Work Visa’s / Non-Canadians Can’t Buy Homes: 2023 New Rules

Prohibition on the Purchase of Residential Property by Non-Canadians Act.

Summary of New Rules, 2023:

Anyone with a work visa will have to have lived here for 3 of the past 4 years and have filed taxes during those years. Here are the RULES!

- Holds a valid work permit as defined in section 2 of the Immigration and Refugee Protection Regulations, or is otherwise authorized to work in Canada in accordance with section 186 of the Regulations;

- Has worked in Canada for a minimum continuous period of 3 years within the past 4 years, where the work meets the definition set out in s. 73(2) of the Regulations; and

- Has filed a Canadian income tax return for a minimum of 3 of the past 4 taxation years preceding the year in which the purchase is made.

Please also find below the Globe and Mail article that ran last week on December 1st.. I copied and pasted the whole article:

Ambiguity about Canada’s ban on foreign home buyers creating hiring headaches for businesses

Canada’s impending ban on foreigners purchasing residential real estate is complicating how businesses hire, promote and transfer immigrant workers because of an information vacuum about the final rules.

The Prohibition on the Purchase of Residential Property by Non-Canadians Act, passed by Parliament earlier this year, will restrict foreigners from buying homes in Canada starting next month. That ban will remain in place for two years – supposedly to curb investor speculation in the housing market.

Although the legislation will come into force on Jan. 1, 2023, the federal government still hasn’t released the final regulations outlining how the prohibition will work. Those details are essential because they will specify which non-Canadians, both individuals and corporations, will be exempt from the ban.

Our legislators, however, seem unaware that 2023 is less than 30 days away. But you can be damn sure the businesses and foreign workers who have to comply with the law are acutely aware of the problem.

“The regulations will be made available soon,” Claudie Chabot, a spokeswoman for the Canada Mortgage and Housing Corporation, wrote in an e-mail. (The national housing agency led the government’s consultation on the law.)

The sooner the better. Businesses and workers are being kept on hold.

The government’s consultation paper proposed that exemptions would only be given to temporary residents who hold a valid work permit and who’ve worked in Canada for a “minimum continuous period of three years within the past four years.” Additionally, those individuals would have to prove they filed Canadian income tax returns for at least three of the four years preceding their property purchase.

That potentially sets a high bar for skilled workers. Is Ottawa really planning to prohibit executives and other talent, who plan to move to Canada with their families, from buying a home until they’ve worked here for three years?

We don’t know because the government still hasn’t finalized the rules. It’s ridiculous.

“If I’m sitting in London, England, and I’m saying, ‘Well, gee, do I want to go to Canada? Do I really want to go through all of this aggravation?’ ” said Stephen Cryne, president and CEO of the Canadian Employee Relocation Council.

Known as CERC, the non-profit organization advocates for increased labour force mobility on behalf of companies in sectors including financial services, technology, natural resources and telecommunications.

As Mr. Cryne points out, top executives who work for companies such as banks, energy companies and manufacturers have plenty of choices about where they and their families choose to live in the world.

“I was speaking with one of our members,” he recounted. “They’re looking at bringing in several executives and their families from South Africa, and [because of the uncertainty around the new rules], they’re second-guessing saying, ‘We’re not sure.’ ”

That’s hardly a vote of confidence in Canada.

CERC is asking the federal government for a blanket exemption for any foreign national with a valid work permit who is living and residing in Canada. It’s a reasonable ask.

“Given Canada’s critical skills shortages, these requirements will place Canada in an uncompetitive position when compared to other countries where such restrictions on the purchase of residential property by foreign nationals may not exist,” CERC told the government in a submission.

The proposed rules are also creating headaches for U.S. relocation management companies that handle employee moves on behalf of Canadian corporations. Some of these American companies will purchase and resell an executive’s home to speed up a move. But as non-Canadians, they could be banned from conducting such property transactions for two years – further complicating the process of relocating employees.

Not only are businesses’ hiring and relocation plans getting gummed up, the regulatory uncertainty about the forthcoming ban also risks chasing away foreign direct investment. Our immigration backlog is already a frustration for foreign companies that want to hire more employees and expand their operations in Canada.

Worst of all, it’s not clear that a ban targeting foreign home buyers will actually prevent speculation in the real-estate market.

After all, non-residents only owned 3.1 per cent of residential property in British Columbia in 2020, according to Statistics Canada. In Ontario, that figure is only 2.2 per cent.

So why is the Liberal government pointing a finger at foreign buyers for pricing Canadians out of the housing market?

This is the problem with populist policies. They might make for good politics, but they often have undesirable consequences for businesses and consumers.

The government needs to clear up the confusion about its foreign-home-buyer ban – and fast.

If Ottawa’s goal is to admit nearly 1.5 million new immigrants to Canada by the end of 2025 to solve labour shortages, it shouldn’t be giving skilled workers reasons to think twice about moving here

Canadian Residential Mortgage Market: Inflation & Interest Rates: the Lead Characters for 2023

Summary:

- The Bank of Canada (BOC) increased interest rates 7 times in 2022. Exactly as expected 16 months ago.

- Inflation is at least 5.7%; and it needs to get down to 3%

- The BoC would rather over-tighten than under-tighten

- Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle

These 4 painful data points mean Prime will increase from 6.45% to 6.70% on Jan 25th.

We now expect there to be at least 1 or 2 more o.25% increases to Prime before it is expected to hold for the rest of 2023, and then begin to decrease in 2024.

Mortgage Mark Herman, Top Calgary Alberta Mortgage Broker

DATA

A lot of the recent talk in financial and real estate circles has been centering on the possibility of a pause in the Bank of Canada’s aggressive interest rate increases. Some speculate that could happen at the next rate setting, later this month, on January 25th.

The Bank raised rates 7 times last year in an effort to rein-in galloping inflation. It does seem to be working, but there are some stubborn sticking points.

Headline inflation, known as the Consumer Price Index (CPI), has dropped. It was 8.1% in July and drifted down to 6.8% in November. However, the drop from October to November was a mere one-tenth of one percentage point and the Bank’s target rate remains significantly below that, at 2.0%.

As well, the BoC’s preferred inflation measure, Core Inflation (which strips out volatile components like food and fuel), actually increased. A simple averaging of the three components that the Bank uses to measure Core Inflation came in at nearly 5.7% in November, up from 5.3% in October.

Other factors that figure into the Bank’s plans include Gross Domestic Product and unemployment. Canada’s GDP continues to grow, albeit modestly, despite rising interest rates. It increased by 0.1%, month-over-month in November. Unemployment dipped 0.1% to 5.0% in December. Both of these tend to fuel higher wages which are a key driver of inflation.

The Bank of Canada, itself, remains firmly dedicated to battling back inflation. Governor Tiff Macklem has said he would rather over-tighten than under-tighten and run the risk of having high inflation linger and become entrenched.

The U.S. central bank has made it clear it plans more rate hikes. Given the integration of the Canadian and American economies, the Bank of Canada does have to pay attention to what its American counterpart does.

The BoC will have new economic data by the time it makes its January 25th announcement. The December numbers will provide a fresh look at how well the inflation fight is going.

Normally it takes 18 to 24 months for interest rate increases to work their way into the economy and we are only about 10 months into this tightening cycle. It is reasonable to expect another 25 basis-point increase on the 25th. Given the Bank’s apparent success so far it also seems reasonable to expect a pause sometime after that.

Looking ahead to a year from now some forecasters say we might start to hear talk of interest rate cuts, which would be welcome news. Cuts would allow the BoC to move toward its, long stated, goal of normalizing rates back into the neutral range of 2.5% to 3.5%. The Bank of Canada, and central banks around the world, have been trying to do that for more than a decade – since the ’08 – ’09 financial collapse.

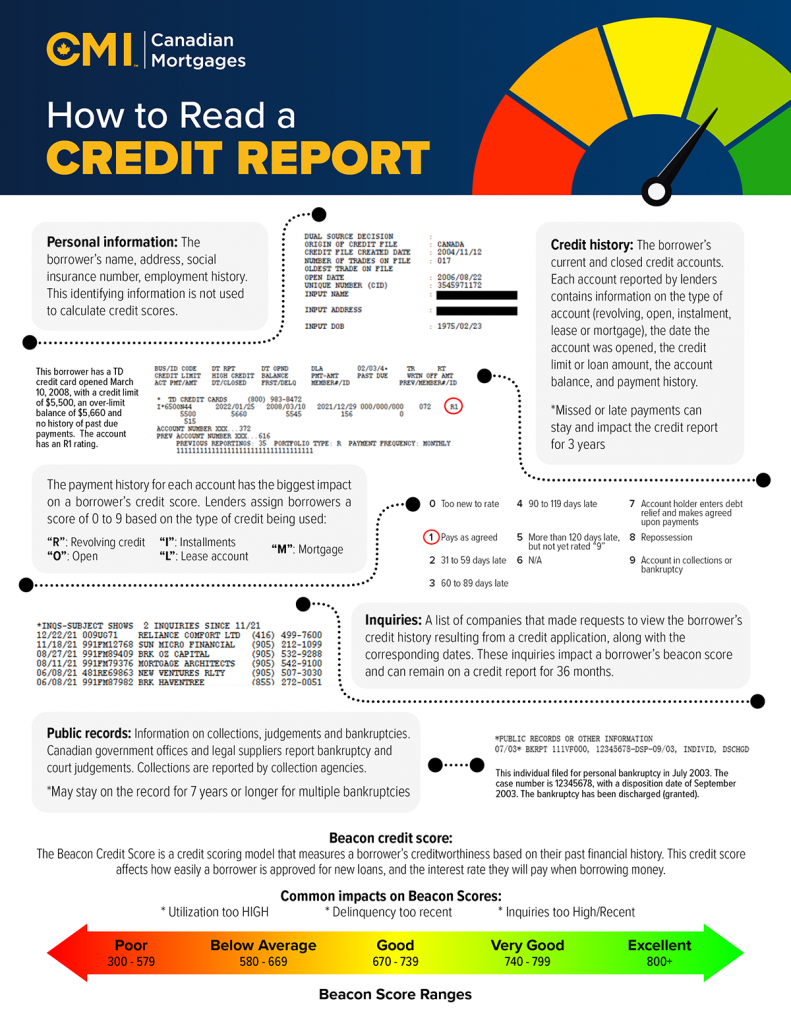

WHAT’S REALLY BEHIND A CREDIT SCORE? Revealing the components of the calculations

Credit scores typically range between 300 and 850 points and provide an indication of a borrower’s capacity r to repay their loans. There are two main credit bureaus in Canada – Equifax and TransUnion – that collect, store, and share information about how you use credit.

5 main factors used to calculate credit scores:

Payment History

The most important factor in a credit score is whether a borrower has a good track record of repaying the money loaned to them. Payment history comprises up to 35% of a credit score. Remind clients that multiple late or missed payments, overdue accounts, bankruptcies and any written off debts will all lower their credit score. Paying back debt quickly can help repair their credit.

Credit Utilization

Credit utilization ratio looks at the percentage of debt used out of all credit limits available to the borrower. If your client has multiple credit cards, revolving lines of credit or other accounts that are maxed out consistently, it can lower their credit score. Help clients examine the type of accounts they hold and stress the importance of managing each of them responsibly.

Credit History

The longer someone has an account open, the better for their credit score. Credit history is a window into how much experience a borrower has managing debt and their ability to pay it off. Work with clients to review active and inactive accounts. Suggest leaving credit card accounts open, even if they don’t use them much, as the age of the account might help boost their score.

New Credit

New credit is another key input to a person’s credit score. Check with clients to see how recently and how often they’ve applied for new credit, as well as how many new accounts have actually been opened. When you apply for new credit, borrowers are subject to a “hard inquiry” so that the lender can check their credit information. If there have been many of these hard credit checks in a short period of time, it could impact their credit score negatively.

Types of Credit

Having more than one type of credit account (while managing them responsibly) can improve your credit score, such as credit cards, an auto loan, mortgages, and lines of credit. This makes up a smaller portion of a borrower’s score, but balancing different types of credit can be a way to raise your client’s score.

How sudden job loss affects your mortgage pre-approval or approval

If you’ve been thinking about buying a house, you’ve probably considered how much you can afford in mortgage payments. Have you also thought about what would happen if you lost your source of income?

While the sudden loss of employment is always a possibility, the current uncertainty of our economy has made more people think about the stability of their income. Whether you’ve already made an offer on a home or you’ve just started looking, here is how job loss could affect your mortgage approval.

What role does employment play in mortgage approval?

In addition to ensuring you earn enough to afford a mortgage payment; mortgage lenders want to see that you have a history of consistent income and are likely to in the future. Consistent employment is the best way to demonstrate that.

To qualify for any mortgage, you’ll need proof of sufficient, reliable income. Your mortgage broker will walk you through the income documents your lender will need to verify you’re employed and earning enough income. So, if your employment situation is questionable, you may want to reconsider a home purchase until your employment is more secure.

Should you continue with your home purchase after you’ve lost your job?

What if you’ve already qualified for a mortgage, and your employment circumstances change? Simply put, you must tell your lender. Hiding that information might be considered fraud, and your lender will find out when they verify your information prior to closing. If we are aware of this change we may be able to work it out with the lender.

What if you don’t tell the lender or us – your broker – and hope the lender does not find out?

The lender will probably “pull your financing” if they find out on their own, and this can happen right up to the minute before possession, like 11:59 am on possession day.

At best, you may “close late” and there are fees for that, at worst, you could both:

· Lose your deposit that you gave and

· Be sued for “specific performance” of completing a legal and binding contract to buy the home. If the sellers need the funds to close on another house, they could “fire sale” the home for say $50,000 less and sue you for that to. And you will probably lose.

If you’ve already gone through the approval process, then you know that your lender is looking for steady income and employment.

Here are some possible scenarios where you may be able to continue with your purchase:

- If you secure another job right away and the job is in the same field as your previous employment at a direct competitor. You will still have to requalify, and it may end up being for less than the original loan, but you may be able to continue with your home purchase. Be aware, if your new employer has a probationary period (usually three months), you might not be approved.

- TIP: ask if you can have probation waived or be hired without probation.

- If you have a co-signer on your mortgage, and that person earns enough to qualify on their own, you may be able to move forward. Be sure your co-signer is aware of your employment situation.

- If you have other sources of income that do not come from employment, they may be considered. The key factors are the amount and consistency of the income. Income from retirement plans, rentals, investments, and even spousal or child support payments may be considered if we have not used that income to qualify you please tell us.

Can you use your unemployment income when applying for a mortgage?

Generally, Employment Insurance income can’t be used to qualify for a mortgage. The exceptions for most financial institutions are seasonal workers or people with cyclical employment in industries such as fishing or construction. In this situation, you’ll be asked to show at least a 2-year cycle of employment followed by Employment Insurance benefits.

Also if you are in an apprenticeship, then you are on EI when you are in your “school term” and that is totally fine.

What happens if you’re furloughed (temporary leave of absence)?

Not all job losses are permanent. As we’ve seen during the COVID-19 pandemic, many workers were put on temporary leave. If you’ve already been approved for a mortgage and are closing on a house, your lender might take a “wait-and-see” approach and delay the closing if you can demonstrate you’ve only been furloughed. In these cases, you’ll need a letter from your employer that has a return-to-work date on it. Keep in mind, if you don’t return to work before your closing date, your lender will likely cancel the approval and ask for a resubmission later.

If you haven’t started the application process, it would be wise to wait until you are back to work for at least 3-months to demonstrate consistent employment.

Your credit score and debt servicing ratios may change because of lost income, which means you may no longer meet your lender’s qualifications for a mortgage. While it may not be possible, try to avoid accumulating debt or missing any payments while unemployed.

Talk to your mortgage broker.

You don’t want to get locked into a mortgage you can’t afford. You also don’t want to lose a deposit on a home because you lost your financing. When trying to assess if it’s better to move forward or walk away, we should be your first call.

Bank of Canada holds benchmark interest rate steady & updates 2022 economic outlook

Summary:

- Prime did not change today, Jan 26, and the Bank of Canada (BoC) clearly said they are planning on starting the needed rate increases at the next meeting in 6 weeks, on Wednesday March 2nd.

- The Market has “priced in” between 4 and 6 increases in 2022, each by .25%, and between 2 and 4 increases in 2023, each by .25%

- There may be fewer increases if inflation returns to the target of 2% from today’s 40 year high of about 5%.

- The USA is seeing record 7% inflation and Canada usually gets dragged along with the US numbers so that balances the possibility of fewer increases.

- Mortgage Strategy – secure a fully underwritten, pre-approval, with a 120- day rate hold, from a person, not an online “60-second-mortgage-app” as soon as you think you may be buying in the next 2 years.

- To start a mortgage application with us, click here, and we will call you with in 24-hours to get things going.

DETAILS:

This morning in its first scheduled policy decision of 2022, the Bank of Canada left its target overnight benchmark rate unchanged at what it describes as its “lower bound” of 0.25%. As a result, the Bank Rate stays at 0.5% and the knock-on effect is that borrowing costs for Canadians will remain low for the time being.

The Bank also updated its observations on the state of the economy, both in Canada and globally, leaving a strong impression that rates will rise this year.

More specifically, the Bank said that its Governing Council has decided to end its extraordinary commitment to hold its policy rate at the effective lower bound and that looking ahead, it expects “… interest rates will need to increase, with the timing and pace of those increases guided by the Bank’s commitment to achieving” its 2% inflation target.

These are the other highlights of today’s BoC announcement.

Canadian economy

- The economy entered 2022 with considerable momentum, and a broad set of measures are now indicating that economic slack is absorbed

- With strong employment growth, the labour market has tightened significantly with elevated job vacancies, strong hiring intentions, and a pick up in wage gains

- Elevated housing market activity continues to put upward pressure on house prices

- Omicron is “weighing on activity in the first quarter” and while its economic impact will depend on how quickly this wave passes, the impact is expected to be less severe than previous waves

- Economic growth is then expected to bounce back and remain robust over the Bank’s “projection horizon,” led by consumer spending on services, and supported by strength in exports and business investment

- After GDP growth of 4.5% in 2021, the Bank expects Canada’s economy to grow by 4% in 2022 and about 3.5% in 2023

Canadian inflation

- CPI inflation remains “well above” the Bank’s target range and core measures of inflation have edged up since October

- Persistent supply constraints are feeding through to a broader range of goods prices and, combined with higher food and energy prices, are expected to keep CPI inflation close to 5% in the first half of 2022

- As supply shortages diminish, inflation is expected to decline “reasonably quickly” to about 3% by the end of 2022 and then “gradually ease” towards the Bank’s target over the projection period

- Near-term inflation expectations have moved up, but longer-run expectations remain anchored on the 2% target

- The Bank will use its monetary policy tools to ensure that higher near-term inflation expectations do not become embedded in ongoing inflation

Global economy

- The recovery is strong but uneven with the US economy “growing robustly” while growth in some other regions appears more moderate, especially in China due to current weakness in its property sector

- Strong global demand for goods combined with supply bottlenecks that hinder production and transportation are pushing up inflation in most regions

- Oil prices have rebounded to well above pre-pandemic levels following a decline at the onset of the Omicron variant of COVID-19

- Financial conditions remain broadly accommodative but have tightened with growing expectations that monetary policy will normalize sooner than was anticipated, and with rising geopolitical tensions

- Overall, the Bank projects global GDP growth to moderate from 6.75% in 2021 to about 3.5% in 2022 and 2023

January Monetary Policy Report

The key messages found in the BoC’s Monetary Policy Report published today were consistent with the highlights noted above:

- A wide range of measures and indicators suggest that economic slack is now absorbed and estimates of the output gap are consistent with this evidence

- Public health measures and widespread worker absences related to the Omicron variant are slowing economic activity in the first quarter of 2022, but the economic impact is expected to be less severe than previous waves

- The impacts from global and domestic supply disruptions are currently exerting upward pressure on prices

- Inflationary pressures from strong demand, supply shortages and high energy prices should subside during the year

- Over the medium term, increased productivity is expected to boost supply growth, and demand growth is projected to moderate with inflation expected to decline gradually through 2023 and 2024 to close to 2%

- The Bank views the risks around this inflation outlook as roughly balanced, however, with inflation above the top of the Bank’s inflation-control range and expected to stay there for some time, the upside risks are of greater concern

Looking ahead

The Bank intends to keep its holdings of Government of Canada bonds on its balance sheet roughly constant “at least until” it begins to raise its policy interest rate. At that time, the BoC’s Governing Council will consider exiting what it calls its “reinvestment phase” and reducing the size of its balance sheet. It will do so by allowing the roll-off of maturing Government of Canada bonds.

While the Bank acknowledges that COVID-19 continues to affect economic activity unevenly across sectors, the Governing Council believes that overall slack in the economy is now absorbed, “thus satisfying the condition outlined in the Bank’s forward guidance on its policy interest rate” and setting the stage for increases in 2022.

Mortgage Rate Holds are the theme for buyers in 2022

Mortgage Mark Herman, your friendly Calgary Alberta mortgage broker & New Buyer Specialist.

Nov 2021; Mortgage Rates & Inflation Report

This just in data is when mortgage interest rates are expected to rise.

DATA JUST IN

Canada’s latest employment and inflation numbers have triggered new expectations about the next steps by the Bank of Canada and the arrival of interest rate increases.

BoC Governor Tiff Macklem continues to offer soothing words about inflation, which is current running at 4.1%. That is an 18 year high and more than double the central bank’s 2.0% target.

Macklem has repeatedly said high inflation is temporary; the result of low prices during the pandemic lock-downs, and supply chain problems that have cropped-up as the economy reopens.

Macklem points out that a key factor in long term inflation – wage growth – has not materialized. That is despite Canada returning to pre-pandemic employment levels with the addition of 157,000 jobs in September. It should be noted that the growth of Canada’s labour force during the pandemic means the country is still 276,000 jobs short of full employment. Last week however, Macklem did concede that this temporary inflation may linger for longer than initially expected.

Several prominent economists have weighed-in. Benjamin Tal cautions that inflation is a lagging economic indicator. He says the risks for long-term inflation are present and the Bank of Canada would be better to start raising rates earlier to help mitigate those risks. Doug Porter says there is a growing chance rate increases will come earlier. He expects they will happen quarterly rather than every six months. And, Derek Holt would like to see a rate hike by the end of the year, given that emergency levels of stimulus are in place while inflation is well above target.

Look for mortgage interest rates to start going up close to the end of 2021 and continue until they are back close to PRE-Covid Rates of about 3.35% for the 5-year fixed.

Mortgage Mark Herman, best Calgary mortgage broker for the masses!

EXPLAINER: Why & Where Inflation and Canadian Mortgage Interest Rates

Best answer I have seen yet is below … it still makes the 5-year fixed the better option right now (for most people)Mortgage Mark Herman, Top Calgary Mortgage Broker

The latest significant news was good, but modest. Canada’s unemployment rate dipped to 7.5% with the creation of 94,000 jobs in July. Most of those are full-time and in the private sector.

Employment levels are linked to inflation, which is a key factor watched by the Bank of Canada in setting interest rate policy which, in turn, can affect mortgage rates.

As the labour market tightens up, employers tend to offer higher wages to attract workers. That increases the cost of producing goods and services, driving inflation. As well, as more people get work and earn more money demand for goods and services increases. If that demand outpaces supply, inflation can also result.

Canada finds itself in this position now. Inflation is running high chiefly because of supply constraints caused by the pandemic. At the same time, more and more people are heading back to work.

That has some analysts forecasting the Bank of Canada will be raising rates to calm inflation. The Bank, however, has been saying otherwise.

It is also useful to watch what is happening in the United States. The two economies are tightly linked and actions in the U.S. can offer useful clues about what will happen here.

In its latest assessment of the American economy the U.S. Federal Reserve continued to down play inflation – which is running high there as well – as “transitory”. The Fed continues to look to the second half of 2023 as the most likely time for any possible rate hikes. While the Bank of Canada has said it expects rates could start rising as much as a year sooner than that, it would be unusual for the BoC to move before the Fed.

Mortgage Tip: Where are Canadian Mortgage Rates Going in 2021

SUMMARY:

There is LOTS of room for rates to go up, and very little for rates to go down or even hold steady.

Fixed mortgage rates are predicted to rise by 40% and go back to Pre-Covid rates or higher:

- 2.9% (from 2.09% now) for less than 20% down; CMHC insured

- 3.10% (from 2.24% now) for more than 20% down; conventional / not insured.

Prime – what variable rates are based on:

- The Bank of Canada has moved their target for Prime increase from 2023 to 2022.

- The US Fed has moved their target for Prime increase from 2024 to 2023, and the market expects that to move to 2022 as well.

- Prime is 2.45% today, it was 3.95% just before Covid (Feb, 2020) and will be trending back that way soon.

- Prime – 1% is the rates for today. 2.45% – 1% = 1.45% which is a great rate but how soon and how much will it move?

This article is awesome, and clear on what the changes mean. The summary above is all you need but you love this data, then read on …

Canadian Mortgage Rates Forecast To Rise Over 40%, Posted Rate Can Hit 7%

Canadian inflation is marching higher, and so are the expectations for mortgage rates. One bank sees the 5-year posted rate having more room to rise than fall in the future.

The institution has forecast the posted 5-year fixed-rate mortgage can rise up to 40% by 2024.

While the posted rate is rarely the rate paid by mortgage borrowers, it does impact a number of things. More importantly, it reflects an environment where credit is tightening.

The Posted Mortgage Rate Vs What You Really Pay

The posted mortgage rate is an unusually high mortgage rate that’s kind of like the sticker price of a car. It’s unreasonably high, few people will use it, and it’s mostly to help buyers feel like they’re getting a deal. The spread between the posted rate and a lender’s best available rate is usually between 220 to 250 bps. This means the rate borrows often pay is a full 2.2 to 2.5 percentage points lower than the posted rate. That doesn’t mean the posted rate is useless though.

The two biggest impacts it has are on payment penalties and the stress test. If you were to break your fixed-rate mortgage early, for say refinancing at a lower rate, you have to pay a penalty. That penalty is usually 3-months of interest, or the interest rate differential (IRD). The IRD is the difference between your rate and the posted rate closest to your remaining term. Then subtract any discount you received at origination. It’s pretty much what banks use to make sure you pay a big ole’ penalty for changing plans.

The stress test rate is also likely to be influenced by the posted rate, but maybe not directly. Originally the Bank of Canada benchmark rate was used to determine the stress test rate. This was based on the posted rate at various banks. OSFI, the bank regulator, found it wasn’t very responsive to risk though. Rather than rely on the benchmark, they established a rate floor — the minimum rate that can be used. The criteria for how the floor can evolve can change a lot from now until 2024. However, it’s unlikely the stress test rate would ever fall below the posted rate. The stress test rate is currently around 50bps higher than the posted rate.

Canadian 5-Year Fixed-Rate Mortgages Have More Upside Risk Than Downside

There’s uncertainty, but Canada’s faster than expected recovery shows more upside than down. The five-year posted fixed rate is 4.74% currently. In a downside scenario, they see this falling to 4.40% by the fourth quarter of 2021. The upside scenario sees it rising up to 5.25% in the same quarter. Higher inflation expectations are also contributing to a stronger upside scenario.

Canadian Posted 5-Year Fixed Rate Forecast

By next year, the posted 5-year fixed rate is forecast for an even higher maximum — breaching the 6 point mark. Rates are forecast to have a downside of 4.6% in 2022, and an upside of 6.20%. In 2023, the range rises to 4.70% to 6.60% for the full year. In 2023, it gets a little more uncertain with the range widening from 4.55% to 6.95%. While the latter range is wider, it has a lot more upside than downside. The probability of it falling would likely require a substantial economic slowdown.

Since a number of factors go into a forecast, the longer the date, the more uncertainty it faces. Economic conditions would have to worsen and inflation drop for rates to fall. For rates to rise, Canada would have to continue a strong recovery, and/or see higher levels of inflation. Canada is so dependent on housing now, we likely have many people cheering on a crash to keep rates low.

Link to the full article is here: https://betterdwelling.com/canadian-mortgage-rates-forecast-to-rise-over-40-posted-rate-can-hit-7-desjardins/

Inflation & Mortgage Interest Rates

- 5 Year fixed are going up and never getting back down to where they are now.

- Variables are also great – right now they are Prime – 1% or 2.45% – 1% = 1.45%, and as below, should stay there until 2023! Almost 20 more months!

Both of these are awesome options right now.Mortgage Mark Herman, Top Calgary Alberta mortgage broker for 1st time home buyers

Bond traders believe inflation is going to be rising over the coming months and have been demanding increased bond yields. That has led to increasing interest rates for bonds and, consequently, increasing rates for the fixed-rate mortgages that are funded by those bonds.

The traders say the COVID-19 vaccine rollout and plans for vast infrastructure spending – particularly in the U.S. – are boosting expectations of a broad recovery and an increase in inflation. Better than expected GDP growth in Canada and shrinking unemployment in the U.S. would tend to support those expectations.

This, however, puts the traders at odds with the central banks in both Canada and the United States.

The Bank of Canada and the U.S. Federal Reserve also expect inflation will climb as the pandemic fades and the economy reopens. There is a pent-up demand for goods and services, after all. The central banks see that as transitory, though, and appear to be looking past it. The U.S. Fed has gone so far as to alter its inflation target from 2% to an average of 2%, over time, thereby rolling any post-pandemic spikes into the bigger, longer-term calculations.

The Bank of Canada and the Fed have committed to keeping interest rates low, probably through 2023. Both say inflation will have to be sustained before interest rate moves are made to contain it. The integrated nature of the Canadian and American economies means it is unlikely the BoC will move on interest rates before the U.S. Fed.

$37,000 Payout Penalty at CIBC

The latest in giant payout penalties, this one was $47,291.

Here is a person – one of my ACTUAL ALMOST-Customers who had to swallow a surprise at TD for $35,000. (We tried 3 times to get him to not take that mortgage.)

To make this even more mind blowing, at a 39% tax rate that is $65,700 the person has to pay … about the same as 1-year of income at a full time job, without tax taken off.

- Would you work for 1 year to give it all to your bank if you had to sell or move or close down the mortgage for any reason?

- Would you sign an agreement like that?

- Have you already signed an agreement like this without knowing you have?

EASY to AVOID …

You don’t need to add in this risk to your home purchase. It is easy to get around by taking a mortgage from a major Broker Bank.

Broker banks calculate the payouts the “old way” which was way more fair to you, the buyer. Click here for the posts about payout penalties.

Broker banks also have better Terms & Conditions than the Big-6.

Link to the article: https://toronto.ctvnews.ca/american-who-sold-home-in-toronto-shocked-by-47-000-mortgage-penalty-1.5212884

“Broker Banks have better T&C than all of the Big-6. Call a mortgage broker first.”

Mortgage Mark Herman, Top Rated Calgary Mortgage Broker