History of Economic Bubbles

This is a most interesting info graphic

https://fortunly.com/infographics/historical-financial-bubbles-infographic/

Economic Bubbles: The History, Causes, and Effects

You don’t need to be an expert to understand what economic bubbles are and how they happen. The simplest definition is the rapid and unrealistic inflation of asset prices without any basis in the intrinsic value of the given asset.

Despite the fact that financial bubbles (also known as speculative bubbles) are not rare, people repeatedly fail to recognize speculative trading as it’s happening. Too often, those involved only identify these risky activities in the autopsy. Once the bubble bursts, it’s already too late.

One of the crucial reasons for this is that bubbles are often driven by strong emotions, blurring people’s ability to make rational decisions. When gung-ho traders who are willing to take huge risks start operating in that environment, you have a recipe for disaster.

Investors’ greed (believing that someone will pay more for something than they paid themselves) is accompanied by strong feelings of euphoria (“wow, this investment will be so profitable, let’s buy!”), but also anxiety. Buyers go into denial when prices start to fall (“this is just a temporary reversal, my investment is long-term”). Then, finally, panic sets in, causing a domino effect: everyone starts to sell, ultimately leading to a crash.

A bubble burst can have a devastating effect on the economy, even on a global scale. The most recent example is the Great Recession after the market crash in 2008. However, depending on the economic sector or industry, bubbles can also have some positive effects.

Just consider the dot-com bubble, which forced the information technology industry to consolidate. Although people lost a lot of capital at the time, that money has since been invested many times over in infrastructure, software, servers, and databases. Pretty much every American house and business is now connected to the internet, which has changed how we live and work for good.

The best way to prevent an asset bubble from happening is strategic, common-sense investing. Unfortunately, humans don’t always act sensibly. Bearing that in mind, chances are economic bubbles will continue to occur in the future.

To help you notice these patterns early, we at Fortunly have created an infographic detailing how some of the biggest financial bubbles in history have formed and then burst. Check it out to make sure you don’t fall victim to the hype of “the next big thing.”

Very coolMark Herman, Best Calgary Alberta Mortgage Broker

Why you don’t want your mortgage at your main bank

The Big-5 banks do not love you, they love your money, and now they can “trap” you in their mortgages if you fail the Stress Test.

Highlights of the last post are below. The post from January is here: http://markherman.ca/how-the-big-5-banks-trap-you-in-their-mortgages/

The new mortgage rules – called the B20 – allow the banks to renew you at almost any rate they want – or at least not a competitive one – if your credit, income, or debts should mean you can’t change banks.

If your mortgage is at your main bank they can see:

- your pay and income going into your accounts

- debt balances on your credit report

- what your credit score is

- your debt payments

- your home/ rental addresses so they can accurately guess at your home value.

ALL THIS MEANS they can calculate if you can pass the new “Stress Test.”

If you can’t pass it then they know you can’t change banks, are you are now totally locked into them for your renewal. They can renew you at POSTED RATES … 5.34%, not actual discounted rates they offer everyone, today (June 2019) about 2.99%.

The GOOD NEWS is broker banks do not do any of this … so having your mortgage at your main bank only helps them “grind you” later on. …. so how convenient is having your mortgage at your bank now?

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said an analyst. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations.

Ron Butler said, “Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Variable rates to hold steady for 2019

Here is the latest on changes to the Prime rate for variable mortgages. The news is good as Prime is now expected to stay the same for the balance of 2019!

Remember:

- Variable rates can be locked in at any time for what the rates are on the day you lock in on.

- The maximum payout fee for is 3 months of interest

Rate hike disappears over the horizon

The likelihood of a Bank of Canada interest rate increase appears to be getting pushed further and further beyond the horizon.

The Bank is expected to remain on the sidelines again this week when it makes its scheduled rate announcement on Wednesday.

A recent survey by Reuters suggests economists have had a significant change of heart about the Bank’s plans. Just last month forecasters were calling for quarter-point increase in the third quarter with another hike next year. Now the betting is for no change until early 2020. There is virtually no expectation there will any rate cut before the end of next year.

The findings put the Bank of Canada in line with the U.S. Federal Reserve and other major central banks. World economies have hit a soft spot largely due to trade uncertainties between China and the United States.

This is good news for variables

Mark Herman, Top Calgary Mortgage Broker

RBC: Mortgage Mistakes

RBC made what I think are some some pretty serious – and costly – mistakes for their customers and it is too bad … for the customers!

My 2 favorite quotes from this article are:

“My husband and I both felt pretty robbed,” she said. “I feel … it was deceptive.”

and

“Based on his reading of it, the tone of the bank’s letter to affected customers is “probably an attempt to avoid litigation, because if they took the opposite position then people would be owed money,” he said, noting the letter falls well short of an apology or acceptance of responsibility.

“There is no particular offer … to compensate or provide a small amount of money as a token of having made a mistake,” he said.”

Here is the full article:

“Always get mortgage advice from a full-time, professional, mortgage broker”

Mortgage Mark Herman; Calgary, Alberta top rated mortgage broker.

How the Big-5 Banks Trap You in Their Mortgages

- what your credit score is

- your pay and income going into your accounts

- your debt payments

- other debt balances on your credit report

- your home/ rental addresses so they can accurately guess at your home value.

Highlights of the article link below are:

Canada’s biggest banks are tightening their grip … as new rules designed to cut out risky lending make it harder for borrowers to switch lenders … the country’s biggest five banks … are reporting higher rates of renewals by existing customers concerned they will not qualify for a mortgage with another bank.

“B-20 has created higher renewal rates for the big banks, driving volumes and goosing their growth rates,” said Eight Capital analyst Steve Theriault. “It’s had the unintended consequence of reducing competition.”

Royal Bank of Canada (RBC), the country’s biggest lender, said last month that mortgage renewal rates [are up …] due in part to the B-20 regulations and also to improvements it has made to make it easier for customers to renew.

Ron Butler, owner of Toronto-based brokerage Butler Mortgage, said the changes leave borrowers with less choice.

“Even if they are up-to-date with their repayments, borrowers may find they don’t qualify with other lenders so they’re stuck with their bank at whatever rate it offers,” he said.

Senior Canadian bankers such as RBC … and TD … voiced their support for the new rules prior to their introduction, saying rising prices were a threat to Canada’s economy.

While analysts say RBC and TD are expected to benefit from higher-than-normal retention rates in 2019, not everyone is sure borrowers will benefit.

“The banks are becoming more sophisticated in targeting borrowers who would fail the stress test and they can charge them higher rates at renewal knowing they can’t move elsewhere,” Butler said.

Link to the full article is here: https://business.financialpost.com/news/fp-street/canadas-big-banks-tighten-grip-on-mortgage-market-after-rule-changes

We saw the “Mortgage Renewal Trap” coming long ago when the Stress Test was announced. It is more important than ever to consider Mortgage Broker Lenders for your mortgage now.

Mark Herman, Top Calgary Alberta Mortgage Broker.

Inverted Yield Curves, Impacts on Prime Rate Changes and Variable Rate Mortgages

Summary:

For the 2nd time in 50 years the “Yield Curve” has inverted – meaning that long term rates are now lower than short term rates. This can signal a recession is on the way.

This Means …

- Alberta will look better comparatively to Canada’s hot housing markets which should finally cool down.

- Canada’s Prime rate increases look to be on hold until Spring. This makes the variable rates now look MUCH Better. There were 3 rate increases expected and these may not materialize – making the VARIABLE rate look better.

- Broker lender’s have VARIABLE rates that range between .1% and .65% BETTER than the banks do. If you are looking at variable rates we should look further into this in more detail.

DATA BELOW …

- More on the predictions on rate increases

- WTF is an inverted Yield Curve – lifted from “the Hustle”

-

Predictions on Prime

Three interest rate hikes in 2019 — that’s what economists have been predicting for months, as part of the Bank of Canada’s ongoing strategy to keep the country’s inflation levels in check. But, according to one economist, that plan may have changed.

The BoC held the overnight rate at 1.75 percent yesterday, and released a statement a senior economist at TD, believes hints that the next hike may not come until next spring.

“We no longer expect the Bank of Canada to hike its policy interest rate in January,” he writes, in a recent note examining the BoC’s decision. “Spring 2019 now appears to be the more likely timing.”

Meanwhile the Canadian rates and macro strategist at BMO, puts the odds of a rate hike in January at 50 percent.

“While the Bank reiterated its desire to get policy rates to neutral, the path to neutral is clearly more uncertain than just a couple of months ago,” he writes, in his most recent note. “Looking ahead to January, the BoC will likely need to be convinced to hike (rather than not).”

A VIDEO ON WHY VARIABLE RATE MAY BE THE WAY TO GO FOR YOUR PLANS

- https://vimeo.com/279581066

- This video is from my colleague Dustin Woodhouse and he perfectly presents the story on the variable. He also ONLY works in the BC Lower Mainland; if you live there HE should be doing your mortgage, if you don’t WE should be.

2. WTF is an ‘inverted yield curve,’ and what does it mean for the economy?

For the first time since 2007, the 2- to 5-year US Treasury yield curve has inverted. Historically, this has served as a somewhat reliable indicator of economic downturn, which means people are freaking out, which means…

OK, hold up: What exactly is a yield curve, and why is it inverting?

‘Lend long and prosper’ (so say the banks)

In short, a yield curve is a way to gauge the difference between interest rates and the return investors will get from buying shorter- or longer-term debt. Most of the time, banks demand higher interest for longer periods of time (cuz who knows when they’re gonna see that money again?!).

A yield curve goes flat when the premium for longer-term bonds drops to zero. If the spread turns negative (meaning shorter-term yields are higher than longer maturity debt), the curve is inverted…

Which is what is happening now

So what caused this? It’s hard to say — but we prefer this explanation: Since December 2015, the Fed has implemented a series of 6 interest rate hikes and simultaneously cut its balance sheet by $50B a month.

According to Forbes, the Fed has played a major part in suppressing long-term interest rates while raising short-term interest rates.

Yield curve + inversion = economic downturn (sometimes)

The data don’t lie. A yield curve inversion preceded both the first tech bubble and the 2008 market crash.

Though, this theory has had some notable “false positives” in its lifetime — so it’s not exactly a foolproof fortune teller.

Heck, IBM found the size of high heels tends to spike during hard times. As of now, the experts who believe the sky to be falling remain in the minority.

There is lots to digest in the data above. Please feel free to contact me to discuss in more detail.

Mark Herman, 403-681-4376

Top Calgary Alberta Mortgage Broker

Your Banking Relationship: They leverage your mortgage to rake in credit cards profits.

Below is part of an article where the bank is sad their mortgages are down 500% from last year. At the same time they made 16% more from ramming credit cards and Lines of Credits down their mortgage customer’s throats so it’s all okay in the end. For them… and how about for you?

The blue part shows that mortgage is the key to create what customers feel is a “relationship” with the bank so they can then sell you all their high margin products.

Broker lenders only “sell” 1 thing, mortgages, so consider separating your banking and your mortgage and get the best mortgage possible – through a broker lender.

“Having your mortgage at your bank is only convenient for them to rake it in off of your credit card fees.”

Mark Herman, top Calgary mortgage broker

Here is the article:

Bloomberg News, Doug Alexander, August 23, 2018 …

Canadian Imperial Bank of Commerce’s prediction of a mortgage slowdown has come true…

Despite the mortgage slowdown, CIBC posted a 16% jump in Canadian personal and commercial banking earnings due to a “significant” expansion … and growth in credit cards and unsecured loans amid rising interest rates, Chief Financial Officer Kevin Glass said.

“Those would be the major offsets in terms of mortgage growth declining,” Glass said in a phone interview. “Mortgages are a key product for us — it’s very important from a client relationship perspective — but it’s not a high margin product, so if mortgages come off it has a far smaller impact than rate increases do, for instance.”

Brokers vs. Banks – The Differences

Love it when the newspapers do the telling for us.

Almost 40% of all mortgages are via brokers now. Up from 25% 15 years ago. There is a reason to use a broker that has been in business for 15 years or longer, like Mortgage Mark Herman of Mortgages Are Marvellous.

https://www.thestar.com/life/advice/2018/07/31/mortgage-brokers-vs-banks-the-pros-and-cons.html

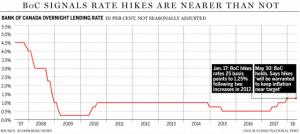

Prime rates should go up in July

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

This only affects variable rate mortgages and there are 2 increases to Prime expected for 2018, this one and one in December – depending on how the economy goes.

- The Bank of Canada is expected to raise interest rates on July 11th.

- They normally increase Prime by 0.25% at a time, Prime is 3.45% now and should then go to 3.70%.

- The Central bank also emphasized that the increase will be needed to contain inflation.

This makes the 5-year fixed rates look much better as rates are slowly going back to 4% – the Theoretical Minimum

Mark Herman, Top Calgary Alberta Mortgage Broker

Some will wonder what stopped the Bank of Canada from raising interest rates today. It does seem likely that policy makers struggled with the decision, as they had little bad to say about the economy.

The reason for the delay is the same as it’s been since the start of the year: U.S. President Donald Trump. Canada’s central bank remains concerned that U.S. trade-and-tax policy will weigh on Canadian business investment, so much so that it is prepared to risk a little inflation by waiting for more clarity.

Few thought the central bank would raise interest rates on May 30. Poloz had been clear that he was comfortable with inflation running a little faster than the target rate of 2 per cent. He also said last month that hard evidence on investment would be a crucial variable and no such information has yet been published.

The central bank had been wary that its three interest-rate increases since last summer would choke domestic spending. But households seem to be coping just fine, which means the Bank of Canada can resume pushing interest rates higher.

Here is the link for the entire article: http://business.financialpost.com/news/economy/bank-of-canada-holds-interest-rate-at-1-25

The Details: What you need to know about “discount mortgages.”

Grandma always said, “The price is the price, but the details are the details!”

There are discounted and restricted mortgage rates out there but they do not share the details of their disadvantages up front with you.

- Restricted or Limited Products / Bait & Switch

People will not even sign a 3 year cell- phone contact any more but they will try to save $15 a month on a restricted mortgage; which could cost them $30,000 as a payout penalty – BUYER BEWARE is what the regulators say.

Brokers often advertise these products to get you to call them and then they switch you into a “regular product” if you are lucky – or you get a “restricted product” that you probably do not want if you know all the details.

Discount mortgages called “limited” or “restricted” and often have:

- No rate holds

- Only monthly payments

- Only 1 statement a year

- No on-line administration = call centre only

- Only 5/5 extra repayment option – most broker lenders are 15/15 + 2x or 20/20

- The 1st number is the % of the original mortgage amount you can repay every year without penalty

- The 2nd number is the increase in monthly payment in % you can do without penalty.

- The 2x = double the payment!

- And they use the bank payout penalty calculations – as below in the Dirty Trick – AND in addition to that penalty, a 3% fee of the entire mortgage balance added to the penalty!

- This could easily end up at $30,000.

The other main “Details” that are not often disclosed are:

2.Collateral Charge

To keep you from leaving the bank for a lower rate when you renew later, the banks register your mortgage as a collateral charge – which is the same as an “I owe you” / IOU for the home. Other banks will not take another banks IOU for a mortgage; which means:

- A lawyer will have to re-register your mortgage at land titles; $1000.

- An appraisal is needed as the registration is usually for more than the value of the home; $450

- http://blog.markherman.ca/?s=collateral

- This means on renewal you will not get the best rates because it will cost you about $1500 – $2500 to move banks – even after your term is over.

3. The “Dirty Trick” of how the banks calculate your payout penalty

- If you have to move or break your mortgage the payout calculation is usually way lower at a broker-only bank than any of the big banks. The big banks all calcualte the penatly the same way now – to their advantage, not yours.

- http://blog.markherman.ca/2015/08/26/payout-penalties-how-the-big-5-banks-get-you/

To avoid these products, or to disucss what your personal situation may be, call us any time at 403-681-4376.

Mark Herman, Top Calgary, Alberta, mortgage broker for renewals, first time home buyers and home purchases.