| Prices are Rising Everywhere– This Transitory Could Last A Long Time |

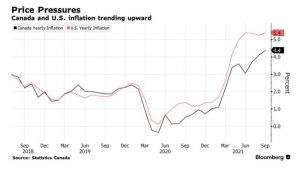

| Today’s release of the September Consumer Price Index (CPI) for Canada showed year-over-year (y/y) inflation rising from 4.1% in August to 4.4%, its highest level since February 2003. Excluding gasoline, the CPI rose 3.5% y/y last month.

The monthly CPI rose 0.2% in September, at the same pace as in the prior month. Month-over-month CPI growth has been positive for nine consecutive months.

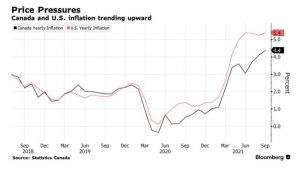

Today’s inflation is a global phenomenon–prices are rising everywhere, primarily due to the interplay between global supply disruptions and extreme weather conditions. Inflation in the US is the highest in the G7 (see chart below). The economy there rebounded earlier than elsewhere in the wake of easier Covid restrictions and more significant markups.

Central banks generally agree that the surge in inflation above the 2% target levels is transitory, but all now recognize that transitory can last a long time. Bank of Canada Governor Tiff Macklem acknowledged that supply chain disruptions are “dragging on” and said last week high inflation readings could “take a little longer to come back down.” |

|

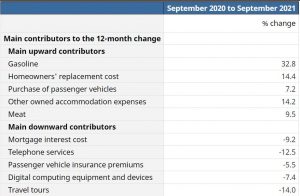

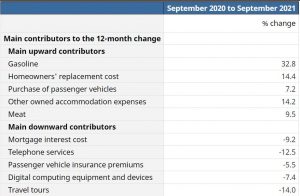

| Prices rose y/y in every major category in September, with transportation prices (+9.1%) contributing the most to the all-items increase. Higher shelter (+4.8%) and food prices (+3.9%) also contributed to the growth in the all-items CPI for September.

Prices at the gas pump rose 32.8% compared with September last year. The contributors to the year-over-year gain include lower price levels in 2020 and reduced crude output by major oil-producing countries compared with pre-pandemic levels.

Gasoline prices fell 0.1% month over month in September, as uncertainty about global oil demand continued following the spread of the COVID-19 Delta variant (see charts below). |

|

|

| Bottom Line

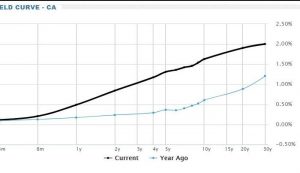

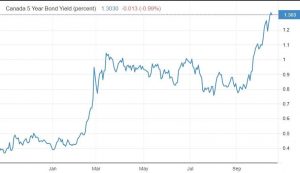

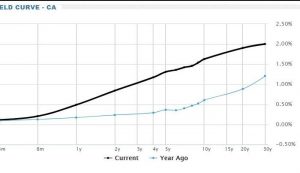

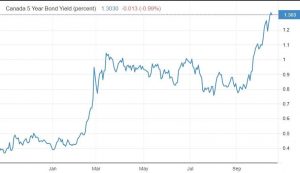

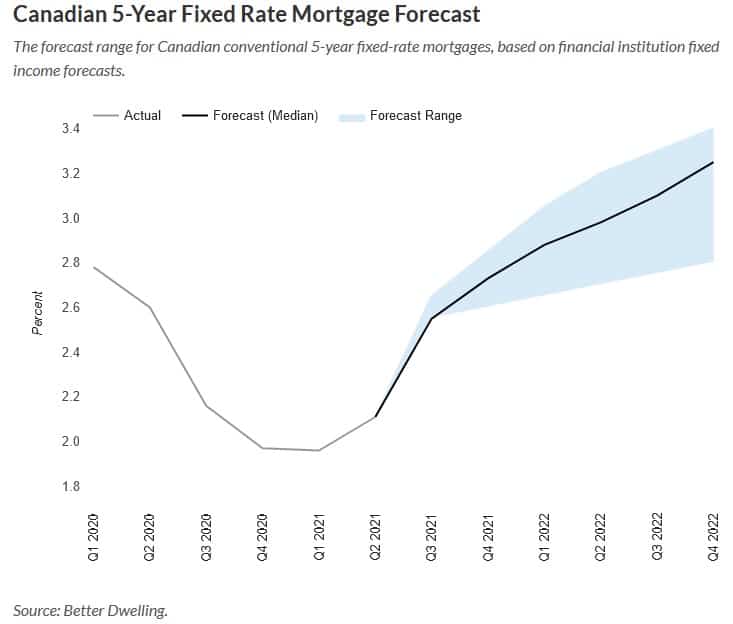

Today’s CPI release was the last significant economic indicator before the Bank of Canada meeting next Wednesday, October 27. While no one expects the Bank of Canada to hike overnight rates next week, market-driven interest rates are up sharply (see charts below). Fixed mortgage rates are edging higher with the rise in 5-year Government of Canada bond yields. The right-hand chart below shows the yield curve today compared to one year ago. The curve is hinged at the steady 25 basis point overnight rate set by the BoC, but the chart shows that the yield curve has steepened sharply with the rise in market-determined longer-term interest rates.

Moreover, several market pundits on Bay Street call for the Bank of Canada to hike the overnight rate sooner than the Bank’s guidance suggests–the second half of next year. Traders are now betting that the Bank will begin to hike rates early next year. The overnight swaps market is currently pricing in three hikes in Canada by the end of 2022, which would bring the policy rate to 1.0%. Remember, they can be wrong. Given the global nature of the inflation pressures, it’s hard to imagine what tighter monetary policy in Canada could do to reduce these price pressures. The only thing it would accomplish is to slow economic activity in Canada vis-a-vis the rest of the world, particularly if the US Federal Reserve sticks to its plan to wait until 2023 to start hiking rates.

It is expected that the Bank will taper its bond-buying program once again to $1 billion, from the current pace of $2 billion.

The Bank will release its economic forecast next week in the Monetary Policy Report. It will need to raise Q3 inflation to 4.1% from its prior forecast of 3.9%. |

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases. Read More

A normal English article with predictions of Canadian Mortgage Interest Rate Predictions, September 2021.

We think rates are headed up and here are the rates...

Q: What is going on with INFLATION and where are the mortgage INTEREST RATES going to go?

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)

Mortgage Mark Herman, Top Calgary Mortgage Broker

The Bank of Canada is not making its next rate announcement until September. That has market watchers looking to other indicators as they attempt to foresee what is coming for the economy and interest rates.

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates. Read More

AND NOW A GUEST ARTICLE BUY Derek Goodman …

How to Get a Home Loan When You Own a Home-Based Business

When your home-based business starts to grow, this is a good thing. But what if it’s growing so much that you need to purchase a larger home? This can get tricky because applying for a home loan when you own your own business is sometimes a little harder than when you are employed by a company. But don’t let this dissuade you! It is perfectly possible for a small business owner to apply for — and get approved for — a home loan. Here are some of the ways you can improve your chances. Read More

What is everyone doing with the money they saved during Covid?

- Eating out, travel, debt reduction and BUYING HOMES!

- Mortgage rates are low and home prices are close to 2005 levels!

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Latest Bank of Canada Survey:

As COVID-19 continues to be pushed down in Canada, consumer spending is expected to go up. The latest survey by the Bank of Canada suggests that will lead to an even greater demand for homes. Read More

SUMMARY:

There is LOTS of room for rates to go up, and very little for rates to go down or even hold steady.

Fixed mortgage rates are predicted to rise by 40% and go back to Pre-Covid rates or higher: Read More

Here is the near term expectations of mortgage interest rates.

Short version:

- 5 Year fixed are going up and never getting back down to where they are now.

- Variables are also great – right now they are Prime – 1% or 2.45% – 1% = 1.45%, and as below, should stay there until 2023! Almost 20 more months!

Both of these are awesome options right now.

Mortgage Mark Herman, Top Calgary Alberta mortgage broker for 1st time home buyers

THE DATA:

Bond traders believe inflation is going to be rising over the coming months and have been demanding increased bond yields. That has led to increasing interest rates for bonds and, consequently, increasing rates for the fixed-rate mortgages that are funded by those bonds. Read More

| | | | | | | | | | |

Q: What is going on with INFLATION and where are the mortgage INTEREST RATES going to go?

Q: What is going on with INFLATION and where are the mortgage INTEREST RATES going to go?