Mortgage Rates Up Due to Inflation

|

|

|

|

|

|

|

|

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

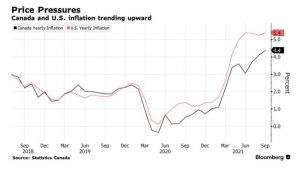

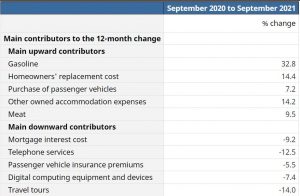

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

Canadian Mortgage Rates: Higher Soon, How High?

A normal English article with predictions of Canadian Mortgage Interest Rate Predictions, September 2021.

We think these rates are going to happen but ON A LONGER TIME RANGE that what they think.

Summary of Expected Rates*

- 2.55% – 2.65% in October, 2021

- 2.60% – 2.85% in December, 2021, reduction in buying power of 7%

- 3.10% – 3.30% in October, 2021, reduction in buying power of 8% – 14%

*These rates can totally happen, and are still lower than Pre-Covid rates, but also consider these things that would delay economic recovery/ keep rates low: Iraq – any thing, a 4th and 5th wave of Covid, new variants, USA droughts/ wild weather.

Mortgage Mark Herman, top Calgary Alberta mortgage broker, for new buyers

And a Renewal Surprise:

You may be surprised by the cost of a renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. That is an extra $26,000 if interest a year. ANSWER: look at renewing early. We can help you out with that.

OK … on with the news:

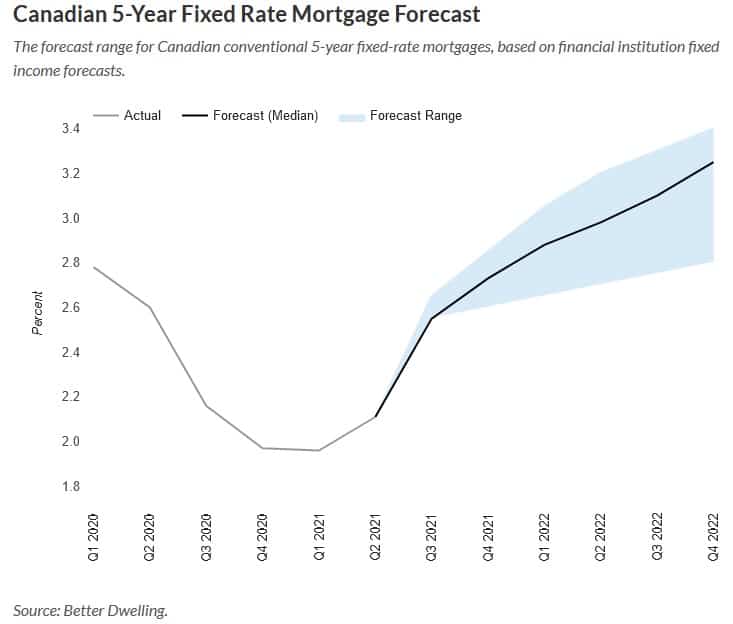

The Canadian economy is improving, excluding some minor hiccups like this morning’s GDP. An improved economy needs less stimulus, and that means higher mortgage rates. To see what Canada is in for, we modeled a forecast range for 5-year fixed-rate mortgages. If Canada doesn’t go into a double-dip recession, much higher mortgage rates are coming.

Canadian 5 Year Fixed-Rate Mortgage Forecast

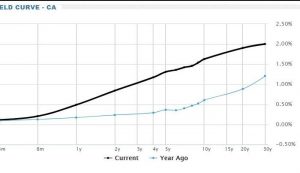

Today we’re looking at 5-year fixed-rate mortgage interest, and where it’s heading. More specifically, we’ll be focusing on conventional (aka uninsured) mortgage rates. These are for homeowners with a decent amount of equity, and a loan to value ratio below 80%. Insured and variable rate mortgages follow a different path. However, they’ll generally follow the same trend.

This model is based on fixed income forecasts created by major financial institutions. Since they’re forecasting how much investors will make, we can forecast how much you’ll pay. Just a couple of quick notes for the nerds, and aspiring nerds.

The strength of the economy and the recovery are going to be big factors in determining how high these go. A stronger economy means a faster recovery, and along with that is higher mortgage rates. Weaker economic performance will generally mean lower rates to stimulate borrowing. As economic conditions change, so will these forecasts.

Credit liquidity will also play a role in the direction of mortgage rates. If there’s excess capital to lend, mortgage lenders tend to accept smaller margins. This helps to lower the cost of borrowing since they’ll make it up on revenue. If capital for mortgages becomes scarce, mortgage rates rise to adjust to demand.

Today’s chart assumes a medium level of credit liquidity. That is, not much excess, but it’s not scarce either. That’s how the mortgage market was pre-pandemic, and we’ll assume it goes back to that.

Canadian Mortgage Rates Are Going To Climb

Mortgage borrowing costs are likely to reach pre-pandemic levels soon. Our median 5-year fixed-rate forecast is 2.55% by the end of Q3 2021. Based on the most bullish yield forecast, it would rise to 2.65%. The downside yield forecast is the same as the median.

Most institutions have consistent near-term expectations. That sounds weird, but it makes sense. Near-term forecasts are the most visible, with the least number of variables compounding. As forecasts are further out, we’ll see the gap widen as their difference in outlook is magnified.

Canadian 5-Year Fixed Rate Mortgage Forecast

The forecast range for Canadian conventional 5-year fixed-rate mortgages, based on financial institution fixed income forecasts.

Mortgage Interest Rates Can Increase Substantially By Year-End

By the end of this year, we start to really see the potential for these rates to climb. By Q4 2021, the median forecast would put a typical 5-year fixed-rate mortgage at 2.73%. The forecast range becomes wider, going from 2.6% (low) to 2.85% (high). It may not sound like much, but it can have a big impact.

The rate of change is much more important than the actual number. If you go from a 2% rate to a 2.73% rate, your cost of interest rises 36.5%. If we exclude the stress test, buying power sees a 7.84% decline. Since recent buyers are mostly stress-tested, default isn’t much of an issue. However, the cost and size of debt can be.

Mortgages Rates May Rise More Than A Point By Next Year

Next year is going to be a big one for mortgage rates if the economy recovers as expected. The median 5-year fixed-rate forecast works out to 3.10% by the end of Q3 2022, which can lead to an 11.5% reduction in buying power. On the low end, the rate still comes in at 2.7%, reducing buying power by 8.0% outside of a stress test. The high range would see it climb all the way to 3.30%, pulling maximum mortgage credit 14.3% lower. Keep in mind the stress test rate may also adjust higher as well. It depends on how comfortable OSFI is with rates rising closer to their stress test number.

Another factor to consider here is the cost of the renewal. A $500,000 mortgage with a 5-year fixed rate of 2.0% would pay around $46,080 in interest over the term. If that rises to 3.1% next year, the cost of interest over the same period would be $72,183. I don’t know about you, but $26,000 is a decent chunk of money to spend over a year.

Existing mortgage holders close to renewal may want to text their mortgage broker. If you see the economy improving, locking in rates might save you a little money. It might not though, depending on whether you have prepayment penalties. It’s always best to run the numbers with a broker on various scenarios though.

Pending a double-dip recession doesn’t occur, higher mortgage rates are coming. Maybe not as high as the Desjardins forecast, but definitely higher than it is now. Those supersized mortgages with short terms are going to divert more capital from the economy on renewal. The takeaway isn’t how high mortgage rates can climb though. It’s how absurdly cheap mortgage debt has been during the pandemic.

Link to the actual article: https://betterdwelling.com/canadian-mortgage-rates-will-rip-higher-soon-heres-how-high/#_

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

Post-Covid Home Demand to Continue – Data

What is everyone doing with the money they saved during Covid?

- Eating out, travel, debt reduction and BUYING HOMES!

- Mortgage rates are low and home prices are close to 2005 levels!

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

Latest Bank of Canada Survey:

As COVID-19 continues to be pushed down in Canada, consumer spending is expected to go up. The latest survey by the Bank of Canada suggests that will lead to an even greater demand for homes.

The Bank of Canada’s Survey of Consumer Expectations… indicates:

- 40% of respondents managed to save more money than usual during the pandemic.

- They expect to spend about 35% of those savings over the next 2 years on activities that have been restricted during the pandemic, such as dining out.

- Respondents plan to put 10% of their savings toward debt repayment and

- 10% toward a down payment on a home.

14% plan to buy a home soon, much of that was driven by renters, with 20% saying they want to get into the market.

80% of the respondents who have “worked from home” expect to continue with that and there is a consistent with the shift in demand for larger properties, away from city centres.

Mortgage Tip: Where are Canadian Mortgage Rates Going in 2021

SUMMARY:

There is LOTS of room for rates to go up, and very little for rates to go down or even hold steady.

Fixed mortgage rates are predicted to rise by 40% and go back to Pre-Covid rates or higher:

- 2.9% (from 2.09% now) for less than 20% down; CMHC insured

- 3.10% (from 2.24% now) for more than 20% down; conventional / not insured.

Prime – what variable rates are based on:

- The Bank of Canada has moved their target for Prime increase from 2023 to 2022.

- The US Fed has moved their target for Prime increase from 2024 to 2023, and the market expects that to move to 2022 as well.

- Prime is 2.45% today, it was 3.95% just before Covid (Feb, 2020) and will be trending back that way soon.

- Prime – 1% is the rates for today. 2.45% – 1% = 1.45% which is a great rate but how soon and how much will it move?

This article is awesome, and clear on what the changes mean. The summary above is all you need but you love this data, then read on …

Canadian Mortgage Rates Forecast To Rise Over 40%, Posted Rate Can Hit 7%

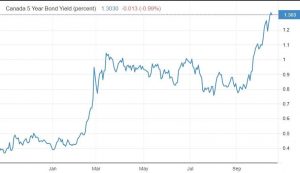

Canadian inflation is marching higher, and so are the expectations for mortgage rates. One bank sees the 5-year posted rate having more room to rise than fall in the future.

The institution has forecast the posted 5-year fixed-rate mortgage can rise up to 40% by 2024.

While the posted rate is rarely the rate paid by mortgage borrowers, it does impact a number of things. More importantly, it reflects an environment where credit is tightening.

The Posted Mortgage Rate Vs What You Really Pay

The posted mortgage rate is an unusually high mortgage rate that’s kind of like the sticker price of a car. It’s unreasonably high, few people will use it, and it’s mostly to help buyers feel like they’re getting a deal. The spread between the posted rate and a lender’s best available rate is usually between 220 to 250 bps. This means the rate borrows often pay is a full 2.2 to 2.5 percentage points lower than the posted rate. That doesn’t mean the posted rate is useless though.

The two biggest impacts it has are on payment penalties and the stress test. If you were to break your fixed-rate mortgage early, for say refinancing at a lower rate, you have to pay a penalty. That penalty is usually 3-months of interest, or the interest rate differential (IRD). The IRD is the difference between your rate and the posted rate closest to your remaining term. Then subtract any discount you received at origination. It’s pretty much what banks use to make sure you pay a big ole’ penalty for changing plans.

The stress test rate is also likely to be influenced by the posted rate, but maybe not directly. Originally the Bank of Canada benchmark rate was used to determine the stress test rate. This was based on the posted rate at various banks. OSFI, the bank regulator, found it wasn’t very responsive to risk though. Rather than rely on the benchmark, they established a rate floor — the minimum rate that can be used. The criteria for how the floor can evolve can change a lot from now until 2024. However, it’s unlikely the stress test rate would ever fall below the posted rate. The stress test rate is currently around 50bps higher than the posted rate.

Canadian 5-Year Fixed-Rate Mortgages Have More Upside Risk Than Downside

There’s uncertainty, but Canada’s faster than expected recovery shows more upside than down. The five-year posted fixed rate is 4.74% currently. In a downside scenario, they see this falling to 4.40% by the fourth quarter of 2021. The upside scenario sees it rising up to 5.25% in the same quarter. Higher inflation expectations are also contributing to a stronger upside scenario.

Canadian Posted 5-Year Fixed Rate Forecast

By next year, the posted 5-year fixed rate is forecast for an even higher maximum — breaching the 6 point mark. Rates are forecast to have a downside of 4.6% in 2022, and an upside of 6.20%. In 2023, the range rises to 4.70% to 6.60% for the full year. In 2023, it gets a little more uncertain with the range widening from 4.55% to 6.95%. While the latter range is wider, it has a lot more upside than downside. The probability of it falling would likely require a substantial economic slowdown.

Since a number of factors go into a forecast, the longer the date, the more uncertainty it faces. Economic conditions would have to worsen and inflation drop for rates to fall. For rates to rise, Canada would have to continue a strong recovery, and/or see higher levels of inflation. Canada is so dependent on housing now, we likely have many people cheering on a crash to keep rates low.

Link to the full article is here: https://betterdwelling.com/canadian-mortgage-rates-forecast-to-rise-over-40-posted-rate-can-hit-7-desjardins/

2021: here Are Mortgage Rates Going?

|

|

How a job loss affects your mortgage approval

If you’ve been thinking about buying a house, you’ve probably considered how much you can afford in mortgage payments. Have you also thought about what would happen if you lost your source of income?

While the sudden loss of employment is always a possibility, the current uncertainty of our economy has made more people think about the stability of their income. Whether you’ve already made an offer on a home or you’ve just started looking, here is how job loss could affect your mortgage approval.

What role does employment play in mortgage approval?

In addition to ensuring you earn enough to afford a mortgage payment; mortgage lenders want to see that you have a history of consistent income and are likely to in the future. Consistent employment is the best way to demonstrate that.

To qualify for any mortgage, you’ll need proof of sufficient, reliable income. Your mortgage broker will walk you through the income documents your lender will need to verify you’re employed and earning enough income. So, if your employment situation is questionable, you may want to reconsider a home purchase until your employment is more secure.

Should you continue with your home purchase after you’ve lost your job?

What if you’ve already qualified for a mortgage, and your employment circumstances change? Simply put, you must tell your lender. Hiding that information might be considered fraud, and your lender will find out when they verify your information prior to closing.

If you’ve already gone through the approval process, then you know that your lender is looking for steady income and employment.

Here are some possible scenarios where you may be able to continue with your purchase:

- If you secure another job right away and the job is in the same field as your previous employment. You will still have to requalify, and it may end up being for less than the original loan, but you may be able to continue with your home purchase. Be aware, if your new employer has a probationary period (usually three months), you might not be approved. Consult your broker.

- If you have a co-signer on your mortgage, and that person earns enough to qualify on their own, you may be able to move forward. Be sure your co-signer is aware of your employment situation.

- If you have other sources of income that do not come from employment, they may be considered. The key factors are the amount and consistency of the income. Income from retirement plans, rentals, investments, and even spousal or child support payments may be considered under the right circumstances.

Can you use your unemployment income when applying for a mortgage?

Generally, Employment Insurance income can’t be used to qualify for a mortgage. The exceptions for most financial institutions are seasonal workers or people with cyclical employment in industries such as fishing or construction. In this situation, you’ll be asked to show at least a two-year cycle of employment followed by Employment Insurance benefits.

However, it’s not the ideal situation and most lenders won’t be willing to approve your mortgage under those conditions.

What happens if you’re furloughed (temporary leave of absence)?

Not all job losses are permanent. As we’ve seen during the COVID-19 pandemic, many workers were put on temporary leave. If you’ve already been approved for a mortgage and are closing on a house, your lender might take a “wait-and-see” approach and delay the closing if you can demonstrate you’ve only been furloughed. In these cases, you’ll need a letter from your employer that has a return-to-work date on it. Keep in mind, if you don’t return to work before your closing date, your lender will likely cancel the approval and ask for a re-

submission later.

If you haven’t started the application process, it would be wise to wait until you are back to work for at least three months to demonstrate consistent employment.

Your credit score and debt servicing ratios may change because of lost income, which means you may no longer meet your lender’s qualifications for a mortgage. While it may not be possible, try to avoid accumulating debt or missing any payments while unemployed.

Talk to your mortgage broker.

“You don’t want to get locked into a mortgage you can’t afford.

You also don’t want to lose a deposit on a home because you lost your financing.

When trying to assess if it’s better to move forward or walk away, we should be your first call.”

Mortgage Mark Herman; Calgary Alberta Mortgage Broker

$37,000 Payout Penalty at CIBC

The latest in giant payout penalties, this one was $47,291.

Here is a person – one of my ACTUAL ALMOST-Customers who had to swallow a surprise at TD for $35,000. (We tried 3 times to get him to not take that mortgage.)

To make this even more mind blowing, at a 39% tax rate that is $65,700 the person has to pay … about the same as 1-year of income at a full time job, without tax taken off.

- Would you work for 1 year to give it all to your bank if you had to sell or move or close down the mortgage for any reason?

- Would you sign an agreement like that?

- Have you already signed an agreement like this without knowing you have?

EASY to AVOID …

You don’t need to add in this risk to your home purchase. It is easy to get around by taking a mortgage from a major Broker Bank.

Broker banks calculate the payouts the “old way” which was way more fair to you, the buyer. Click here for the posts about payout penalties.

Broker banks also have better Terms & Conditions than the Big-6.

Link to the article: https://toronto.ctvnews.ca/american-who-sold-home-in-toronto-shocked-by-47-000-mortgage-penalty-1.5212884

“Broker Banks have better T&C than all of the Big-6. Call a mortgage broker first.”

Mortgage Mark Herman, Top Rated Calgary Mortgage Broker

CIBC mortgage penalties: “UNFAIR”

We always focus on the Terms and Conditions of the mortgage. Most people have no idea what the bank is talking about when they sign the mortgage. We DO as we do this every day.

Here is a link from a Canadian Law website about a CLASS ACTION LAW SUIT against CIBC for calculating their payout penalties incorrectly: https://canliiconnects.org/en/commentaries/66074

My favorite part of the article is here:

“difficulty of enforcing fairness to consumers … there is a serious imbalance of bargaining power between the oligopolistic banks and individual borrowers. Legislative action to provide better consumer protection would be desirable.”

MORE

And here is a link to a guy that was almost our customer but stayed at his bank because they matched our broker rate. And now he is paying a $35,000.00 payout penalty because of it.

https://wordpress.com/block-editor/post/blog.markherman.ca/1447