Updated: Using Disability Income to Qualify for a Canadian Mortgage: 2024

NOTE: this post has been updated in August 2024.

CAN DISABILITY INCOME BE USED TO QUALIFY FOR A CANADIAN MORTGAGE?

YES, it is possible to use disability income to qualify for a pre-approval or a full mortgage approval.

Underlying Economic data on BoC holding Prime rate the same, December 5, 2023

Bank of Canada holds its policy interest rate steady, updates its outlook

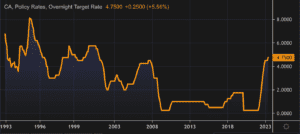

Against the backdrop of a decelerating economy and growing calls for less restrictive monetary policy, the Bank of Canada made its final scheduled interest rate decision of the year today.

That decision – to keep its overnight policy interest rate at 5.00% – was broadly expected. What was not entirely expected (or welcome) was the Bank’s statement that it is “still concerned” about risks to the outlook for inflation and “remains prepared to raise” its policy rate “further” if needed.

Canadian Mortgage Data – Nov 14

There has been a little relief for mortgage shoppers in recent days.

- Fixed-rates have come down slightly, led by declining yields for government bonds.

- Variable-rate mortgages appear to be maintaining their discounts and most market watchers believe the Bank of Canada has reached the top of this rate-hiking cycle.

The Bank, however, continues to warn that Canadians should be preparing for interest rates to remain higher for longer. Senior Deputy Governor Carolyn Rogers made that point again during a recent speech in Vancouver, saying it is important to adjust proactively to that possibility. Rogers cited a number of global considerations for higher rates including: China and other developing nations joining the worldwide economy; a decline in attractive investment opportunities for businesses; and an overall, international, adjustment to higher rates.

Data on those negative amortization mortgages

Queston 1: What about all these (negative amortizing) mortgages that will now take 71 years to pay off?

Answer:

Yes, they are called VRMs – Variable rate Mortgages – and we don’t really offer/sell /even talk about them for that exact reason – what if the rates rates jump? And they did.

Winning Variable Rate Strategy: end-2023

Here are the current Canadian mortgage rates and the Variable looks to be the best for these reasons ...

When Will Canadian Mortgage Rates Begin to Fall?

Last week, the Bank of Canada held its policy rate at 5%. The decision was expected given slowing in the economy and modest improvement to core inflation measures.

The Bank is likely at the end of its tightening cycle. How soon it eases rates – and how low will rates go in the near to medium term – is the question #1

Canadian Economic Forecast – Nov- Mortgage related use

Bank of Canada holds its interest rate steady, publishes updated economic forecasts

On October 25th, the Bank of Canada announced that it would maintain its Canadian Prime Rate stays at 7.3% – stating that there is “growing evidence” that past interest rate increases are dampening economic activity and relieving price pressures.

Persistent inflation leads the Bank of Canada to increase benchmark interest rate

UGH! The BoC whacks borrowers again.

Mark Herman, Top Calgary Alberta Mortgage Broker

Yesterday, the Bank of Canada increased its overnight interest rate to 5.00% (+0.25% from June) because of the “accumulation of evidence” that excess demand and elevated core inflation are both proving more persistent and after taking into account its “revised outlook for economic activity and inflation.”

Canadian economy running too hot, BoC increases Prime by .25%

Hot Economic growth leads the Bank of Canada to increase its benchmark interest rate

Today, the Bank of Canada increased its overnight interest rate to 4.75% (+0.25% from April) because of higher-than-expected growth in Canada’s economy in the first quarter and the view that monetary policy was not yet restrictive enough to bring inflation down to target.

BoC Holds Canadian Prime at 6.7% on April 12th – Good News!

Today, April 12, 2023, the Bank of Canada held its policy interest rate at 4.50%, a welcome outcome for borrowers after almost a year of constant increases, and a timely confidence-builder for the real estate industry as it enters the spring market.