FOR A CANADIAN MORTGAGE?

YES, it is possible to use disability income to qualify for a pre-approval or a full mortgage approval.

IMPORTANT:

We are ONLY able to use disability income AS A “TOP UP” WHEN YOU ARE BUYING WITH ANOTHER PERSON

- who has standard/ T4 employment income OR qualifies as SELF-EMPLOYED

- AND your file needs more income to “top-up” the qualification amount to get to your target mortgage amount.

Unfortunately, we are not able to use:

- Disability income where it is more than 50% of the income needed to qualify for the mortgage.

- AISH income – the lenders deem provincial supplements as to “risky” and only use “federal programs.”

- If either of these are your situation, we recommend going to an ATB Branch, not online but a BRANCH.

Below are a few clarifications on the typical disability incomes that the banks can use.

- Not all banks accept all types of disability income so we use a few different lenders to ensure we have all your bases covered.

NEXT STEP

Call or send me an email with your contact data so we can have a chat on the phone if you are needing to use a “TOP-UP” via disability income for your purchase.

- I answer from 9-9 x 363, am in the office from 10 – 6:30 most days, best time to call is between 11 am – 3 pm.

- No need to pre-book, just call!

- (How different is that?)

Long-term & Short-term Disability Pension/Insurance

If the borrower has a non-taxable income, the Bank, CMHC and Sagen allow the income to be grossed-up.

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Long-term disability: 100% of long-term disability income can be used.

Provide one of the following:

- Letter from the organization or from QPP confirming long-term or permanent disability. If the letter is outdated (over 120 days), current bank statements confirming the deposits are being made to the borrower’s account are also needed

- T4A(P) confirming disability income.

Short-term disability: 100% of the employment income can be used for short-term disability.

Provide the following:

- A letter from the employer confirming the borrower’s return date, position and salary with a verbal confirmation from the employer to ensure the date on the letter is correct. If the return date cannot be confirmed, the disability income can be used for qualifications.

Pension & Retirement Income/Life Annuity

Retirement pensions are fixed incomes, CPP (Canada Pension Plan), OAS (Old Age Security), GIS (Guaranteed Income Supplement), provincial pension plans and private/corporate pensions and must be Canadian pension and evident on Canadian tax return.

IF you are Splitting Retirement Income: In the case where the pension income is shared for tax purposes, the transferring spouse/common-law partner must be on file and only the amount that has not been transferred/split is admissible.

Provide the most recent two documents of the following depending on the source of the declared retirement income:

- Most recent NOA supported by T1 General

- RL-2 Slip

- T4A, T4A(P)

- Letter from the initiating party confirming the yearly pension amount

- Letter from the organization confirming income and permanency of income

- Copy of current bank statement showing the automatic deposit

- Copy of current monthly cheque stub

For CPP, OAS, QPP and GIS, only one relevant document for each source is required from the list above.

RRIF

Income from a RRIF is admissible if there is proof that the portfolio generates a sustainable income amount for the length of the term.

This is a tough one to nail down as the portfolio has to be sustainable and not “drained” over the term of the loan, as in, there will still be a substantial balance in 5 years, if the mortgage is a 5-year term.

Provide the following:

- The most recent NOA supported by T1 General

- Recent RRIF statement to show that the borrower has sufficient assets to support the indicated income for the length of the term

First Nations

This is a non-taxable income. The income can be grossed-up as follows:

- Less than $30,000, this income may be increased by 25%

- At least $30,000, this income may be increased by 35%

Provide the following:

- Copy of the status card needed.

“We use disability income all the time in our practice to top-up mortgage amounts and have access to the banks and lenders that allow it’s use.

Mortgage Mark Herman, top Calgary Alberta and BC mortgage broker, for 21 years.

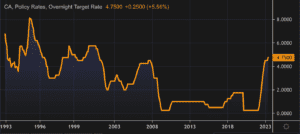

Underlying Economic data on BoC holding Prime rate the same, December 5, 2023

Bank of Canada holds its policy interest rate steady, updates its outlook

Against the backdrop of a decelerating economy and growing calls for less restrictive monetary policy, the Bank of Canada made its final scheduled interest rate decision of the year today.

That decision – to keep its overnight policy interest rate at 5.00% – was broadly expected. What was not entirely expected (or welcome) was the Bank’s statement that it is “still concerned” about risks to the outlook for inflation and “remains prepared to raise” its policy rate “further” if needed.

The Bank’s observations are captured in the summary below.

Since August, we have been saying the VARIABLE RATE mortgage is the way to go, and this proves we were right on the money.

Mortgage Mark Herman, top Calgary Alberta and Victoria BC mortgage broker

Inflation facts and housing market commentary

- A slowdown in the Canadian economy is reducing inflationary pressures in a “broadening range” of goods and services prices

- Combined with a drop in gasoline prices, this contributed to easing of CPI inflation to 3.1% in October

- However, “shelter price inflation” picked up, reflecting faster growth in rent and other housing costs along with the continued contribution from elevated mortgage interest costs

- In recent months, the Bank’s preferred measures of core inflation have been around 3.5-4%, with the October data coming in towards the lower end of this range

- Wages are still rising by 4-5%

Canadian economic performance

- Economic growth “stalled through the middle quarters of 2023 with real GDP contracting at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter

- Higher interest rates are clearly restraining spending: consumption growth in the last two quarters was close to zero, and business investment has been volatile but essentially flat over the past year

- Exports and inventory adjustment “subtracted” from GDP growth in the third quarter, while government spending and new home construction provided a boost

- The labour market continues to ease: job creation has been slower than labour force growth, job vacancies have declined further, and the unemployment rate has risen modestly

- Overall, these data and indicators for the fourth quarter suggest the economy is “no longer in excess demand”

Global economic performance and outlook

- The global economy continues to slow and inflation has eased further

- In the United States, growth has been stronger than expected, led by robust consumer spending, but is “likely to weaken in the months ahead” as past policy rate increases work their way through the economy

- Growth in the euro area has weakened and, combined with lower energy prices, has reduced inflationary pressures

- Oil prices are about $10-per-barrel lower than was assumed in the Bank’s October Monetary Policy Report

- Financial conditions have also eased, with long-term interest rates “unwinding” some of the sharp increases seen earlier in the autumn. The US dollar has weakened against most currencies, including Canada’s

Summary and Outlook

Despite (or in the Bank’s view because of) further signs that monetary policy is moderating spending and relieving price pressures, it decided to hold its policy rate at 5% and to continue to normalize its balance sheet.

The Bank also noted that it remains “concerned” about risks to the outlook for inflation and remains prepared to raise its policy rate further if needed. The Bank’s Governing Council also indicated it wants to see further and sustained easing in core inflation, and continues to focus on the balance between demand and supply in the economy, inflation expectations, wage growth, and “corporate pricing behaviour.”

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.” As a result, we will have to wait until next year for any sign of rate relief.

What’s next?

The Bank’s next interest rate announcement lands on January 24, 2024.

In the meantime, please feel free to call me and discuss financing options that will empower you in this economic cycle, and the ones ahead.

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

This decision provides some comfort to borrowers who have seen their mortgage costs rise steadily since March of 2022. As for real relief – in the form of rate cuts – the Bank demurred, noting that its preferred measures of core inflation show “little downward momentum.” Consequently, the Bank said it is holding this policy rate and continuing its current policy of quantitative tightening.

We capture the Bank’s observations and its latest economic forecasts in the summary below.

Inflation facts and outlook

- In Canada, inflation measured by the Consumer Price Index (“CPI”) has been volatile in recent months: 2.8% in June, 4.0% in August, and 3.8% in September

- Higher interest rates are moderating inflation in many goods that people buy on credit, and this is spreading to services

- Food inflation is easing from very high rates; however, in addition to elevated mortgage interest costs, inflation in rent and other housing costs remains high

- Near-term inflation expectations and corporate pricing behavior are normalizing only gradually, and wages are still growing around 4% to 5%

- The Bank’s preferred measures of core inflation show little downward momentum

Canadian housing and economic performance

- There is growing evidence that past interest rate increases are dampening economic activity and relieving price pressures

- Consumption has been subdued, with softer demand for housing, durable goods and many services

- Weaker demand and higher borrowing costs are weighing on business investment

- A surge in Canada’s population is easing labour market pressures in some sectors while adding to housing demand and consumption

- In the labour market, recent job gains have been below labour force growth and job vacancies have continued to ease; however, the labour market remains “on the tight side” and wage pressures persist

- Overall, a range of indicators suggest that supply and demand in the economy are now “approaching balance”

Global economic performance and outlook

- The global economy is slowing and growth is forecast to moderate further as past increases in policy interest rates and the recent surge in global bond yields weigh on demand

- The Bank projects global GDP growth of 2.9% this year, 2.3% in 2024 and 2.6% in 2025. While this outlook is little changed from the Bank’s July Monetary Policy Report, the composition has shifted, with the US economy proving stronger and economic activity in China weaker than expected

- Growth in the Euro area has “slowed further”

- Inflation has been easing in most economies, as supply bottlenecks resolve and weaker demand relieves price pressures but underlying inflation is persisting, meaning central banks must “continue to be vigilant”

- Oil prices are higher than the BoC assumed in July, and the war in Israel and Gaza is a new source of geopolitical uncertainty

Summary and Outlook

The BoC noted that after averaging 1% over the past year, economic growth is expected to remain “weak” for the next year before increasing in late 2024 and through 2025. Near-term weakness in growth reflects both the broadening impact of past increases in interest rates and slower foreign demand. The subsequent economic “pickup” will be driven by household spending as well as stronger exports and business investment in response to improving fore

ign demand. Spending by governments contributes materially to growth over the forecast horizon. Overall, the Bank expects the Canadian economy to grow by 1.2% this year, 0.9% in 2024 and 2.5% in 2025.

In the Bank’s October projection, CPI inflation is expected to average about 3.5% through the middle of next year before gradually easing to 2% in 2025. Inflation is expected to return to the Bank’s target about the same time as policymakers forecast in their July 2023 projection, “but the near-term path is higher because of energy prices and ongoing persistence in core inflation.”

As for what to expect going forward, the Bank had this to say about interest rates: “With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet. However, Governing Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed.”

The message is therefore clear: the Bank wants to see downward momentum in core inflation before it changes tack, and continues to be focused on the “balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour.”

Once again, the Bank ended its communique with a familiar phrase: it remains “resolute in its commitment to restoring price stability for Canadians.”

What’s next?

The Bank’s final (scheduled) interest rate announcement of 2023 takes place December 6th and we will follow immediately after with our next executive summary.

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

Leading up to today’s announcement, many economists feared that the BoC would have no choice but to raise rates in the face of persistent inflation and recent GDP growth. Their fears were founded.

To understand the Bank’s thinking on this important topic, we highlight its latest observations below:

Inflation facts and outlook

- In Canada, Consumer Price Index (CPI) inflation “ticked up in April” to 4.4%, the first increase in 10 months, with prices for a broad range of goods and services coming in higher than expected

- Goods price inflation increased, despite lower energy costs

- Services price inflation remained elevated, reflecting strong demand and a tight labour market

- The Bank continues to expect CPI inflation to ease to around 3% in the summer, as lower energy prices “feed through” and last year’s large price gains “fall out” of the yearly data

- However, with three-month measures of core inflation running in the 3.50%-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target

Canadian housing and economic performance

- Canada’s economy was stronger than expected, with GDP growth of 3.1% in Q1 2023

- Consumption growth was “surprisingly strong and broad-based,” even after accounting for the boost from population gains

- Demand for services continued to rebound

- Spending on “interest-sensitive goods” increased and, more recently, “housing market activity has picked up”

- The labour market remains tight: higher immigration and participation rates are expanding the supply of workers but new workers have been quickly hired, reflecting continued strong demand for labour

- Overall, excess demand in the economy looks to be “more persistent” than anticipated

Global economic performance and outlook

- Globally, consumer price inflation is coming down, largely reflecting lower energy prices compared to a year ago, but underlying inflation remains stubbornly high

- While economic growth around the world is softening in the face of higher interest rates, major central banks are signalling that interest rates may have to rise further to restore price stability

- In the United States, the economy is slowing, although consumer spending remains surprisingly resilient and the labour market is still tight

- Economic growth has essentially stalled in Europe but upward pressure on core prices is persisting

- Growth in China is expected to slow after surging in the first quarter

- Financial conditions have tightened back to those seen before the bank failures in the United States and Switzerland

Summary and Outlook

The BoC said that based on the “accumulation of evidence,” its Governing Council decided to increase its policy interest rate, “reflecting our view that monetary policy was not sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

The Bank says quantitative tightening is complementing the restrictive stance of monetary policy and normalizing the Bank’s balance sheet.

Going forward, the Bank said it will continue to assess the dynamics of core inflation and the outlook for CPI inflation with particular focus on “ evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving” its inflation target.

Once again, the Bank repeated its mantra that it “remains resolute in its commitment to restoring price stability for Canadians.”

Next up

With today’s announcement now behind us, a new round of speculation will begin in advance of the Bank’s next policy announcement on July 12th.

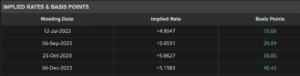

Odds of New Rates

Market odds now have a July 12 hike at a 61% probability, with potentially another increase by December.

Just 1 more Prime Rate increase would take the benchmark prime rate from 6.95% at the end of today to a nosebleed 7.20% (last seen in February 2001).

There may well be another Prime Rate increase on July. We have strategies to beat these rates so please call and we can sort out a situation that works for you.

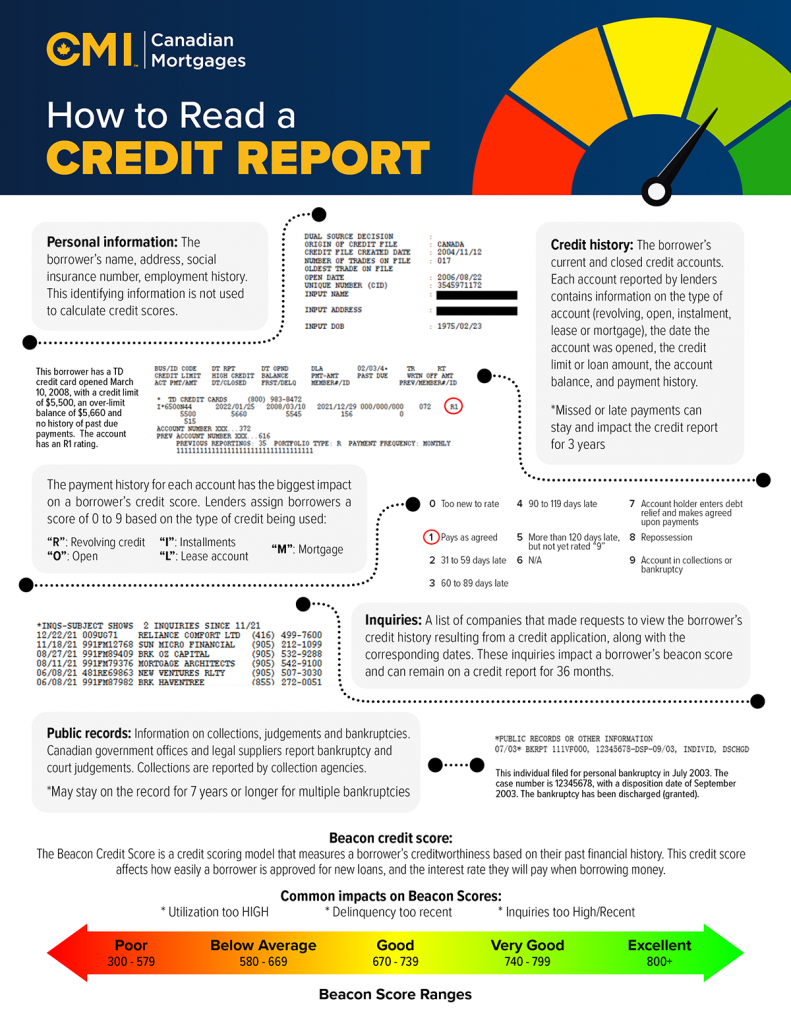

WHAT’S REALLY BEHIND A CREDIT SCORE? Revealing the components of the calculations

Credit scores typically range between 300 and 850 points and provide an indication of a borrower’s capacity r to repay their loans. There are two main credit bureaus in Canada – Equifax and TransUnion – that collect, store, and share information about how you use credit.

5 main factors used to calculate credit scores:

Payment History

The most important factor in a credit score is whether a borrower has a good track record of repaying the money loaned to them. Payment history comprises up to 35% of a credit score. Remind clients that multiple late or missed payments, overdue accounts, bankruptcies and any written off debts will all lower their credit score. Paying back debt quickly can help repair their credit.

Credit Utilization

Credit utilization ratio looks at the percentage of debt used out of all credit limits available to the borrower. If your client has multiple credit cards, revolving lines of credit or other accounts that are maxed out consistently, it can lower their credit score. Help clients examine the type of accounts they hold and stress the importance of managing each of them responsibly.

Credit History

The longer someone has an account open, the better for their credit score. Credit history is a window into how much experience a borrower has managing debt and their ability to pay it off. Work with clients to review active and inactive accounts. Suggest leaving credit card accounts open, even if they don’t use them much, as the age of the account might help boost their score.

New Credit

New credit is another key input to a person’s credit score. Check with clients to see how recently and how often they’ve applied for new credit, as well as how many new accounts have actually been opened. When you apply for new credit, borrowers are subject to a “hard inquiry” so that the lender can check their credit information. If there have been many of these hard credit checks in a short period of time, it could impact their credit score negatively.

Types of Credit

Having more than one type of credit account (while managing them responsibly) can improve your credit score, such as credit cards, an auto loan, mortgages, and lines of credit. This makes up a smaller portion of a borrower’s score, but balancing different types of credit can be a way to raise your client’s score.

Rates and Prices Trending Up Due to Inflation and War

Mid-March Commentary: Rates and Prices Trending Up Due to Inflation! and War!!

On March 2nd, 2022, the Bank of Canada made its most anticipated decision on interest rates since the pandemic began. After weeks of speculation and anticipation of an increase, central bankers finally pulled the trigger and moved their overnight rate higher.

For the 1st time since the pandemic began to hurt the economy in March 2020, the Bank raised its overnight benchmark rate by .25% and the knock-on effect is that borrowing costs for Canadians will rise modestly although by historical norms, remain low.

In its updated comments on the state of the economy, the Bank and singled out the unprovoked invasion of Ukraine by Russia as a “major new source of uncertainty” that will add to inflation “around the world,” and have negative impacts on confidence that could weigh on global growth.

Below are the other highlights…

Canadian economy and the housing market

- Economic growth in Canada was very strong in the fourth quarter of 2021 at 6.7%, which is stronger than the Bank’s previous projection and confirms its view that economic slack has been absorbed

- Both exports and imports have picked up, consistent with solid global demand

- In January 2022, the recovery in Canada’s labour market suffered a setback due to the Omicron variant, with temporary layoffs in service sectors and elevated employee absenteeism, however, the rebound from Omicron now appears to be “well in train”

- Household spending is proving resilient and should strengthen further with the lifting of public health restrictions

- Housing market activity is “more elevated,” adding further pressure to house prices

- First-quarter 2022 growth is “now looking more solid” than previously projected

Canadian inflation and the impact of the invasion of Ukraine

- CPI inflation is currently at 5.1%, as the BoC expected in January, and remains well above the Bank’s target range

- Price increases have become “more pervasive,” and measures of core inflation have all risen

- Poor harvests and higher transportation costs have pushed up food prices

- The invasion of Ukraine is putting further upward pressure on prices for both energy and food-related commodities

- Inflation is now expected to be higher in the near term than projected in January

- Persistently elevated inflation is increasing the risk that longer-run inflation expectations could drift upwards

- The Bank will use its monetary policy tools to return inflation to the 2% target and “keep inflation expectations well-anchored”

Global economy

- Global economic data has come in broadly in line with projections in the Bank’s January Monetary Policy Report

- Economies are emerging from the impact of the Omicron variant of COVID-19 more quickly than expected, although the virus continues to circulate, and the possibility of new variants remains a concern

- Demand is robust, particularly in the United States

- Global supply bottlenecks remain challenging, “although there are indications that some constraints have eased”

Looking ahead

As the economy continues to expand and inflation pressures remain elevated, the Bank made a clear point of telling Canadians “To expect interest rates to rise further.”

The resulting quantitative tightening (which central bankers framed as “QT” rather than the previous term “QE” for quantitative easing) would complement increases in the Bank’s policy-setting interest rate. The timing and pace of further increases in the policy rate, and the start of QT, will be guided by the Bank’s ongoing assessment of the economy and its commitment to achieving a 2% inflation target.

BoC’s next scheduled policy announcement is April 13, 2022. We will update you following that announcement as always.

Rising rates: fixed or variable?

The Bank of Canada pulled the trigger on an interest rate increase, the first since October 2018 and the Bank has made it clear more increases are coming.

The upward move and the Bank’s messaging have rekindled the perennial mortgage debate: fixed or variable. The answer remains the perennial: it depends.

It depends on the borrower’s end goals, finances and their desire for stability. That last point, stability, is what leads most Canadian home buyers to opt for a 5-year, fixed-rate mortgage. But in purely financial terms – and saving money – variable-rate mortgages tend to be cheaper, and they do not have to be volatile.

In a rising rate environment, many borrowers worry about the cost of their debt going up. But right now, variable-rates are notably lower than fixed-rates and it will take several Bank of Canada increases to close the gap. In the meantime, that amounts to savings for the borrower.

Those savings – often hundreds of dollars a month – could be applied against principal. As rates rise the amount can be adjusted, thereby keeping total monthly payments the same and evening-out any volatility.

It should be remembered that fixed-rates are rising as well. They are tied to Government of Canada 5-year bond yields. Those yields have been increasing, and at least some of that is tied to increases in U.S. government bond yields. Canadian bonds tend to move in sync with American bonds, but those changes do not necessarily reflect the Canadian economy. In other words, the changes are not completely within our control.

A Few More Words on Russia Invading Ukraine

Markets were thrown into a tizzy. They plunged. But the frenzy was short lived. By the end of the day markets were back in the black.

Canada’s economic exposure to Russia and Ukraine is relatively small. Canada imported $1.2 billion from Russia in 2020; Russia imported roughly the same from Canada – less than a week’s worth of commercial traffic across the Ambassador Bridge.

The key factor in the conflict, for Canada, will likely be the price of oil, which has climbed past $100 a barrel. Rising oil prices and higher fuel costs have been a principal driver of inflation here, and inflation is the main concern of the Bank of Canada. It is currently running at 5.1%, a 30 year high, and the central bank is under growing pressure to bring it under control.

Oil is also an important part of Canada’s resource economy. Higher prices will likely lead to more production. Any embargo of Russian oil will create demand for Canadian product. That, in turn, would put more load onto Canada’s economic recovery, which is strong but hampered by pandemic labour shortages and supply-chain problems which, again, are adding to inflation pressures.

None the less, war creates uncertainty, and uncertainty triggers caution among central bankers. A recent Reuters poll of 25 economists suggests the Bank of Canada will go ahead with a quarter-point rate hike this week.

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

Post-Covid Home Demand to Continue – Data

What is everyone doing with the money they saved during Covid?

- Eating out, travel, debt reduction and BUYING HOMES!

- Mortgage rates are low and home prices are close to 2005 levels!

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Latest Bank of Canada Survey:

As COVID-19 continues to be pushed down in Canada, consumer spending is expected to go up. The latest survey by the Bank of Canada suggests that will lead to an even greater demand for homes.

The Bank of Canada’s Survey of Consumer Expectations… indicates:

- 40% of respondents managed to save more money than usual during the pandemic.

- They expect to spend about 35% of those savings over the next 2 years on activities that have been restricted during the pandemic, such as dining out.

- Respondents plan to put 10% of their savings toward debt repayment and

- 10% toward a down payment on a home.

14% plan to buy a home soon, much of that was driven by renters, with 20% saying they want to get into the market.

80% of the respondents who have “worked from home” expect to continue with that and there is a consistent with the shift in demand for larger properties, away from city centres.

Inflation & Mortgage Interest Rates

- 5 Year fixed are going up and never getting back down to where they are now.

- Variables are also great – right now they are Prime – 1% or 2.45% – 1% = 1.45%, and as below, should stay there until 2023! Almost 20 more months!

Both of these are awesome options right now.Mortgage Mark Herman, Top Calgary Alberta mortgage broker for 1st time home buyers

Bond traders believe inflation is going to be rising over the coming months and have been demanding increased bond yields. That has led to increasing interest rates for bonds and, consequently, increasing rates for the fixed-rate mortgages that are funded by those bonds.

The traders say the COVID-19 vaccine rollout and plans for vast infrastructure spending – particularly in the U.S. – are boosting expectations of a broad recovery and an increase in inflation. Better than expected GDP growth in Canada and shrinking unemployment in the U.S. would tend to support those expectations.

This, however, puts the traders at odds with the central banks in both Canada and the United States.

The Bank of Canada and the U.S. Federal Reserve also expect inflation will climb as the pandemic fades and the economy reopens. There is a pent-up demand for goods and services, after all. The central banks see that as transitory, though, and appear to be looking past it. The U.S. Fed has gone so far as to alter its inflation target from 2% to an average of 2%, over time, thereby rolling any post-pandemic spikes into the bigger, longer-term calculations.

The Bank of Canada and the Fed have committed to keeping interest rates low, probably through 2023. Both say inflation will have to be sustained before interest rate moves are made to contain it. The integrated nature of the Canadian and American economies means it is unlikely the BoC will move on interest rates before the U.S. Fed.